Here's Why We Think Atlantic Capital Bancshares, Inc.'s (NASDAQ:ACBI) CEO Compensation Looks Fair for the time being

CEO Doug Williams has done a decent job of delivering relatively good performance at Atlantic Capital Bancshares, Inc. (NASDAQ:ACBI) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 20 May 2021. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Atlantic Capital Bancshares

How Does Total Compensation For Doug Williams Compare With Other Companies In The Industry?

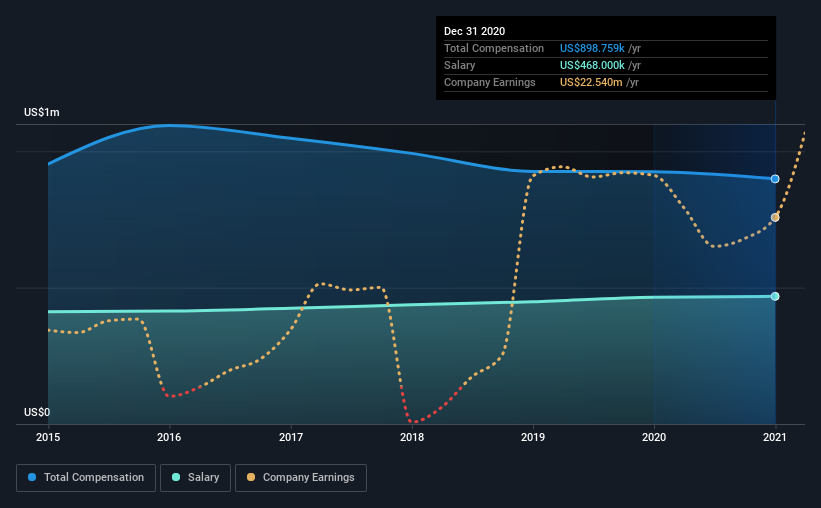

According to our data, Atlantic Capital Bancshares, Inc. has a market capitalization of US$553m, and paid its CEO total annual compensation worth US$899k over the year to December 2020. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is US$468.0k, represents a considerable chunk of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between US$200m and US$800m, we discovered that the median CEO total compensation of that group was US$1.1m. So it looks like Atlantic Capital Bancshares compensates Doug Williams in line with the median for the industry. What's more, Doug Williams holds US$6.9m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$468k | US$465k | 52% |

Other | US$431k | US$460k | 48% |

Total Compensation | US$899k | US$925k | 100% |

Speaking on an industry level, nearly 42% of total compensation represents salary, while the remainder of 58% is other remuneration. According to our research, Atlantic Capital Bancshares has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Atlantic Capital Bancshares, Inc.'s Growth

Atlantic Capital Bancshares, Inc.'s earnings per share (EPS) grew 44% per year over the last three years. Its revenue is up 17% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Atlantic Capital Bancshares, Inc. Been A Good Investment?

With a total shareholder return of 31% over three years, Atlantic Capital Bancshares, Inc. shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Atlantic Capital Bancshares that investors should think about before committing capital to this stock.

Important note: Atlantic Capital Bancshares is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.