Here's Why Target Hospitality (NASDAQ:TH) Has A Meaningful Debt Burden

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Target Hospitality Corp. (NASDAQ:TH) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Target Hospitality

What Is Target Hospitality's Net Debt?

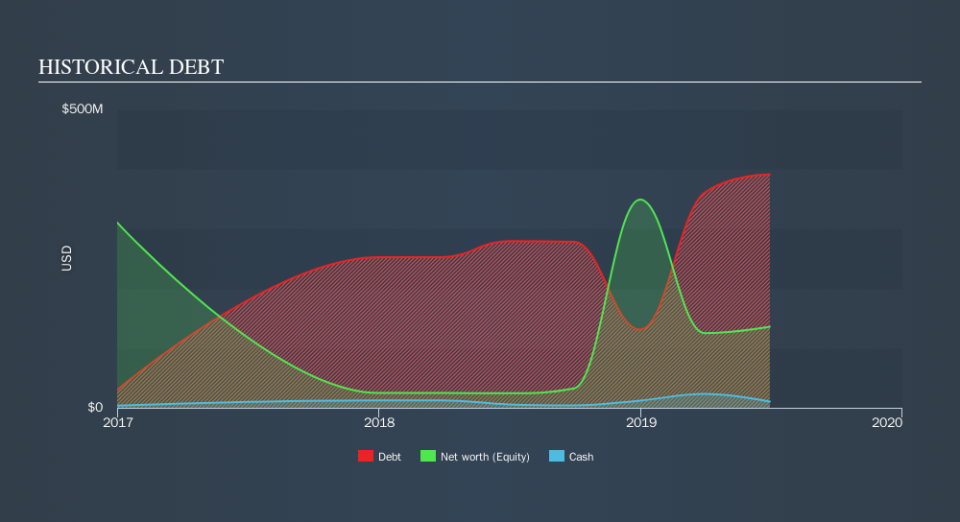

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Target Hospitality had US$391.2m of debt, an increase on US$279.5m, over one year. However, it does have US$10.4m in cash offsetting this, leading to net debt of about US$380.8m.

A Look At Target Hospitality's Liabilities

According to the last reported balance sheet, Target Hospitality had liabilities of US$64.9m due within 12 months, and liabilities of US$408.0m due beyond 12 months. Offsetting this, it had US$10.4m in cash and US$52.3m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$410.2m.

This is a mountain of leverage relative to its market capitalization of US$633.4m. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Target Hospitality's net debt to EBITDA ratio of about 2.5 suggests only moderate use of debt. And its strong interest cover of 21.2 times, makes us even more comfortable. Notably, Target Hospitality's EBIT launched higher than Elon Musk, gaining a whopping 244% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Target Hospitality's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Target Hospitality saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

We feel some trepidation about Target Hospitality's difficulty conversion of EBIT to free cash flow, but we've got positives to focus on, too. For example, its interest cover and EBIT growth rate give us some confidence in its ability to manage its debt. Looking at all the angles mentioned above, it does seem to us that Target Hospitality is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Given our hesitation about the stock, it would be good to know if Target Hospitality insiders have sold any shares recently. You click here to find out if insiders have sold recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.