Here's Why it is Worth Investing in Unifirst (UNF) Stock Now

Unifirst Corporation UNF currently seems to be a smart choice for investors seeking exposure in the uniform-related space. Solid fundamentals and positive revision in earnings estimates are reflective of healthy growth potential of the stock.

The Wilmington, MA-based company currently sports a Zacks Rank #1 (Strong Buy). It belongs to the Zacks Uniform and Related industry, which belongs to the broader Zacks Industrial Products sector.

The industry is currently placed in the top 17 % (with Zacks Industry Rank #44) of more than 250 Zacks industries. Notably, the top 50% of the Zacks-ranked industries tend to outperform the bottom 50% by a factor of more than 2 to 1.

Below we discussed why investing in Unifirst will be a smart choice.

Share Price Performance, Earnings Projections: Market sentiments seem to be working in favor of the company over time. Over the past three months, its shares have yielded 27.3% return compared with 20% growth recorded by the industry, while the sector witnessed a 3.9% decline.

We believe that impressive financial results helped in driving sentiments for the stock. The company beat earnings estimates by 44.71% in the third quarter of fiscal 2019 (ended May 2019). Also, its average earnings surprise was a positive 19.53% for the last four quarters.

For fiscal 2019 (ending August 2019), the company anticipates earnings per share of $8.75-$8.85, up from the previously mentioned $7.65-$7.90.

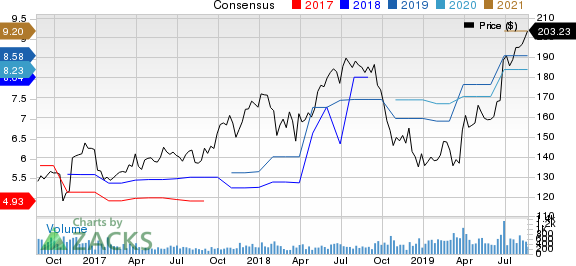

Further, its earnings estimates have been raised in the past 60 days. The Zacks Consensus Estimate for the company’s earnings is pegged at $8.58 for fiscal 2019 and $8.23 for fiscal 2020 (ending August 2020), reflecting 9.2% and 8.9% growth from the respective 60-day-ago figures.

Unifirst Corporation Price and Consensus

Unifirst Corporation price-consensus-chart | Unifirst Corporation Quote

Top-Line Strength: Unifirst caters to a diverse customer base through three business segments — Core Laundry Operations, Specialty Garments and First Aid. Its prime customers are service companies, maintenance facilities, delivery services, wholesalers, restaurants, automobile service centers and others. Also, business expansion in international arenas is a boon for the company. For fiscal 2019, it anticipates revenues of $1.802-$1.809 billion, up from $1.785-$1.795 billion mentioned earlier.

The Zacks Consensus Estimate for Unifirst’s revenues is pegged at $1.8 billion for fiscal 2019 and $1.8 billion for fiscal 2020, suggesting year-over-year growth of 6.6% and 1.7%, respectively.

Buyouts: Over time, the company fortified the product portfolio and leveraged business opportunities through the addition of assets. In the first three quarters of fiscal 2019, it acquired four assets worth approximately $2.4 million (net of cash acquired).

It is worth mentioning here that acquired assets boosted the company’s Specialty Garments segment’s sales by 7.6% in the third quarter of fiscal 2019.

Shareholder-Friendly Policies: Unifirst uses capital for rewarding shareholders handsomely. In the first three quarters of fiscal 2019 (ended May 2019), it repurchased common stock worth $21 million and paid out a cash dividend of approximately $6.2 million.

Notably, the company raised its dividend rate from 3.75 cents to 11.25 cents in fiscal 2018 (ended August 2018). Also, share repurchase program of $100 million were authorized in January 2019.

Other Key Picks

Some other top-ranked stocks in the sector are Graham Corporation GHM, DXP Enterprises, Inc. DXPE and Roper Technologies, Inc. ROP. All these stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, earnings estimates for these stocks have improved for the current year. Further, earnings surprise for the last reported quarter was 100% for Graham, 4.29% for DXP Enterprises and 0.99% for Roper.

It’s Illegal in 42 States, But Investors Will Make Billions Legally

In addition to the companies you read about above, today you get details on the newly-legalized industry that’s tapping into a “habit” that Americans spend an estimated $150 billion on every year.

That’s twice as much as they spend on marijuana, legally or otherwise.

Zacks special report revealing how investors can profit from this new opportunity. As more states legalize this activity, the industry could expand by as much as 15X. Zacks’ has just released a Special Report revealing 5 top stocks to watch in this space.

See these 5 “sin stocks” now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Unifirst Corporation (UNF) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research