Here's Why You Should Hold on to FactSet (FDS) Stock

FactSet Research Systems Inc. FDS carries an impressive Growth Score of A. This style score condenses all the essential metrics from the company’s financial statements to get a true sense of quality and sustainability of its growth.

We believe that FactSet, with a market cap of $11.6 billion and long-term (three to Five years) expected EPS growth rate of 8.5%, is a stock investors should retain in their portfolio.

In the past year, the company’s shares have gained 9.2% compared with 22.7% growth of the industry it belongs to.

Factors That Bode Well

FactSet is benefiting from a growing customer base, high client retention rate, solid revenue growth and a competitive pricing strategy. The company’s revenues increased 4.2% year over year in the second quarter of fiscal 2020. The company added 87 clients in the quarter, taking the total number to 5,688. Client retention rate at the end of the quarter was 89%.

Although many companies across diverse sectors have suspended dividend payouts amid the coronavirus crisis, Factset is one of those few companies that are staying afloat amid the economic crisis and hiking dividends.

On May 5, the company announced the approval of a 7% hike, raising the quarterly cash dividend from 72 cents per share to 77 cents per share. This marks the fifteenth consecutive year of dividend hike. FactSet has a track record of consistent dividend payment. It paid $100.1 million, $89.4 million and $80.9 million in dividends in fiscal 2019, 2018 and 2017, respectively.

Some Risks

FactSet has a debt-laden balance sheet. Total debt at the end of second-quarter fiscal 2020 was $860 million, up from $840 million at the end of the prior quarter.

Further, the company’s cash and cash equivalent of $367 million at the end of the second-quarter fiscal 2020 was well below this debt level, underscoring that the company doesn’t have enough cash to meet this debt burden. However, cash level can meet the short-term debt of $28 million.

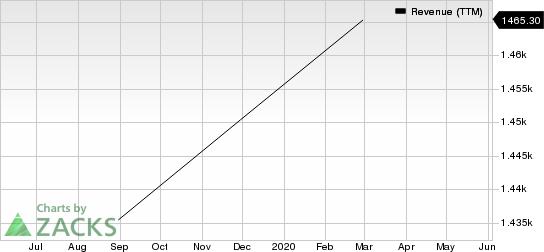

FactSet Research Systems Inc. Revenue (TTM)

FactSet Research Systems Inc. revenue-ttm | FactSet Research Systems Inc. Quote

Zacks Rank and Stocks to Consider

FactSet currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader Zacks Business Services sector are Elastic N.V. ESTC, SailPoint Technologies Holdings, Inc. SAIL and SPS Commerce, Inc. SPSC, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings (three to five years) growth rate for Elastic, SailPoint Technologies and SPS Commerce is estimated at 25.9%, 15% and 15%, respectively.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FactSet Research Systems Inc. (FDS) : Free Stock Analysis Report

SPS Commerce, Inc. (SPSC) : Free Stock Analysis Report

SailPoint Technologies Holdings, Inc. (SAIL) : Free Stock Analysis Report

Elastic N.V. (ESTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research