Here's Why I Think Air Partner (LON:AIR) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Air Partner (LON:AIR). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Air Partner

Air Partner's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Air Partner managed to grow EPS by 11% per year, over three years. That's a good rate of growth, if it can be sustained.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Air Partner is growing revenues, and EBIT margins improved by 8.1 percentage points to 16%, over the last year. That's great to see, on both counts.

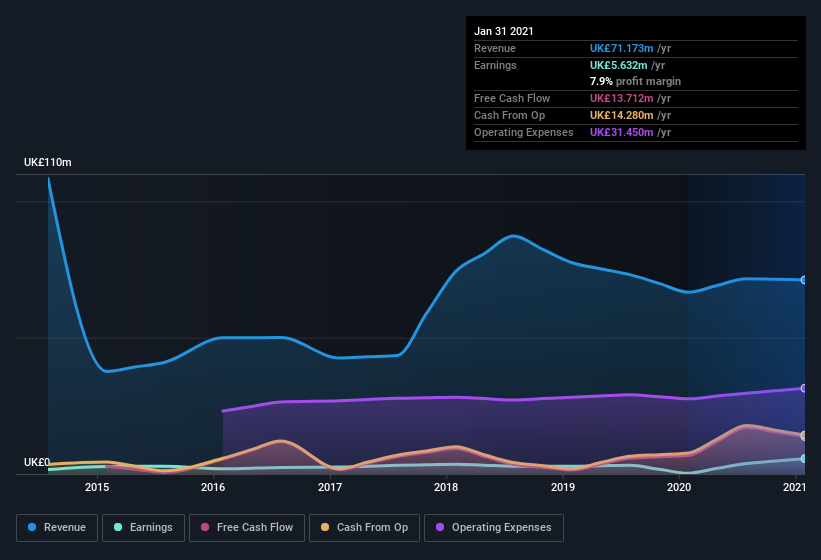

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Air Partner is no giant, with a market capitalization of UK£61m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Air Partner Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at Air Partner were both selling and buying shares; but happily, as a group they spent UK£76k more on stock, than they netted from selling it. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. It is also worth noting that it was Independent Non-Executive Chairman Edmond Warner who made the biggest single purchase, worth UK£56k, paying UK£0.75 per share.

Is Air Partner Worth Keeping An Eye On?

One important encouraging feature of Air Partner is that it is growing profits. While some companies are struggling to grow EPS, Air Partner seems free from that morose affliction. The gravy on the mushroom pie is the insider buying, which has me tasting potential opportunity; one for the watchlist, I'd posit. Still, you should learn about the 6 warning signs we've spotted with Air Partner (including 1 which is a bit unpleasant) .

As a growth investor I do like to see insider buying. But Air Partner isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.