Here's Why RPC's (RES) Shares Rise 16.8% Since Q1 Earnings

RPC, Inc.’s RES shares jumped 16.8% even though the company missed earnings estimates for the first quarter, the results of which were announced on Apr 28. Investors are hopeful about rising shale activities as oil prices have significantly recovered from the historical lows witnessed in the past year. Moreover, a strong balance sheet will help it navigate through any market volatility.

The company reported first-quarter 2021 loss of 5 cents per share, wider than the Zacks Consensus Estimate of a loss of 3 cents. Moreover, the figure deteriorated from the year-ago loss of 4 cents per share.

It reported quarterly revenues of $182.6 million, which surpassed the consensus mark of $164 million. However, the top line plunged from the year-ago figure of $243.8 million.

The weak first-quarter earnings were caused by lower activities and decreased pricing. Adverse weather in February affected the quarterly activity levels. The negatives were partially offset by lower costs and expenses.

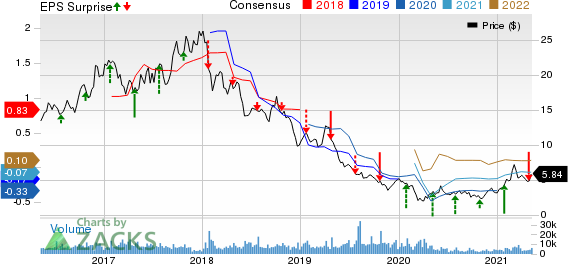

RPC, Inc. Price, Consensus and EPS Surprise

RPC, Inc. price-consensus-eps-surprise-chart | RPC, Inc. Quote

Segmental Performance

Operating loss in the Technical Services segment totaled $5.8 million, narrower than a loss of $12.2 million in the year-ago quarter. The improvement was supported by rising activity levels in most of the service lines.

Operating loss in the Support Services segment came in at roughly $3 million against the unit’s operating profit of $1.5 million in the year-ago quarter. The downside was caused by lower activities.

Total operating loss for the quarter was $10.5 million, narrower than the year-ago loss of $218.7 million. Average domestic rig count was 396 for the March quarter, reflecting 49.6% fall from the year-ago level.

Cost and Expenses

Cost of revenues contracted from $181.9 million in first-quarter 2020 to $146.2 million. Moreover, selling, general and administrative expenses fell to $30.6 million for the quarter from the year-ago figure of $36.5 million.

Financials

RPC’s total capital expenditure for the March quarter of 2021 amounted to $11.8 million.

As of Mar 31, the company had cash and cash equivalents of $85.4 million, up sequentially from $84.5 million in the fourth quarter. Despite the volatile market scenario, it maintained a debt-free balance sheet.

Guidance

The company reiterated its 2021 capital expenditures guidance at $55 million, indicating a decline from the 2020 figure of $65 million. It intends to take cautiously optimistic steps as the market recovers. As such, RPC will not likely increase equipment fleets until a profitable situation comes up. Higher oil prices are favoring increased customer spending.

Zacks Rank & Stocks to Consider

The company currently has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space include National Energy Services Reunited Corp. NESR, NOW Inc. DNOW and Hess Corporation HES, each having a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

National Energy’s bottom line for 2021 is expected to rise 49.2% year over year.

NOW’s bottom line for 2021 is expected to rise 70.8% year over year.

Hess’ bottom line for 2021 is expected to surge 150.9% year over year.

Zacks Top 10 Stocks for 2021

In addition to the stocks discussed above, would you like to know about our 10 best buy-and-hold tickers for the entirety of 2021?

Last year's 2020Zacks Top 10 Stocks portfolio returned gains as high as +386.8%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

AccessZacks Top 10 Stocks for 2021 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hess Corporation (HES) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

NOW Inc. (DNOW) : Free Stock Analysis Report

NATIONAL ENERGY (NESR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research