The Hingtex Holdings (HKG:1968) Share Price Is Down 44% So Some Shareholders Are Getting Worried

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Hingtex Holdings Limited (HKG:1968) share price slid 44% over twelve months. That contrasts poorly with the market return of 5.3%. Because Hingtex Holdings hasn't been listed for many years, the market is still learning about how the business performs. Shareholders have had an even rougher run lately, with the share price down 35% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for Hingtex Holdings

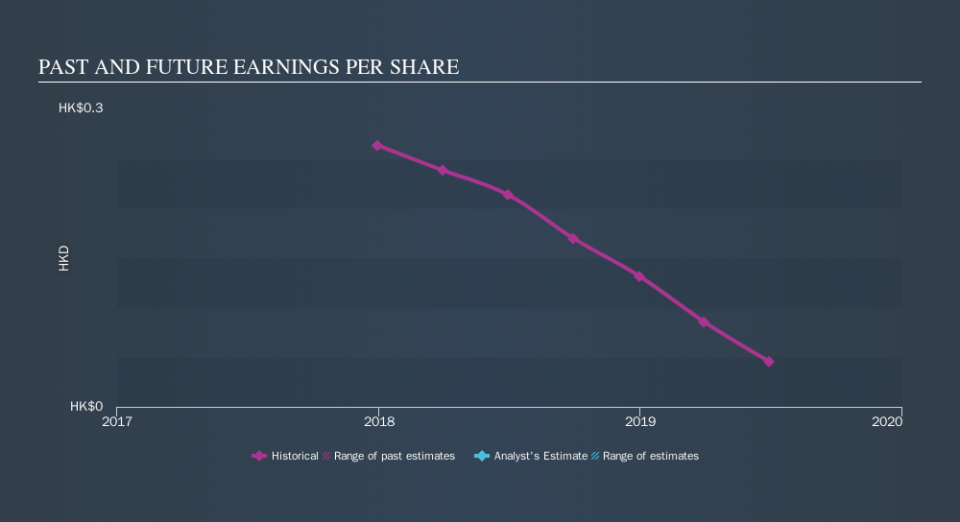

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unhappily, Hingtex Holdings had to report a 79% decline in EPS over the last year. This fall in the EPS is significantly worse than the 44% the share price fall. It may have been that the weak EPS was not as bad as some had feared.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Hingtex Holdings the TSR over the last year was -42%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While Hingtex Holdings shareholders are down 42% for the year (even including dividends) , the market itself is up 5.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 35% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. Before forming an opinion on Hingtex Holdings you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.