Here's Why You Should Hold on to Walgreens Boots (WBA) for Now

Walgreens Boots Alliance, Inc. WBA is gaining from strategic alliances and a slew of product launches. The company exited fourth-quarter fiscal 2021 with better-than-expected results. Robust sales of Boots.com look encouraging. The recently concluded investment in Shields Health Solutions, too, instills optimism in the stock. However, a weak solvency position and stiff competition do not bode well.

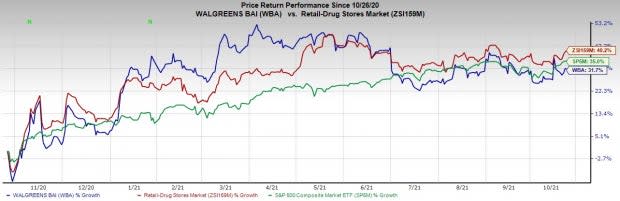

Over the past year, the Zacks Rank #3 (Hold) stock has gained 31.7% versus 40.2% growth of the industry and a 35% rise of the S&P 500.

The renowned pharmacy-led health and beauty retail company has a market capitalization of $42.44 billion. Its earnings for fourth-quarter fiscal 2021 surpassed the Zacks Consensus Estimate by 13.6%.

Over the past five years, the company registered earnings growth of 3.3%, which compares to the industry’s 6.1% rise and the S&P 500’s 2.8% increase. The company’s long-term projected growth rate of 4.4% lags the industry’s growth projection of 5.4% and the S&P 500’s estimated 11.5% increase.

Image Source: Zacks Investment Research

Let’s delve deeper.

Factors At Play

Q4 Upsides: Walgreens Boots exited fourth-quarter fiscal 2021 with better-than-expected earnings and revenues. The robust sales of Boots.com instill investor confidence. The continued acceleration of Walgreens’ omnichannel offerings and a rise in MyWalgreens memberships are notable upsides during the quarter. Faster retail pick-up-related development in the United States, acceleration of its investment in VillageMD and increasing rollout of Village Medical at Walgreens’ full-service primary care clinics look encouraging. Expansions of both margins are an added advantage. Meanwhile, Walgreens Boots has a consistent dividend-paying history, with five-year annualized dividend growth being 5.51%.

New Alliances Look Strategic: We are upbeat about Walgreens Boots’ recent alliances to drive U.S. retail drugstore market growth. In September 2021, through its wholly-owned subsidiary, Walgreen Co., the company completed the majority investment in Shields Health Solutions. Further, during the fiscal fourth quarter, Walgreens Boots and Blue Shield of California announced a new strategic collaboration to expand access to healthcare, lower costs and bring innovative services to enhance the consumer experience for individuals, families and communities throughout California.

Product Launches: Walgreens Boots’ slew of product launches in the past few months raise optimism. In August 2021, the company launched 'Scarlet' bank account and debit card nationwide to promote financial security and offer rewards. During the fiscal fourth-quarter earnings update, the company announced the launch of Walgreens Health. This new segment will focus on bringing together the company’s healthcare ambitions and powering up the new and existing assets to support the journey.

Downsides

Competition: Walgreens Boots faces significant competition in the retail drug store space from notable players like CVS Health Corporation CVS. Notably, the retail wing of CVS Caremark witnessed a record market share gain following the termination of the Walgreens-Express Scripts contract. While Walgreens Boots’ dull performance improves with customers' return, CVS management’s commentary on retaining most of the client wins raises concern.

Weak Solvency: Walgreens Boots exited fiscal 2021 with cash and cash equivalents of $1.19 billion. The company’s total debt of $8.98 billion at the end of fiscal 2021 was much higher than the corresponding cash and cash equivalent figure. Further, its current-year payable debt of $1.30 billion exceeded the short-term cash level. This is particularly problematic in terms of the company’s solvency level as, during the year of economic downturn, the company is not holding sufficient cash for short-term debt repayment.

Macroeconomic Woes: Walgreens Boots’ business operations have been adversely impacted by the challenging market conditions in the International division, particularly the Boots business in the U.K. This was primarily on account of the economic environment and the uncertainty associated with Brexit. Additionally, reduced or flat consumer spending may drive Walgreens Boots and its competitors to offer additional products at promotional prices.

Estimate Trend

Over the past 30 days, the Zacks Consensus Estimate for its earnings has moved 1.8% down to $5.00.

The Zacks Consensus Estimate for first-quarter fiscal 2022 revenues is pegged at $33.4 billion, suggesting an 8.02% fall from the year-ago reported number.

Zacks Rank and Key Picks

Better-ranked stocks from the broader medical space include National Vision Holdings, Inc. EYE and Henry Schein, Inc. HSIC, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

National Vision has a long-term earnings growth rate of 23%.

Henry Schein has a long-term earnings growth rate of 13.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

National Vision Holdings, Inc. (EYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.