Do HMS Networks's (STO:HMS) Earnings Warrant Your Attention?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in HMS Networks (STO:HMS). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for HMS Networks

How Fast Is HMS Networks Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud HMS Networks's stratospheric annual EPS growth of 50%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

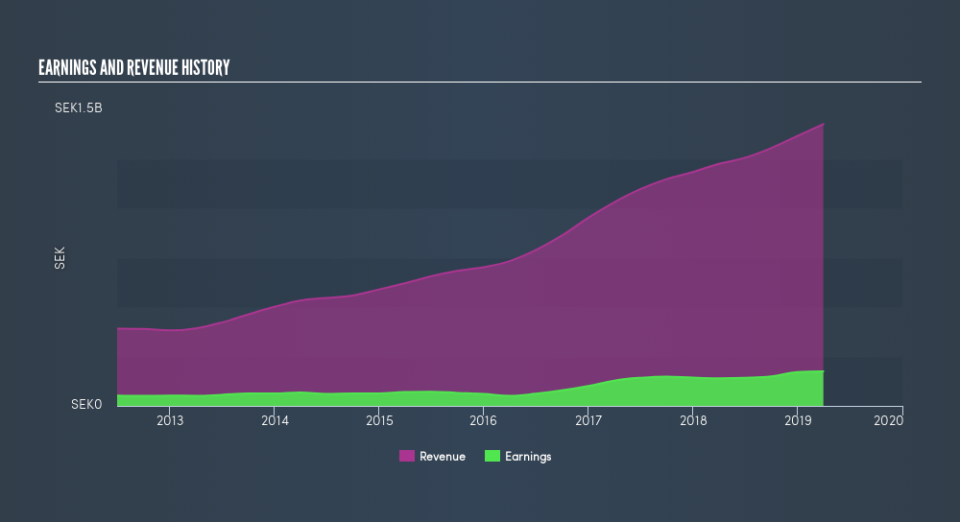

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note HMS Networks's EBIT margins were flat over the last year, revenue grew by a solid 16% to kr1.4b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check HMS Networks's balance sheet strength, before getting too excited.

Are HMS Networks Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own HMS Networks shares worth a considerable sum. Indeed, they hold kr348m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 4.4% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like HMS Networks with market caps between kr3.9b and kr15b is about kr5.7m.

HMS Networks offered total compensation worth kr4.5m to its CEO in the year to December 2017. That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add HMS Networks To Your Watchlist?

HMS Networks's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. HMS Networks certainly ticks a few of my boxes, so I think it's probably well worth further consideration. Of course, just because HMS Networks is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Although HMS Networks certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.