The Hospitality Properties Trust (NASDAQ:HPT) Share Price Is Down 11% So Some Shareholders Are Getting Worried

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. So we wouldn't blame long term Hospitality Properties Trust (NASDAQ:HPT) shareholders for doubting their decision to hold, with the stock down 11% over a half decade.

View our latest analysis for Hospitality Properties Trust

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate half decade during which the share price slipped, Hospitality Properties Trust actually saw its earnings per share (EPS) improve by 9.0% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Or possibly, the market was previously very optimistic, so the stock has disappointed, despite improving EPS. It's strange to see such muted share price performance despite sustained growth. Perhaps a clue lies in other metrics.

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. It's not immediately clear to us why the stock price is down but further research might provide some answers.

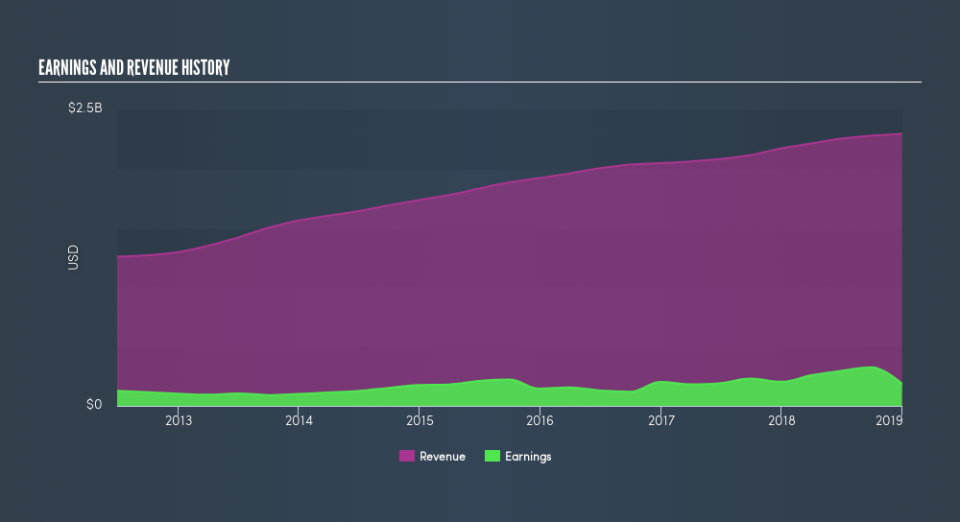

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Hospitality Properties Trust

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Hospitality Properties Trust's TSR for the last 5 years was 28%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Hospitality Properties Trust provided a TSR of 7.1% over the last twelve months. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 5.1% per year over five year. This suggests the company might be improving over time. Before forming an opinion on Hospitality Properties Trust you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

But note: Hospitality Properties Trust may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.