Here's Why I Think Parkland Fuel (TSE:PKI) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Parkland Fuel (TSE:PKI). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Parkland Fuel

How Quickly Is Parkland Fuel Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. I, for one, am blown away by the fact that Parkland Fuel has grown EPS by 51% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

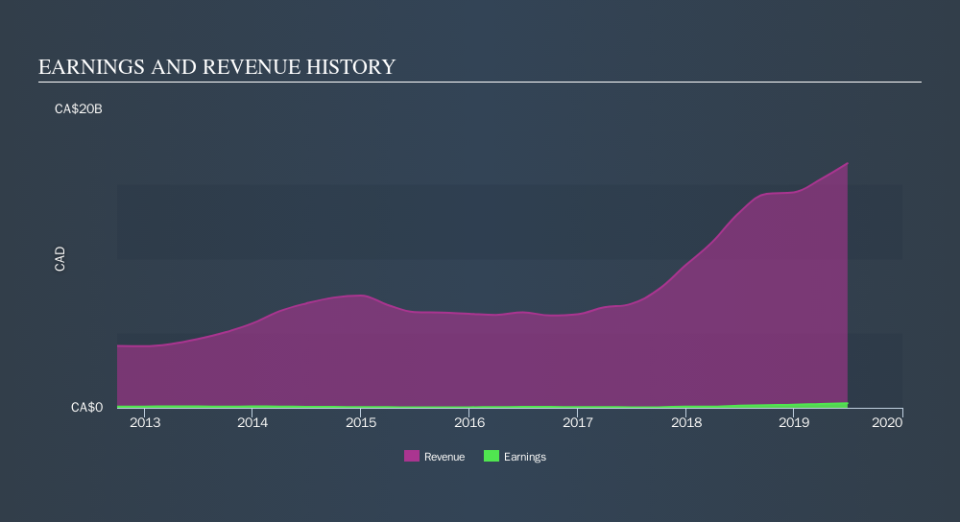

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Parkland Fuel maintained stable EBIT margins over the last year, all while growing revenue 25% to CA$16b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Parkland Fuel EPS 100% free.

Are Parkland Fuel Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold -CA$1.4m worth of shares. But that's far less than the CA$7.1m insiders spend purchasing stock. This makes me even more interested in Parkland Fuel because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Timothy Rhodes for CA$6.9m worth of shares, at about CA$41.20 per share.

On top of the insider buying, it's good to see that Parkland Fuel insiders have a valuable investment in the business. Indeed, they hold CA$63m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 1.0% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Bob Espey, is paid less than the median for similar sized companies. For companies with market capitalizations between CA$5.3b and CA$16b, like Parkland Fuel, the median CEO pay is around CA$5.2m.

The Parkland Fuel CEO received CA$3.8m in compensation for the year ending December 2018. That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Parkland Fuel Worth Keeping An Eye On?

Parkland Fuel's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Parkland Fuel deserves timely attention. Of course, just because Parkland Fuel is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Parkland Fuel is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.