Here's Why Sanwaria Consumer (NSE:SANWARIA) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Sanwaria Consumer Limited (NSE:SANWARIA) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Sanwaria Consumer

What Is Sanwaria Consumer's Net Debt?

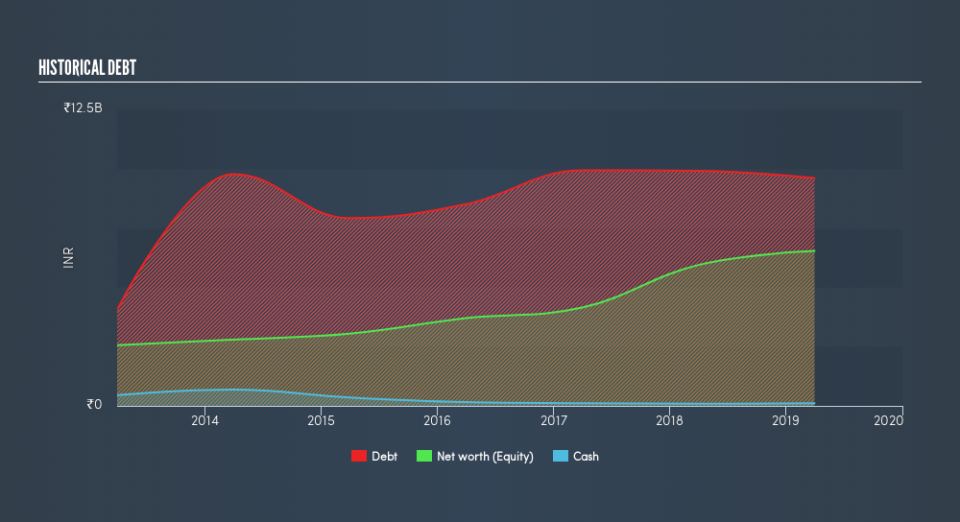

As you can see below, Sanwaria Consumer had ₹9.61b of debt, at March 2019, which is about the same the year before. You can click the chart for greater detail. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is Sanwaria Consumer's Balance Sheet?

We can see from the most recent balance sheet that Sanwaria Consumer had liabilities of ₹10.6b falling due within a year, and liabilities of ₹644.0m due beyond that. Offsetting this, it had ₹107.2m in cash and ₹11.9b in receivables that were due within 12 months. So it can boast ₹776.2m more liquid assets than total liabilities.

It's good to see that Sanwaria Consumer has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Sanwaria Consumer has a debt to EBITDA ratio of 3.3 and its EBIT covered its interest expense 3.4 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. On a lighter note, we note that Sanwaria Consumer grew its EBIT by 23% in the last year. If it can maintain that kind of improvement, its debt load will begin to melt away like glaciers in a warming world. When analysing debt levels, the balance sheet is the obvious place to start. But it is Sanwaria Consumer's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Sanwaria Consumer created free cash flow amounting to 7.4% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Sanwaria Consumer's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. Looking at all the aforementioned factors together, it strikes us that Sanwaria Consumer can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Over time, share prices tend to follow earnings per share, so if you're interested in Sanwaria Consumer, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.