Hindenburg’s Bond Whale Target Caught Up in Market-Rigging Probe

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Kazakhstan is seeking to curb alleged manipulation by billionaire Timur Turlov’s Freedom Holding Corp. — a group targeted by US short-seller Hindenburg Research last year — in the country’s local-currency sovereign debt market.

Most Read from Bloomberg

Putin Steps Into US Race to Back ‘Old-Style’ Biden Over Trump

Japan Loses Its Spot as World's Third-Largest Economy as It Slips Into Recession

The watchdog took an initial step in November by providing brokers with a list of 13 limited partnerships that are no longer allowed to conduct deals with certain securities, according to people familiar with the matter. The decision, they said, takes aim at companies not directly affiliated with Freedom but suspected of being involved with it in what authorities have alleged amounts to manipulation.

Local authorities also plan to restrict the ability of the Nasdaq-listed firm to deploy its units as buyers and sellers in what the regulator says helps the company to rig trades, according to the people, who requested anonymity to speak about deliberations that aren’t public. Their effort is focusing on repurchase operations, in which securities are sold with an agreement to buy them back later.

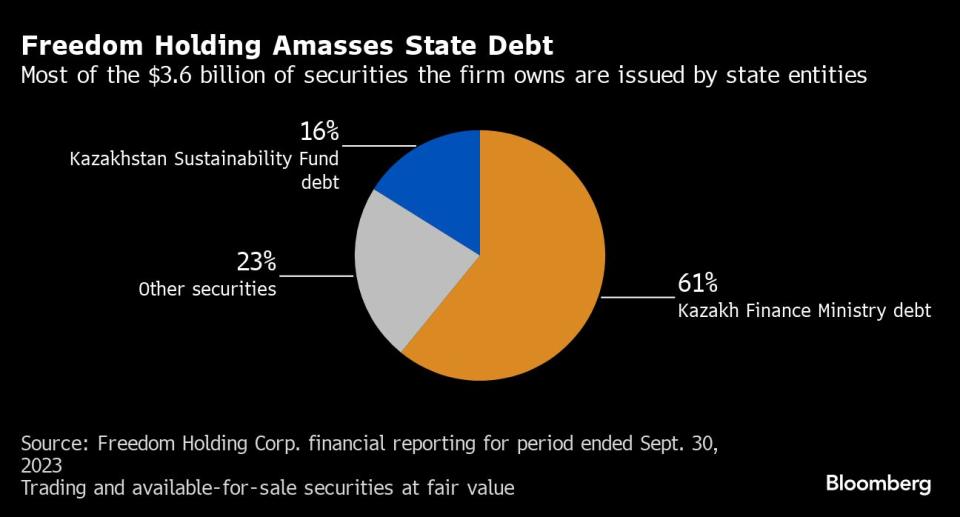

Freedom Holding Corp. is the parent of Kazakhstan-based brokers Freedom Global Plc and Freedom Finance JSC, which in turn owns a local bank and two insurance companies. The group has become a whale in the local debt market by amassing more than 6% of all outstanding tenge-denominated securities issued by the Finance Ministry, according to Bloomberg calculations.

The country’s financial regulator, officially known as the Agency for Regulation and Development of Financial Market, confirmed that last year it fined Freedom Finance and its units for transactions “committed for the purpose of manipulation.” It’s brought no cases against them in 2024, according to an emailed reply to questions.

Freedom Holding said it couldn’t challenge the decisions directly with the regulator after procedural changes in late 2022 made the criteria used to detect market manipulation less clear. The firm’s units repeatedly denied any wrongdoing during court hearings held in Kazakhstan. Last year, Freedom dismissed Hindenburg’s claims as “speculation and a set of unsubstantiated facts.”

Freedom, based in Almaty, built a regional financial powerhouse by providing retail investors access to equities and initial public offerings abroad. The company’s shares rose as much as 1% in early trading in New York on Thursday.

After long facing outside criticism — which included assessments from S&P Global Ratings — for its proprietary trading of local stocks, the firm in recent years started to take on a bigger presence in the less risky market for government debt and quasi-sovereign securities such as those issued by Kazakhstan Sustainability Fund JSC, a state entity controlled by the central bank.

An external review commissioned by the independent members of Freedom’s board of directors and published in January said the sustainability fund’s bonds are “held as part of a deliberate and legitimate trading strategy” which the company expects to become profitable as a result of changes it anticipates in interest rates.

Questionable Deals

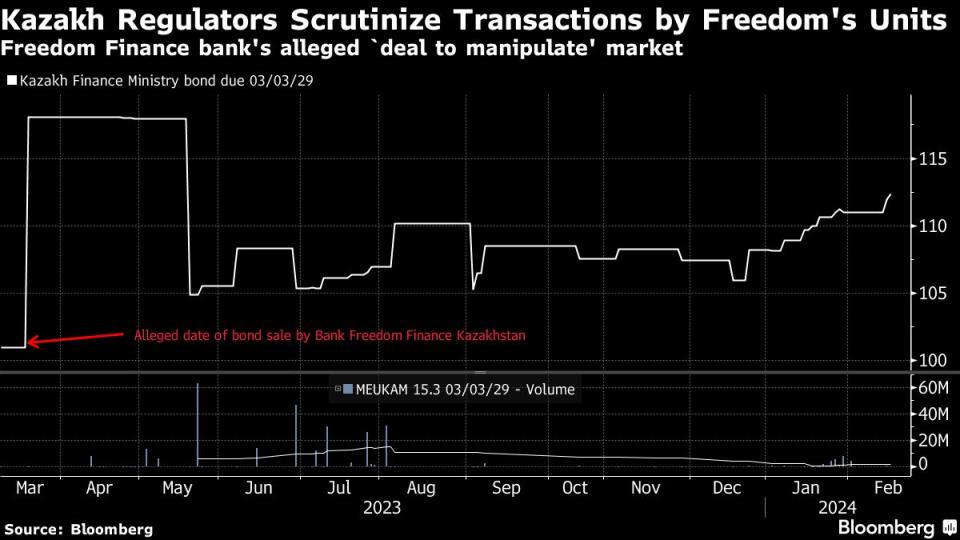

Potentially suspect trades by Freedom’s units drove up the prices of some local sovereign bonds, according to court filings viewed by Bloomberg. Freedom Finance was the most active trader of government notes last year.

Bidding up the price of debt would have a double significance for Freedom, contributing to its profits and enabling it to borrow more money by putting up the securities as collateral.

Freedom identifies and tries to enter illiquid segments of the market where it can sway prices, in part by attempting to gain ownership of a majority of traded securities, the people said.

The previously unreported legal cases last year resulted in several fines levied on Freedom’s brokerages and its banking and insurance units between February and August 2023, according to Almaty court filings.

The insurers are the subject of a draft order, published in December, that aims to cut their capacity to engage in repurchase operations by about two-thirds, the people said. The directive is currently under discussion by the financial markets regulator and could still undergo changes.

Turlov, who controls about 71% of Freedom, criticized the initiative as an “extremely exotic way” to control interest-rate risk, telling Bloomberg that it’s not in line with international practices including the latest Basel regulatory standards.

Stiffer oversight of Freedom at its home base follows Hindenburg’s report on Aug. 15 that included accusations that ranged from fraud and market manipulation to circumventing sanctions.

The latest Kazakh investigations in 2023 determined Turlov’s companies were in fact using certain trades to book profit by revaluing the debt they still held on their balance sheet, according to the people. That followed a probe by the regulator early last year into suspected manipulation of local bond prices by some of Turlov’s firms.

At the time, Freedom told Bloomberg it had received no complaints from the regulator over yields on securities issued by the sustainability fund. The company denied that any of its transactions — which it said are routinely audited — amounted to manipulation.

In 2023, Kazakh judges have upheld some of the fines given for manipulating the market after Freedom contested them in court. Freedom lost most of the appeals but some cases might still be pending or unresolved.

Turlov said fines across the group amounted to less than $50,000 last year and were not a “material” factor for his company.

In July, the country’s watchdog fined Freedom Finance, the holding’s Almaty-based brokerage, for manipulating Kazakhstan Sustainability Fund’s bonds in February, according to later filings with Almaty’s administrative court. Freedom Finance denied any wrongdoing in the lower court and the court of appeal, which both ruled against it.

The regulator also fined Astana-based Freedom Finance Global in July for manipulating the fund’s debt. The brokerage denied the accusations but lost the case both in the lower court and the court of appeals.

Some of the verdicts appear to contradict the conclusions reached in Freedom’s external review of allegations made by Hindenburg. The audit found “there was no evidence identified” that the company “has engaged in market manipulation” of securities including the sustainability fund’s debt.

Repo Funding

Freedom Holding’s securities portfolio expanded by 3.5 times over the 18 months ended Sept. 30, according to S&P. It holds the assets “mostly on the balance sheet” of the Kazakh bank owned by Freedom Finance, with about 75%-80% of the book funded by repurchase deals, Annette Ess, S&P’s credit analyst in Frankfurt, said by email.

“The group takes a considerable amount of market risk – that is, the risk of price volatility,” she said.

Turlov’s group is operating in a debt market that’s drawn the interest of major international fund managers but isn’t yet included in global indexes.

As part of their effort to attract greater inflows, the Kazakh authorities are planning to introduce the practice of primary dealership, which enables several financial institutions to buy debt directly from the government and should help make pricing more transparent.

The Kazakh Finance Ministry’s bonds made up nearly two-thirds of the total $3.6 billion in debt held by Freedom as of Sept. 30, according to its consolidated report. Bonds issued by Kazakhstan Sustainability Fund accounted for another $612 million.

As early as in 2017, Freedom drew regulatory ire for its reliance on equity repo agreements to borrow short-term money and then use it to buy more stocks.

Freedom’s activities in the local debt market follow a similar approach. Court filings in Kazakhstan offer a fuller view of such transactions by Freedom’s units.

According to a November case filed with the Almaty administrative court, Bank Freedom Finance Kazakhstan in March bought 2029 securities issued by the Finance Ministry in the primary market.

Just over two weeks later, it sold some of them at a markup, in what the regulator called “a deal to manipulate the securities market.” The bank’s representative told the court there was no proof of any wrongdoing and denied the accusations, which resulted in a fine.

The investigations in 2023 prompted the Kazakh regulator to fine Freedom Finance itself and one of its insurers. It penalized another insurance unit, Freedom Finance Life, twice in February that year and Freedom Finance Bank three times between February and August, according to the watchdog’s website.

Concerns over Freedom’s practices and its buildup of investment in government and quasi-sovereign bonds prompted the regulator to try to limit the credit risk it allows insurers engaging in repurchase operations, the people said.

The order under discussion is designed to sharply cut the value of securities pledged as repo collateral for the purposes of calculating insurers’ liquid assets, a decision that directly affects Freedom Finance’s units.

Freedom’s accumulation of tenge securities was effectively a bet that Kazakh interest rates would decline, said S&P’s Ess.

Instead, local borrowing costs stayed elevated after going up sharply after the Russian invasion of Ukraine in February 2022. Even with monetary easing that started last August, rates remain higher than the pre-war level.

Far tighter policy after the start of the war resulted in a “large-scale mispricing of sovereign debt,” Turlov said. The central bank-run pension fund played a de-facto market maker role at the time, conducting operations that led to a flat yield curve and caused longer-term securities to drop sharply in value, he said.

Yields at the time of bond issuance “differed significantly” from those in the secondary market, and “the deviation in prices itself was recognized as a fact of market manipulation,” Turlov said.

(Updates with share price in seventh paragraph.)

Most Read from Bloomberg Businessweek

How Paramount Became a Cautionary Tale of the Streaming Wars

‘Playing God’: This Labor Activist’s Relentless Emails Force Companies to Change

©2024 Bloomberg L.P.