Here's Why We Think American Water Works Company (NYSE:AWK) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like American Water Works Company (NYSE:AWK), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for American Water Works Company

How Fast Is American Water Works Company Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. American Water Works Company managed to grow EPS by 10% per year, over three years. That's a good rate of growth, if it can be sustained.

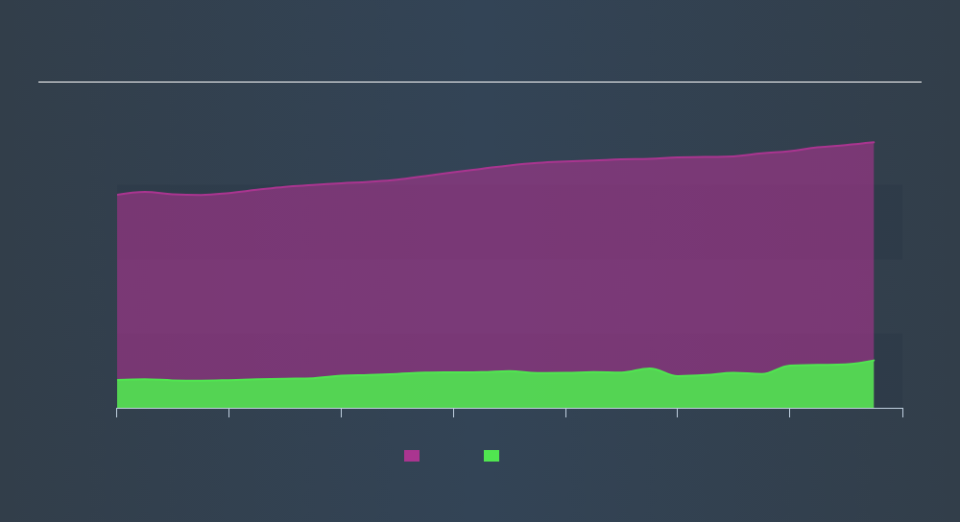

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note American Water Works Company's EBIT margins were flat over the last year, revenue grew by a solid 4.3% to US$3.6b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for American Water Works Company.

Are American Water Works Company Insiders Aligned With All Shareholders?

Since American Water Works Company has a market capitalization of US$21b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Indeed, they hold US$42m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like American Water Works Company, with market caps over US$8.0b, is about US$11m.

The CEO of American Water Works Company only received US$5.0m in total compensation for the year ending December 2018. That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Does American Water Works Company Deserve A Spot On Your Watchlist?

As I already mentioned, American Water Works Company is a growing business, which is what I like to see. Earnings growth might be the main game for American Water Works Company, but the fun does not stop there. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. Now, you could try to make up your mind on American Water Works Company by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although American Water Works Company certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.