High-Yield Stocks for the Dividend Investor

Dividend investors should have a look at the following stocks as their dividend yields beat the S&P 500's yield (1.72% as of Feb. 14), which is used as a benchmark for the U.S. stock market.

BHP Group

The first company to consider is BHP Group Ltd. (NYSE:BHP).

Shares of the Australian mining, metals and oil company closed at $51.69 on Feb. 14 for a market capitalization of $131.33 billion.

NASDAQ:TIGO).

Shares of the Luxembourg-based provider of cable and mobile services in South America and Africa closed at $46.64 on Feb. 14 for a market capitalization of $4.72 billion.

Based on Friday's closing price, Millicom International offers a 5.66% yield for both the trailing 12-month dividend and the forward dividend.

In 2019, the company paid a semi-annual cash dividend of $1.32 per common share on May 10 and Nov. 12.

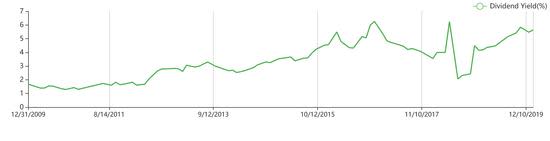

The current dividend yield is close to a three-year high. GuruFocus indicates that the current dividend yield is also good as it is high compared to its historical values. This suggests that the stock is a profitable investment.

Over the past 12 months through Feb. 14, the stock declined 24% to trade below the 200-, and 50-day simple moving average lines. It is still slightly above the 100-day line.

The 52-week range is $40.83 to $63.53. The 14-day relative strength index of 47 indicates the stock is neither overbought nor oversold.

The stock has a price-book ratio of 2.17 versus the industry median of 1.89 and a price-sales ratio of 1.09 versus the industry median of 1.39.

GuruFocus assigned a low rating of 3 out of 10 for the company's financial strength, but a positive rating of 6 out of 10 for its profitability.

Wall Street issued a buy recommendation rating for the stock with an average price target of $62.20 per share.

Cheesecake Factory

The third company to consider is Cheesecake Factory Inc. (NASDAQ:CAKE).

Shares of the Calabasas, California-based restaurant chain closed at $40.31 on Feb. 14 for a market capitalization of $1.8 billion.

Based on Friday's closing price, Cheesecake Factory offers a 3.42% trailing 12-month dividend yield and a 3.57% forward dividend yield. Currently, the company pays a quarterly dividend of 36 cents per common share. The last payment was made to shareholders on Nov. 26. The company has been paying dividends for about seven years.

The current dividend yield is good according to GuruFocus. It is near a 10-year high, suggesting that investors are dealing with a profitable stock.

The stock fell 14% over the past year through Feb. 14 to below the 200- and 100-day simple moving average lines. The share price is still above the 50-day line.

The 52-week range is $35.83 to $51.15 per share. The 14-day relative strength index of 55 suggests the stock is neither oversold nor overbought.

Further, the stock has a price-earnings ratio of 19.2 versus the industry median of 24.18 and a price-sales ratio of 0.76 versus the industry median of 0.9.

GuruFocus assigned a positive rating of 5 out of 10 for the company's financial strength and a high rating of 8 out of 10 for its profitability.

Wall Street issued a hold recommendation rating for the stock with an average target price of $45.63 per share.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?