Hornbach Holding KGaA (ETR:HBH) Has A Somewhat Strained Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Hornbach Holding AG & Co. KGaA (ETR:HBH) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Hornbach Holding KGaA

What Is Hornbach Holding KGaA's Debt?

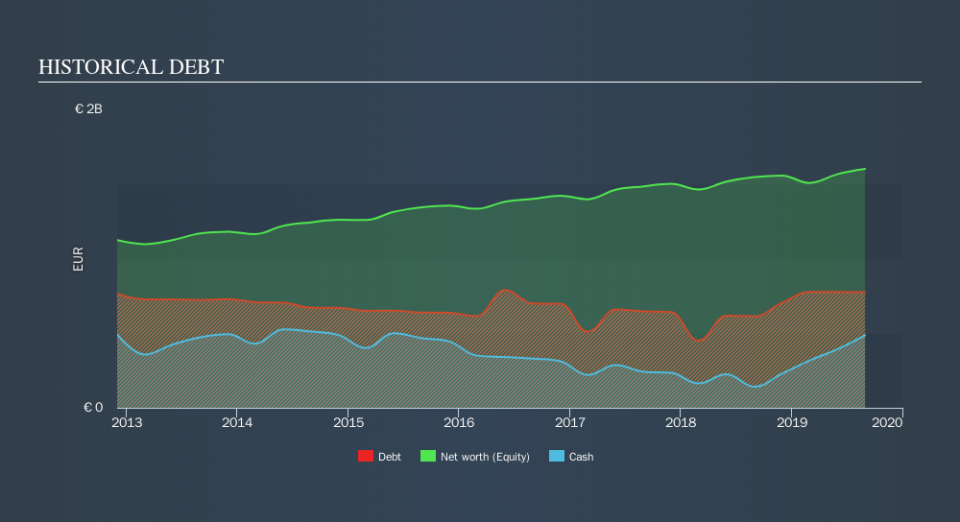

You can click the graphic below for the historical numbers, but it shows that as of August 2019 Hornbach Holding KGaA had €774.6m of debt, an increase on €612.1m, over one year. However, it also had €486.0m in cash, and so its net debt is €288.6m.

How Strong Is Hornbach Holding KGaA's Balance Sheet?

According to the last reported balance sheet, Hornbach Holding KGaA had liabilities of €928.5m due within 12 months, and liabilities of €1.28b due beyond 12 months. Offsetting this, it had €486.0m in cash and €58.8m in receivables that were due within 12 months. So it has liabilities totalling €1.66b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the €864.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we definitely think shareholders need to watch this one closely. After all, Hornbach Holding KGaA would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Hornbach Holding KGaA's low debt to EBITDA ratio of 1.0 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.9 last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. One way Hornbach Holding KGaA could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 14%, as it did over the last year. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Hornbach Holding KGaA can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Hornbach Holding KGaA created free cash flow amounting to 3.3% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Mulling over Hornbach Holding KGaA's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least it's pretty decent at managing its debt, based on its EBITDA,; that's encouraging. Overall, we think it's fair to say that Hornbach Holding KGaA has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Hornbach Holding KGaA's earnings per share history for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.