Here's Why We're Watching Checkmate Pharmaceuticals' (NASDAQ:CMPI) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So should Checkmate Pharmaceuticals (NASDAQ:CMPI) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Checkmate Pharmaceuticals

Does Checkmate Pharmaceuticals Have A Long Cash Runway?

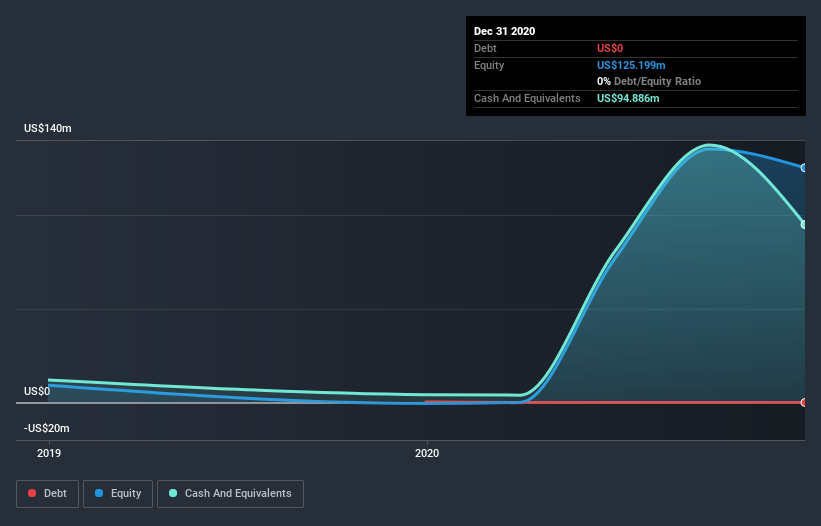

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2020, Checkmate Pharmaceuticals had cash of US$95m and no debt. In the last year, its cash burn was US$38m. That means it had a cash runway of about 2.5 years as of December 2020. Arguably, that's a prudent and sensible length of runway to have. You can see how its cash balance has changed over time in the image below.

How Is Checkmate Pharmaceuticals' Cash Burn Changing Over Time?

Because Checkmate Pharmaceuticals isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. Over the last year its cash burn actually increased by 42%, which suggests that management are increasing investment in future growth, but not too quickly. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Checkmate Pharmaceuticals Raise More Cash Easily?

Given its cash burn trajectory, Checkmate Pharmaceuticals shareholders may wish to consider how easily it could raise more cash, despite its solid cash runway. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Checkmate Pharmaceuticals has a market capitalisation of US$58m and burnt through US$38m last year, which is 66% of the company's market value. Given how large that cash burn is, relative to the market value of the entire company, we'd consider it to be a high risk stock, with the real possibility of extreme dilution.

How Risky Is Checkmate Pharmaceuticals' Cash Burn Situation?

On this analysis of Checkmate Pharmaceuticals' cash burn, we think its cash runway was reassuring, while its cash burn relative to its market cap has us a bit worried. We don't think its cash burn is particularly problematic, but after considering the range of factors in this article, we do think shareholders should be monitoring how it changes over time. Taking a deeper dive, we've spotted 4 warning signs for Checkmate Pharmaceuticals you should be aware of, and 1 of them is potentially serious.

Of course Checkmate Pharmaceuticals may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.