HK Summit Latest: Goldman Sees Better Capital Markets Outlook

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Hong Kong kicked off its global finance summit, where about 300 executives from Citadel’s Ken Griffin to Goldman Sachs Group Inc.’s David Solomon and Morgan Stanley’s James Gorman are expected to attend.

Most Read from Bloomberg

Rockstar Plans to Announce Much Anticipated ‘Grand Theft Auto VI’

Trump's Wealth Has Jumped $500 Million Since He Left the White House

Apple Delays Work on Next Year’s iPhone, Mac Software to Fix Bugs

Malaysia Renews Hamas Support, Defying Threat of US Sanctions

Conceived last year to restore confidence after years of Covid restrictions and a tightening political climate, the Nov. 6-8 summit’s theme this year is “Living With Complexity.” Wall Street’s elite are descending on a city that has been transformed over the past few years — where finance firms have slashed hundreds of top jobs and tens of thousands of high-skilled people have emigrated.

(All times are HK time)

HK Sees 70,000 Arriving Via Talent Scheme (2:10 p.m.)

Hong Kong had by end-September received more than 180,000 applications for its talent program, the city’s Financial Secretary Paul Chan said.

The government has approved over 100,000 applications, while more than 70,000 have already arrived in Hong Kong, he said.

Mainland Wealth Flowing Into HK Has Increased 3-4 Times (1:47 p.m.)

Wealth from mainland China into Hong Kong has grown 3-4 times this year, said Noel Quinn, CEO of HSBC Holdings Plc.

“There’s a huge flow of wealth management activity coming into Hong Kong post the opening up of Covid,” Quinn said.

The bank’s insurance business this year is up 40%, with a good proportion of that from mainland China, he said.

Goldman Sees Better Outlook for Capital Markets (1:45 p.m.)

The environment for capital market activities should improve next year as investors reset expectations on valuations and the cost of financing, Chief Executive Officer David Solomon said.

“We can operate with very, very healthy capital markets in a 5% interest environment, but the period of reset and acceptance takes some time,” Solomon said.

On financing, he said companies need capital and to bring themselves to public markets in 2024 after being closed for a period of time.

Citigroup Expects Increased Productivity From AI (1:38 p.m.)

Citigroup Inc. should have all 40,000 coders in the bank fully enabled around artificial intelligence by the end of the first quarter in 2024, Chief Executive Officer Jane Fraser said.

“We are conservatively thinking we’d expect to see at least 10% productivity uplift from them,” Fraser said.

Hong Kong Can Be Innovation Gateway (1:08 p.m.)

Hong Kong needs to shift its role from a shop to a service provider and play a bigger role in the region’s innovation system, said Neil Shen, founding partner of HongShan, formerly known as Sequoia China.

The city has university talent for biotech, medtech and robotics and can attract global staff to build international companies, Shen said.

HK GDP Growth To Be Lower Than Expected (12:37 p.m.)

Hong Kong’s economy will grow more than 3% in 2023, Financial Secretary Paul Chan told Bloomberg TV on the sidelines of the summit. Exports, capital formation and private consumption all failed to come back as quickly as expected out of Covid, he said.

The city initially predicted 2023 growth in the 3.5% to 5.5% range before narrowing that to a range of 4% to 5% in August.

“Now we realized that the recovery, although being sustained, is still lower than expected,” Chan said.

Measures to boost the property market are “basically sufficient” for now, but the impact will depend on the external economic situation, he said.

Citadel’s Griffin Says Investors Can’t Ignore China (12:01 p.m.)

Citadel founder Ken Griffin said that global investors have “got to be watching and investing here in China.”

Separately, Griffin said that deglobalization’s consequences for inflation are a “giant wild card” for the global economy. He added that the US government is on a spending spree that could drive up the deficit, which is effectively “pulling in consumption in the here now, at the expense of future generations.”

On the global debate about returning to the office, Griffin said that his staff are back at the firm five days a week.

UBS’s Kelleher Warns of Next Crisis (11:58 a.m.)

The world’s next financial crisis could happen with non-bank financial intermediaries, which now account for half of the global financial assets, UBS Group AG Chairman Colm Kelleher said on one of the panels.

“I think the next crisis when it happens, will be in that sector, it’ll be a fiduciary crisis,” he said. The banking regulator is “very focused on this finally” after being warned of the risk in 2019, he said.

The shadow banking sector is “a real cause of concern,” he said.

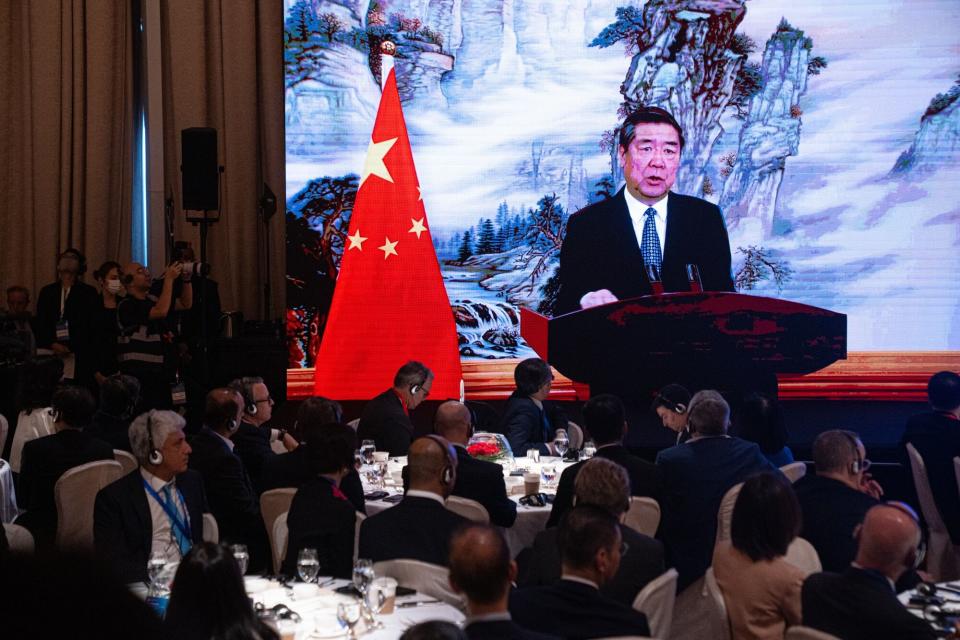

PBOC on Chinese Economy (11:52 a.m.)

A senior official at the People’s Bank of China says he’s sanguine about the economy because some debt risks will recede and the property market has long-term potential.

Global investors have concerns about the Chinese economy including its pace of recovery, and with problems related to real estate and local government borrowing, Deputy Governor Zhang Qingsong acknowledged in a speech in English at the forum.

“You may ask me, are you worried? No, not always, not too much,” he said. “From a long-term perspective, the fundamentals of the Chinese economy remain stable and promising.”

Markets Too Optimistic on Rates Cycle: Bridgewater (11:28 a.m.)

The market is “under-discounting” how long the tightening cycle in the US and Europe will go on before an equilibrium is reached, according to Bridgewater Associates Co-Chief Investment Officer Bob Prince.

Deutsche Bank CEO Worried About Geopolitics (11:04 a.m.)

The calm state of markets, despite global geopolitical events, inflation and rising interest rates, is concerning, Deutsche Bank CEO Christian Sewing said during a panel at the forum. One more geopolitical escalation could lead to a market event, he said.

Mideast to Raise Investments in China: HKEX CEO (10:39 a.m.)

Hong Kong Exchanges & Clearing Ltd. CEO Nicolas Aguzin said he expects top Middle Eastern sovereign wealth funds to increase their investments in China to $1 trillion from about $40 billion now.

The top 10 Middle Eastern sovereign wealth funds expect to increase their assets under management to about $10 trillion from $4 trillion now, of which 10% would mostly be in China, Aguzin told Bloomberg TV at the forum on Tuesday. Hong Kong serves as a good hub for money from the Middle East, and Middle Eastern investors want to make sure that money invested in Hong Kong is also channeled back to their region, Aguzin said.

Money flowing in from Western Europe and the US is slowing, he said. Aguzin declined to comment on the prospects of Saudi Aramco and Didi listing their shares in Hong Kong.

Templeton Looking at ‘Cheap’ China Assets (10:33 a.m.)

Franklin Templeton Investments is interested in China again because it’s “trading so cheap,” the firm’s President Jenny Johnson said on Bloomberg TV at the sidelines of the summit.

Separately, the US Federal Reserve is almost done with rate hikes, and therefore investors can start to lock in longer-term rates, such as in high-yield bonds or private credit, Johnson said.

China to Make HK Listing Easier for Mainland Firms (10:12 a.m.)

China will make it easier for mainland firms to conduct initial public offerings in Hong Kong, said Wang Jianjun, vice chairman of the China Securities Regulatory Commission.

Authorities are also optimizing the stock connect program linking mainland markets with Hong Kong to include block trading, Wang said. This expansion will be launched as soon as possible, as agreement between the different authorities has been reached and details are being worked out, he said.

Apollo Global to Stick To Senior Debt (10 a.m.)

Apollo Global Management is going to stay senior in the capital structure and sees interesting opportunities in hybrid products and asset-backed securities, according to Matthew Michelini, partner and head of Asia Pacific at the firm.

Apollo will continue to hire across its big three priorities, which are origination, global wealth and capital solutions. “We’ll continue to hire across those verticals and we’ll be hiring here in Asia,” he said.

China Urges HK to Look at Asean, Mideast (9:32 a.m.)

Hong Kong should explore Asean and Middle East markets to expand its circle of friends, China Vice Premier He Lifeng said at the forum.

Chinese President Xi Jinping attaches great importance to Hong Kong’s development and will help uphold the city’s standing as an international financial center, He said.

China will support cross-border trades and investments with Hong Kong, expanding the openness of the financial sector with the outside world, He said. The vice premier also urged Hong Kong to adapt to market changes and further integrate into China’s development plans.

HK May Ease Home Curbs (8:46 a.m.)

The city may ease measures if home prices continue to drop, Hong Kong Monetary Authority chief executive Eddie Yue told Bloomberg TV.

“When there is a clear change in cycle, we will relax our countercyclical measures,” Yue said. “If there is further correction, we might want to look at our policy and see whether there is room for further calibration.”

The city’s mortgage default rate is low, Yue said. Existing home prices have fallen about 20% since their 2021 peak to levels last seen in April 2017.

BNY Mellon Bullish on Credit (8:32 a.m.)

High yields still provide a “very good environment” for investors to focus on fixed income and add credit, particularly duration, to their portfolios, said Hanneke Smits, global head of investment management at Bank of New York Mellon Corp.

While it’s hard to call whether they have peaked, high yields provide a safe haven in the current environment, Smits said in an interview with Bloomberg TV on the sidelines of the forum.

--With assistance from Paul van Deventer, David Ingles, Yujing Liu, Bei Hu, Harry Suhartono and Joanne Wong.

Most Read from Bloomberg Businessweek

In Uruguay, a Tax Haven With Lots of Beaches and Little Crime

Top-Ranked MBA Programs Struggle to Reverse Declining Applications

Marvel’s Latest Movie Will Show If Superheroes Ever Get Tired

©2023 Bloomberg L.P.