Honesdale passes earned income tax, council says funds can help fix runoff issues

Honesdale Borough Council on Nov. 6 approved an Earned Income Tax (EIT) of 1% to be applied to everyone working in the borough, regardless of where they live.

It also applies to Honesdale residents who work somewhere else that has the EIT in place, such as the City of Scranton. Instead of having Scranton deduct that tax, it would go to benefit Honesdale.

Someone living outside the borough but working in Honesdale would be subject to Honesdale's tax, unless that person lives where they already have the EIT. In the future, however, if that person's municipality chose to enact the EIT, they would pay the tax to their own municipality instead.

Council members stressed that the tax, expected to bring in $360,000 a year, will help them address serious stormwater runoff issues on the hillsides that are eroding many streets.

Despite this, the tax was passed only after over 90 minutes of discussion and hearing numerous Honesdale residents condemn the tax. Some residents supported an overall tax hike of 1.5 mills applied to every borough property taxpayer, working or not, as a fairer way to raise revenue.

Councilors James Hamill, Tiffany Rogers, Michael Augello and William McAllister voted for the EIT. David Nilsen and Jason Newbon voted against it. Councilor Eric Cooley was absent.

Council President Augello told the assembly that a new council administration begins in January 2024, at which time they could potentially overturn the tax. Elections were the next day. Augello and Cooley did not run for new terms; Rogers, who was appointed last winter, was elected, along with Noelle Mundy who will be new on the council, and James L. Brennan, who previously served as councilor.

James Hunt of Berkheimer Taxpayer Innovations explained that EIT is allowed under Pennsylvania Act 32 of 1965. It allows a municipality to levy up to 1% on income one would report on the PA40 tax form, Line 1, wages for services rendered, and Line 4, net profits.

Honesdale is the last county seat in Pennsylvania to adopt it. Hunt said before the vote that of the 2,540 municipalities in Pennsylvania, only 85 did not levy the tax. "Twenty-two of those happen to be here in Wayne County," Hunt said. Clinton, Dreher, Lehigh, Mount Pleasant, Salem, and Sterling townships in western Wayne County also levy it.

In 2022 there were 654 Honesdale residents paying the EIT elsewhere, where they work, totaling $138,209.40. Now that Honesdale has enacted it, those funds, at the rate the borough set, will return to the borough.

Berkheimer has the contract for Wayne County's taxing district at a rate of 3% of the funds distributed to each municipality for which the funds are collected.

'An insidious tax'

There was considerable grumbling heard after the vote, as the crowd promptly dispersed. Remarks were offered before the vote was taken.

Thomas Shepstone, a planning consultant, reminded that he voiced opposition to Honesdale council over prior EIT proposals, nearly 25 years ago and again two years ago. He called it "an insidious tax" that "spreads like a cancer. You enact it, and as soon as you do, Texas Township, Hawley Borough... will enact it and take it away from you."

Shepstone continued that "unearned income," like dividends, generous pensions, and capital gains, is not impacted. "If someone comes here from New York City and buys a grand home on North Main Street and they are living on their pension, they are not going to pay a dime," he said. A single mother, meanwhile, might earn $45,000 and pay $450.

Bob Rickert of Prompton Tool Inc. said that 51 of their 70 employees would be affected, who do not pay it elsewhere. He said they "effectively will be given a one percent reduction in pay. That's a big hit."

Jeffrey Thol, a financial consultant, advised spreading out the tax burden rather than placing it on only working people. The financially well-secured retiree does not face this tax. The younger workers, however, who replaced them on the job, typically face mortgages and expenses of raising a family and are earning less at that stage in their career, while having to pay the EIT.

Greater Honesdale Partnership (GHP) President Brian Wilken remarked, "The concerns of our membership are a 1% tax makes it even harder to attract good employees at your business... In order to retain good people... you have to pay them double more because they are going to pay taxes on the increase of salary you gave to them and on top of that they are going to get taxed again."

Wilken urged the council to again ask nonprofit Honesdale property owners to make donations in lieu of taxes. GHP also suggests that the borough take advantage of the state’s Strategic Management Planning Program that can help the borough streamline operations and be more efficient.

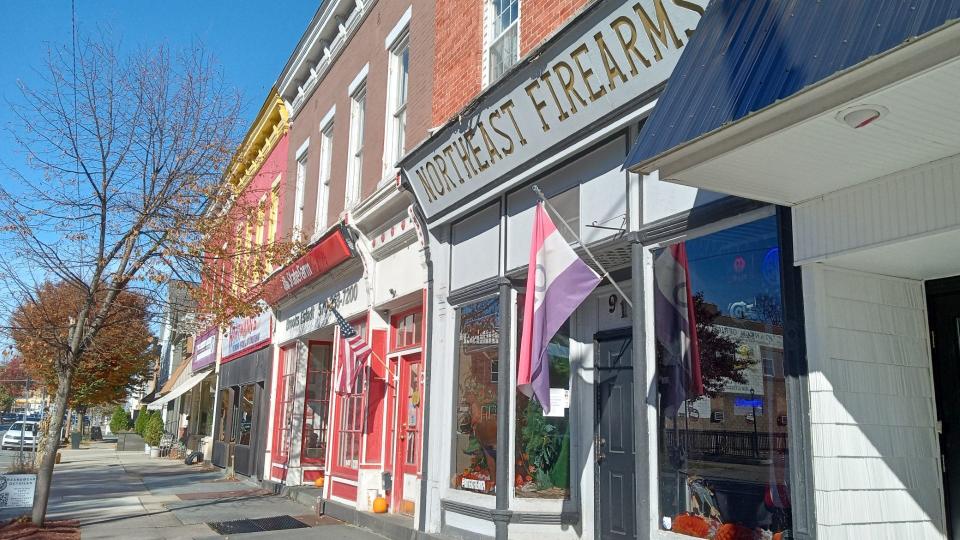

Jill McConnell, owner of Finders Keepers Consignment Boutique, said that prior borough decisions have made it difficult for her employees and customers, including one-way traffic, metering, and parking tickets. "It's a small business, it is hard enough; please don't make it any harder," she asked.

McAllister said that if they did not enact this tax, they would need to raise millage for operations, from a half-mill to 1.5 mills, affecting all borough taxpayers.

Raising millage by this amount, McAllister said, would generate around $40,000 more than the EIT.

Thol and Shepstone each said they would prefer paying the added millage rather than see the EIT. "I'll happily pay the one and a half mills... that's the fair thing to do," Shepstone said.

McAllister stated that like the residents, the borough must deal with rising costs and inflation, and although some residents cannot afford a tax hike, somehow the borough must meet its obligations.

Honesdale 'Inundated by water'

"Honesdale is literally inundated by water," Augello added. The cost of fixing runoff issues, he said, has already reached "a couple million" and could easily reach $20 million "so we don't lose these streets, we don't lose our homes, we don't lose our driveways..."

The council mulled over whether to adopt the EIT or raise millage.

Councilor Nilsen reasoned that while a single working mother may be hurt by the EIT, if millage were to be raised, her landlord would raise rents to cover the millage increase.

McAllister motioned to adopt a 1.5 mill increase; Nilsen seconded. Before voting, Hamill reminded that EIT Honesdale residents currently pay to other municipalities where they work will be paid to Honesdale.

Hamill noted that as county seat, Honesdale has a lot of non-taxable property, 43% of the total. Many residents struggle economically, he said, and feels they were not represented in person that evening while others who are better off voiced support for a tax hike rather than an EIT.

Storm water issues on Crestmont Avenue alone took over $300,000 to correct, Hamill said. Revenue raised by the EIT can help in replacing aged drainage pipes.

There was much audience applause when Hamill asked how the borough can cut expenses rather than increase taxes. One woman asked, "How many parks do we need?" A man suggested regionalizing the police department, spreading the cost among other jurisdictions.

The vote for the tax millage increase failed, 2-4. Augello and McAllister voted for it and Nilsen, Hamill, Newbon and Rogers voted against.

Then the vote to adopt the Earned Income Tax was taken and passed. The tax is scheduled to take effect in January 2024.

The council unanimously approved the tentative budget totaling $5,467,970. The final version will be voted upon at the Nov. 27 council meeting, which begins at 6 p.m. at City Hall.

Peter Becker has worked at the Tri-County Independent or its predecessor publications since 1994. Reach him at pbecker@tricountyindependent.com or 570-253-3055 ext. 1588.

This article originally appeared on Tri-County Independent: Honesdale Council passes income tax; some called for millage hike