Here's Why We Think Blue Ridge Bankshares (NYSEMKT:BRBS) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Blue Ridge Bankshares (NYSEMKT:BRBS), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Blue Ridge Bankshares

How Quickly Is Blue Ridge Bankshares Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. It certainly is nice to see that Blue Ridge Bankshares has managed to grow EPS by 37% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

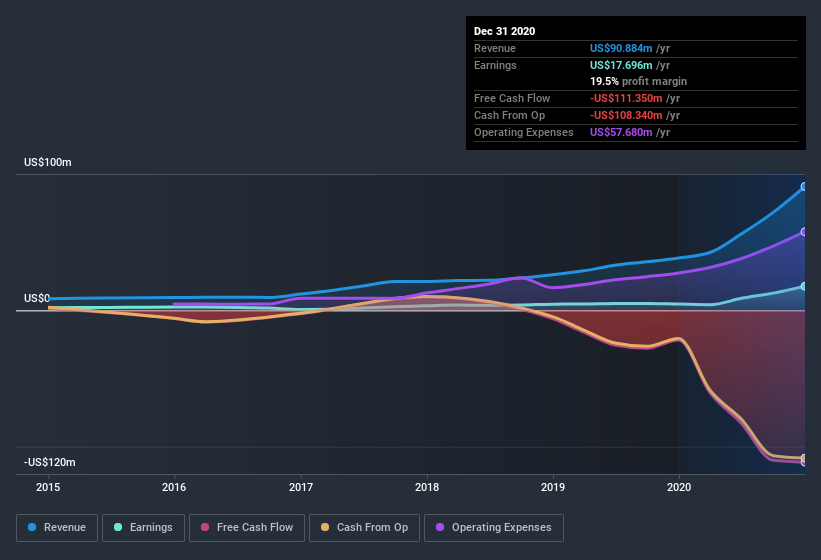

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Blue Ridge Bankshares's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Blue Ridge Bankshares's EBIT margins were flat over the last year, revenue grew by a solid 136% to US$91m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Blue Ridge Bankshares isn't a huge company, given its market capitalization of US$278m. That makes it extra important to check on its balance sheet strength.

Are Blue Ridge Bankshares Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Blue Ridge Bankshares shareholders can gain quiet confidence from the fact that insiders shelled out US$734k to buy stock, over the last year. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. We also note that it was the , Richard Spurzem, who made the biggest single acquisition, paying US$84k for shares at about US$15.04 each.

On top of the insider buying, it's good to see that Blue Ridge Bankshares insiders have a valuable investment in the business. With a whopping US$54m worth of shares as a group, insiders have plenty riding on the company's success. At 19% of the company, the co-investment by insiders gives me confidence that management will make long-term focussed decisions.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Brian Plum, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Blue Ridge Bankshares with market caps between US$100m and US$400m is about US$960k.

The Blue Ridge Bankshares CEO received total compensation of just US$373k in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Blue Ridge Bankshares Deserve A Spot On Your Watchlist?

You can't deny that Blue Ridge Bankshares has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Even so, be aware that Blue Ridge Bankshares is showing 2 warning signs in our investment analysis , you should know about...

As a growth investor I do like to see insider buying. But Blue Ridge Bankshares isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.