Here's Why I Think Sonos (NASDAQ:SONO) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Sonos (NASDAQ:SONO). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Sonos

Sonos's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Sonos has managed to grow EPS by 19% per year over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

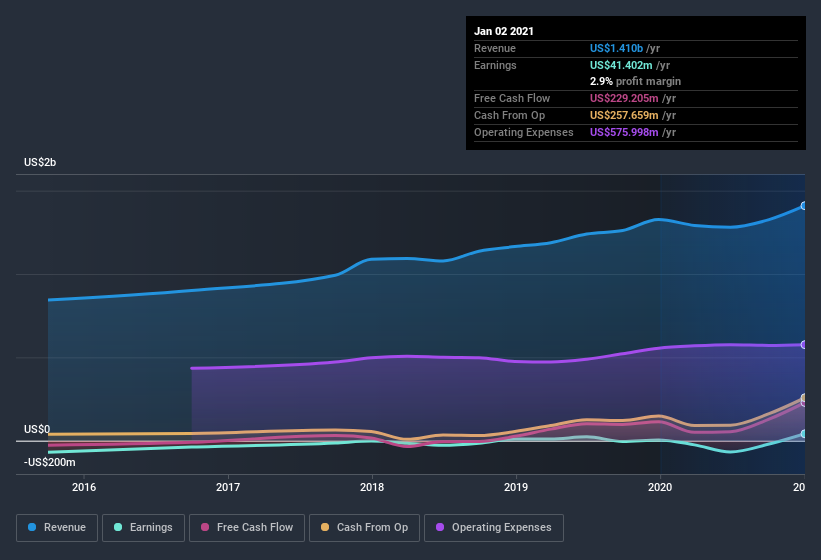

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Sonos shareholders can take confidence from the fact that EBIT margins are up from 0.3% to 4.8%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Sonos?

Are Sonos Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for Sonos is the serious outlay one insider has made to buy shares, in the last year. Specifically, the Independent Chairperson, Michelangelo A. Volpi, accumulated US$2.0m worth of shares around US$37.35. Big insider buys like that are almost as rare as an ocean free of single use plastic waste.

Along with the insider buying, another encouraging sign for Sonos is that insiders, as a group, have a considerable shareholding. Given insiders own a small fortune of shares, currently valued at US$62m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Patrick Spence, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Sonos with market caps between US$2.0b and US$6.4b is about US$5.0m.

Sonos offered total compensation worth US$3.0m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Sonos Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Sonos's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. Before you take the next step you should know about the 3 warning signs for Sonos that we have uncovered.

As a growth investor I do like to see insider buying. But Sonos isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.