Home sales pick up steam in Volusia, Flagler counties. Here's the reason.

After a down year for sales in 2023, Realtor P.W. Mabry is already seeing things pick up in the New Year.

The veteran real estate agent with Re/Max Signature in Ormond Beach just landed a new listing: a single-family house in Daytona Beach's Pelican Bay community. The 3-bedroom, 3-bath house built in 1989 is for sale by its original owner.

"It looks like we're on an up-climb," said Mabry, who was recently installed as 2024 board president for the Daytona Beach Area Association of Realtors. "We have more inventory right now and we have buyers that are calling us to see more properties because of the interest rates going down."

What's sparking the increase in sales?

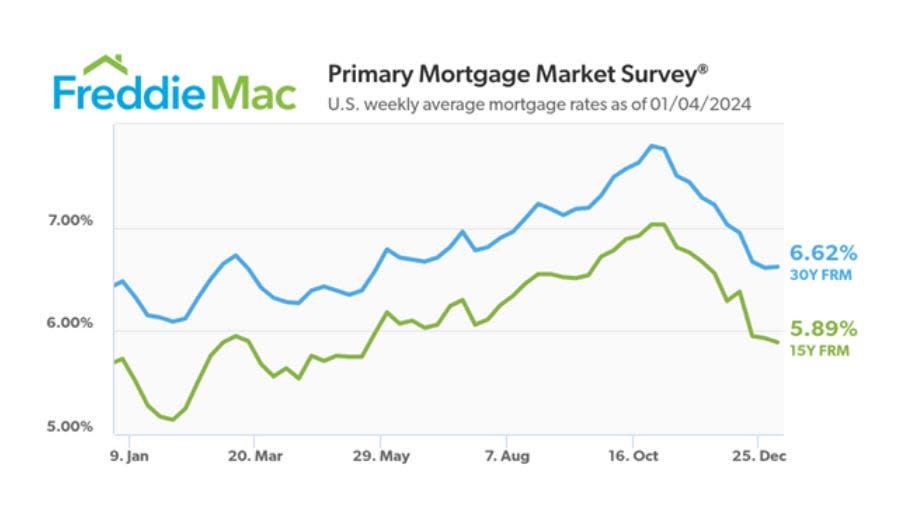

On Thursday, the Federal Home Mortgage Loan Corp., better known as Freddie Mac, reported the average rate for new 30-year fixed-rate mortgage loans held steady at 6.62%, after peaking at nearly 8% in late October.

Falling mortgage rates typically spur increased home sales.

"Whenever the interest rate goes down, you can buy more for your money," said Eddie Marcal, a Realtor with Coldwell Banker Premiere Properties in Palm Coast.

Marcal, the newly installed 2024 board president for the Flagler County Association of Realtors, said his guess is that average rates for new 30-year fixed-rate mortgage loans could dip to 6% or possibly even lower by the end of this year.

More homes are being put on the market

Jenny Snyder, a Realtor with Local Living Realty Group in New Smyrna Beach, said she has three new listings set to be put on the market this month. All are oceanfront condominiums.

"I think 2024 is going to be a good year," said Snyder, who was recently re-elected to a second consecutive term as president of the New Smyrna Beach Board of Realtors. "Mortgage rates are coming down to where they were in 2018 and '19. Lower rates will bring more buyers into the market."

A look at the latest monthly sales reports by area Realtor associations show active listings for single-family homes rose in November to 2,375 in Volusia County, up 13.5% from 2,093 the same month in 2022. In Flagler County, active listings rose to 1,003, up 18.3% from 848 a year ago.

It was the biggest year-over-year percentage gain for Volusia in over two years and in Flagler in the past year and a half.

"The thing that's changed the most in the past two years is mortgage rates," said Toby Tobin, a Realtor with Grand Living Commercial Realty in Palm Coast. "When they go up, it takes some potential buyers and sellers out of the market."

Tobin has been tracking the Flagler County real estate market for more than 20 years for his blog GoToby.com and weekly radio show "Real Estate Matters" on WNZF.

In addition to keeping potential buyers on the sidelines, high rates prevented some would-be sellers from putting their homes on the market because they had mortgage loans at significantly lower rates. That kept the number of homes sold locally this past year "artificially low," he said.

How will more inventory affect home prices?

When supply exceeds demand, it typically causes prices to fall. But don't expect that to happen for local home prices, Realtors say.

That's because the number of people moving to Florida continues to exceed the number leaving. According to the most recent Census Bureau estimates, the population in Volusia County grew from 553,561 to 579,192 between April 1, 2020 and July 1, 2022. Flagler County saw its population grow from 115,383 to 126,705 during that same period.

And builders haven't been able to keep up with the growing demand.

Through the first three quarters of 2023, builders obtained permits for 2,762 new homes in Volusia and 1,323 new homes in Flagler.

That means Volusia County gained 32 new residents a day while builders only added 10 new homes a day. Flagler County gained 14 new residents a day, while builders added fewer than five new homes a day.

"It goes back to simple supply and demand," said Snyder. "I think prices will continue to go up."

In November, the median sale price for single-family homes rose in Volusia County to a new record high of $361,995, up 5.8% from $342,000 the same month in 2022, according to countywide Florida Realtors data provided by the West Volusia Association of Realtors. The previous record set in October was $360,495.

Flagler County Association of Realtors reported that the median sale price of single-family homes sold by its members in November held steady year-over-year at $385,000. The record high remains the $402,500 median sale price recorded in July 2022.

Despite less sales, 2023 was the best for some

Snyder who has been a Realtor the past eight years said 2023 was a down year in terms of number of closings, but her best year in dollar volume.

"Prices were higher for properties," she said.

While Snyder had a career-best 15 closings in 2021, the total value of her 11 transactions this past year was up 25%.

Many of the buyers Snyder represents are from out of state.

The same is true for Marcal. While his closings fell 8% in 2023, compared to 2022, the dollar volume of those transactions rose 15%.

"I do a lot of luxury properties," he said. "I had four sales over $1 million in 2023, including one for just under $2 million. Of those four, two were sold to out-of-state buyers."

Florida is returning to more normal rate of growth

For Mabry, 2021 remains his best year ever both in number of closings and dollar volume. He credits it to the so-called "COVID Bounce" when Florida saw a spike in newcomers.

Now in-migration for Florida is returning to a more normal rate of growth, Mabry does not anticipate sales heating back up to what they were in 2021.

He remains hopeful that 2024 will be a "turning point in a good way. We're all keeping our fingers crossed."

This article originally appeared on The Daytona Beach News-Journal: Home sales pick up steam in Volusia, Flagler counties. Here's why.