Home Depot (HD) Q1 Earnings & Sales Top Estimates, Stock Rises

The Home Depot, Inc. HD has posted first-quarter fiscal 2021 results, wherein earnings and sales beat the Zacks Consensus Estimate and improved year over year. The company gained from the continued strong demand for home-improvement projects as well as its ongoing investments.

Shares of the home-improvement retailer rose 2.2% in the pre-market session, following the better-than-expected first-quarter fiscal 2021 results.

Moreover, the Zacks Rank #3 (Hold) stock has risen 14.5% in the past three months compared with the industry’s growth of 11.9%.

Q1 Highlights

The company’s earnings of $3.86 per share improved 85.6% from $2.08 registered in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate of $3.04.

Net sales advanced 32.7% to $37,500 million from $28,260 million in the year-ago quarter and beat the Zacks Consensus Estimate of $34,880 million. Sales benefited from the continued robust demand for home improvement projects.

The company is effectively adapting to the high-demand environment, driven by investments in its business over the years and the dedication of its associates to serve customers. Its overall comps grew 31%, with a 29.9% improvement in the United States.

In the reported quarter, comps were aided by a 10.3% rise in average ticket and a 19.3% increase in customer transactions. Moreover, sales per square foot rose 29.8%.

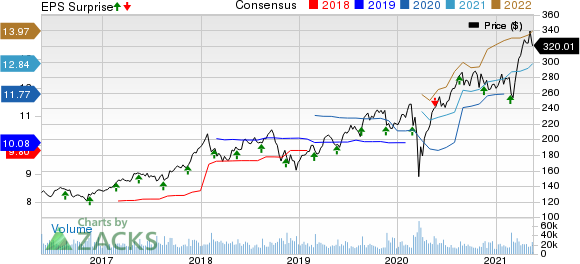

The Home Depot, Inc. Price, Consensus and EPS Surprise

The Home Depot, Inc. price-consensus-eps-surprise-chart | The Home Depot, Inc. Quote

In dollar terms, gross profit increased 32.4% to $12,742 million from $9,625 million in the year-ago quarter, primarily driven by robust sales growth. Meanwhile, gross profit margin was almost flat with the last year at 34%.

Operating income increased 76.5% to $5,781 million, while operating margin expanded 380 bps to 15.4%. Operating margin benefited from top-line growth as well as flat gross margin, offset by higher SG&A and other operating expenses.

Balance Sheet and Cash Flow

Home Depot ended first-quarter fiscal 2021 with cash and cash equivalents of $6,648 million, long-term debt (excluding current maturities) of $34,697 million, and shareholders' equity of $1,748 million. In first-quarter fiscal 2021, it generated $6,310 million of net cash from operations.

In the fiscal first quarter, the company paid out cash dividends of $1,775 million and repurchased shares worth $3,788 million.

3 Better-Ranked Retail Stocks

Lumber Liquidators Holdings, Inc. LL has a long-term earnings growth rate of 22.5% and it sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tecnoglass Inc. TGLS, also a Zacks Rank #1 stock, has a long-term earnings growth rate of 20%.

Abercrombie & Fitch Co. ANF has a long-term earnings growth rate of 18%. It presently flaunts a Zacks Rank #1.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Lumber Liquidators Holdings, Inc (LL) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research