Will High Material Price Continue Dampening Builder Sentiment?

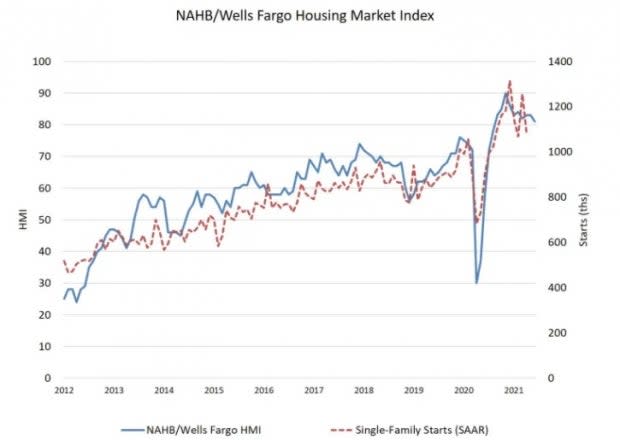

The U.S. Housing industry has been booming of late on surging demand for homes since the pandemic. Yet, rising material costs and supply chain disruptions have de-motivated homebuilders, as is evident from the latest builder confidence reading for June. The NAHB/Wells Fargo Housing Market Index (HMI) reading unveils that sentiment among U.S. homebuilders for newly-built single-family homes slipped to the lowest level since August 2020.

Per the latest HMI, builder confidence fell two points to 81 this month from the May reading of 83.

Despite the sequential drop in homebuilders’ sentiment for June, the reading above 80 still signals strong demand in the housing market. Americans are seeking more work-at-home space to mitigate the risk of the virus spread, which is ultimately boosting demand. Notably, work-from-home or stay-at-home mandates encouraged homeowners to take on more DIY and other home improvement projects that will further benefit repair and remodeling activities.

On Jun 15, industry bellwethers like M.D.C. Holdings, Inc. MDC, Beazer Homes USA, Inc. BZH, Tri Pointe Homes, Inc. TPH, PulteGroup, Inc. PHM and Toll Brothers, Inc. TOL gained 2.4%, 1.8%, 1.6%, 1.3% and 1.2%, respectively, following the news.

Image Source: NAHB

SPDR S&P Homebuilders ETF, iShares U.S. Home Construction ETF and Invesco Dynamic Building & Construction ETF also gained 0.4%, 0.5% and 0.3%, respectively, post the release of HMI.

Inside the Headlines

After being hurt by COVID-led shutdown last year, the economy is now grappling with strikingly high lumber prices, labor shortage and supply chain disruptions. This is evident from the June reading, wherein all the three indices fell sequentially. The indicator that gauges present sales conditions dropped two points to 86 from the last month. Prospective buyer traffic and sales predictions for the next six months also declined two points to 71 and 79, respectively.

The three-month moving averages for the regional HMI reading were also down in each region (barring South). Midwest fell three points to 72, West declined one point to 89 and Northeast dropped five points from the prior month to 78. South, however, inched up one point to 85 from the prior month.

Image Source: Zacks Investment Research

Our Take

The Zacks Building Products - Home Builders industry has slipped 3.2% in the past three months against the Zacks Construction sector and S&P 500 composite’s 3% and 7.4% growth, respectively. This performance reflects the rough patches that the industry is going through.

Higher costs, and lower availability of softwood lumber and other building materials are concerning almost every homebuilder.

In this regard, NAHB Chairman, Chuck Fowke, said, “These higher costs have moved some new homes beyond the budget of prospective buyers, which has slowed the strong pace of home building. Policymakers need to focus on supply-chain issues in order to allow the economic recovery to continue.”

Although the recent lumber prices have shown a downturn of more than 10% from their recent peak seen on Jun 8, the figure is almost two times higher than the 15-year average. Builders have already announced their intentions of future price hikes for homes to deal with rising building materials, and labor and lot costs. Notably, unavoidable increase in new home prices are sidelining some prospective buyers.

Labor is also concerning homebuilders recently, as published by the U.S. Bureau of Labor Statistics. May employment rate for construction declined by 20000, reflecting 225,000 job loss since February 2020.

This apart, deliveries continue to be delayed due to lingering supply-chain issues surrounding the pandemic. These supply constraints are resulting in insufficient appraisals and difficult access to construction loans.

For the week ended Jun 4, mortgage applications for the purchase of a newly built home declined 3.1% year over year from the earlier week, per the Mortgage Bankers Association’s Builder Application Survey released on Jun 9. Refinance also fell 5% from a week ago and 27% year over year. Market pundits revealed that fewer homeowners were able to take advantage of lower rates, which caused the refinance share to dip to the lowest level since April.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

Beazer Homes USA, Inc. (BZH) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

Tri Pointe Homes Inc. (TPH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research