Here's Why I Think Vishay Intertechnology (NYSE:VSH) Might Deserve Your Attention Today

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Vishay Intertechnology (NYSE:VSH). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Vishay Intertechnology

How Fast Is Vishay Intertechnology Growing Its Earnings Per Share?

In the last three years Vishay Intertechnology's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Vishay Intertechnology's EPS soared from US$0.80 to US$1.15, over the last year. That's a impressive gain of 44%.

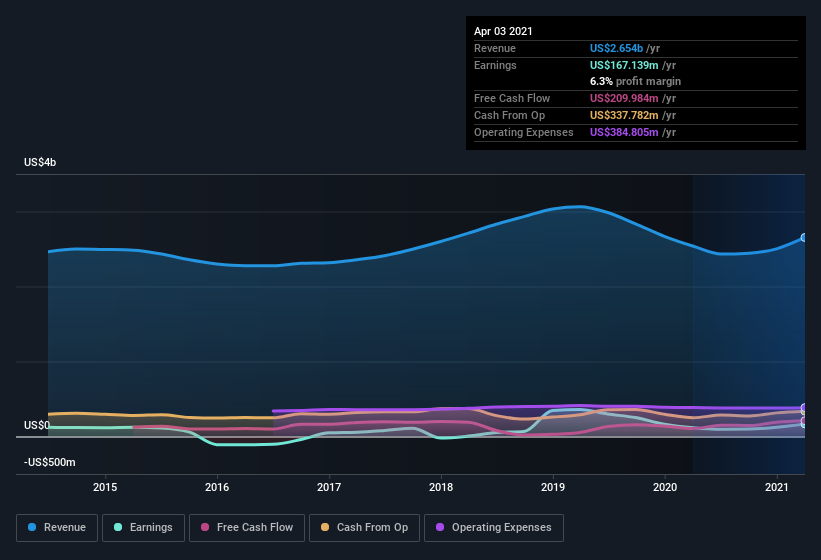

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Vishay Intertechnology's EBIT margins were flat over the last year, revenue grew by a solid 4.6% to US$2.7b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Vishay Intertechnology's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Vishay Intertechnology Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Vishay Intertechnology shares worth a considerable sum. Indeed, they hold US$30m worth of its stock. That's a lot of money, and no small incentive to work hard. Despite being just 0.9% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Vishay Intertechnology To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Vishay Intertechnology's strong EPS growth. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. We don't want to rain on the parade too much, but we did also find 2 warning signs for Vishay Intertechnology that you need to be mindful of.

Although Vishay Intertechnology certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.