Has that house flooded before? Now NC sellers will have to tell you

They won't help a property buyer know if he's buying a great piece of land that's going to quickly appreciate or a lemon, but new rules adopted by the N.C. Real Estate Commission should help remove at least one unknown.

The commission recently voted to require flooding history to be included in a property's disclosure requirements. The move came in response to a petition filed last year by several groups seeking to add flood questions to the state's real estate disclosure form.

Here's why a slew of groups pushed for the changes, and what they mean in reality.

Isn't flood risk already public information?

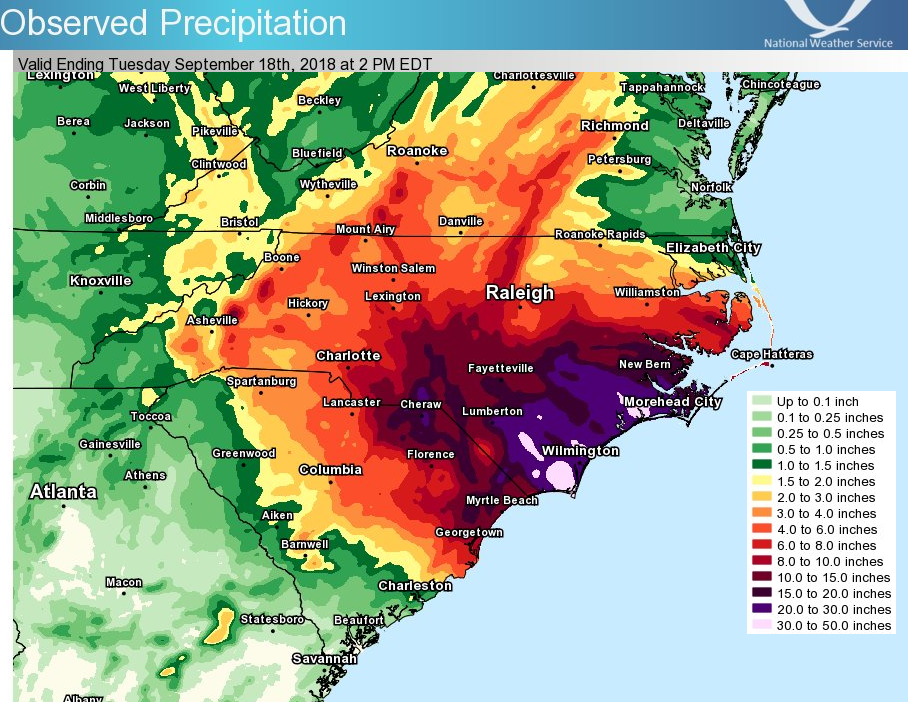

Flooding is North Carolina's most common natural hazard, but not all flooding events, especially those that don't involve federal recovery funds, are easy to track or even recorded.

Under current rules, sellers have to disclose if a property is in a flood hazard zone and requires flood insurance. But many say that doesn't adequately inform potential homebuyers about flood risks and past incidents of flood damage − in large part because many flood zone maps are decades out of date and don't reflect changes tied to recent developments and even climate change.

"The best indicator about if a house will flood isn’t if it's in a flood plain, but if it has flooded before," said Brooks Rainey Pearson, senior attorney with the Southern Environmental Law Center, which represented the Natural Resources Defense Council (NRDC) and several social justice groups in the petition.

According to the Federal Emergency Management Agency (FEMA), two-thirds of states currently have more explicit flood-related disclosure requirements than North Carolina. Climate change is another reason officials have pushed for stronger disclosure requirements, with scientists forecasting our warming weather will bring stronger hurricanes and more intense − albeit less frequent − rain events to the Tar Heel State in future decades.

More than 290,000 single-family homes in North Carolina have past flood damage, according to an August 2022 study done by the NRDC. Last year, more than 13,000 of those were sold. As of 2022, the state had documented 11,984 residential repetitive loss properties, with a net increase of 3,344 repetitive loss properties since 2017, according to N.C. Emergency Management.

How will it work?

Under the new rules, sellers will have to disclose more information about flood-related issues tied to the property.

They include whether a home previously had flood damage, the cost of any flood insurance policies, does the property have a FEMA elevation certificate, and if any flood-related damage claims have been filed.

When will the new disclosure requirements go into effect?

The commission will hold a public hearing on the new rule change in the coming months, and the new disclosure guidelines could go into effect as soon as July 1.

Reporter Gareth McGrath can be reached at GMcGrath@Gannett.com or @GarethMcGrathSN on Twitter. This story was produced with financial support from 1Earth Fund and the Prentice Foundation. The USA TODAY Network maintains full editorial control of the work.

This article originally appeared on Wilmington StarNews: New rules to require NC sellers to tell buyers if house has flooded