Here's Why I Think First Sponsor Group (SGX:ADN) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like First Sponsor Group (SGX:ADN). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for First Sponsor Group

How Fast Is First Sponsor Group Growing?

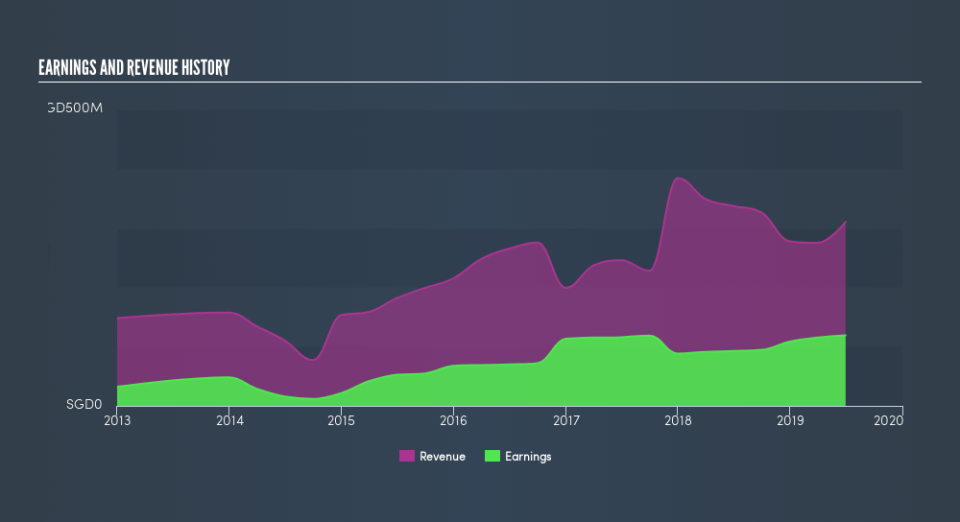

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, First Sponsor Group's EPS has grown 17% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, First Sponsor Group's revenue dropped 8.0% last year, but the silver lining is that EBIT margins improved from 44% to 49%. That's not ideal.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are First Sponsor Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that First Sponsor Group insiders spent a whopping S$1.7m on stock in just one year, and I didn't see any selling. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Non-Executive Chairman Han Ho who made the biggest single purchase, worth S$452k, paying S$1.29 per share.

The good news, alongside the insider buying, for First Sponsor Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold S$31m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 3.0% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does First Sponsor Group Deserve A Spot On Your Watchlist?

You can't deny that First Sponsor Group has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if First Sponsor Group is trading on a high P/E or a low P/E, relative to its industry.

The good news is that First Sponsor Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.