This housebuilder’s balance sheet is sound despite a challenging property market

A sharp pull-back in the share price of MJ Gleeson reflects the margin alert issued by the housebuilder and land development specialist in last week’s trading update, as well as a cash outflow and ongoing weak order intake in the first half of the company’s fiscal year to June 2024.

However, the shares had just enjoyed an excellent run and the recovery was hardly going to be smooth in the current economic environment. As a result, there is no undue cause for concern, especially as the shares still trade at a discount, if small, to book value.

The company’s update for the six months to the end of December provided further evidence, as if it were needed, of how difficult the housing market has remained as the economy has continued to stagnate.

Sales per site per week were 0.41 for the entire period, a slight drop from the 0.43 rate seen in the first nine weeks of the half (as per the full-year results statement on Sept 14), completions fell by 14pc year-on-year and margins undershot expectations, thanks in part to sales incentives designed to shift unsold stock, while the order book shrank again, to 586 plots from 665 in June.

In addition, a £5m net cash pile has become a net debt position of £19m, thanks to the weaker profitability and investment to open new sales sites and bring forward home starts in anticipation of higher demand, itself the potential product of lower mortgage rates and the widely expected easing of monetary policy by the Bank of England.

However, the balance sheet is still sound and MJ Gleeson continues to target a market in which there is a long-term need and in which it has a strong competitive position, namely affordable housing in the North and Midlands. The company’s average selling price is £186,200 and prices for its two-bedroom homes start at £106,500.

The Gleeson Land operation provides valuable asset backing and the company’s £271m market value represents a small discount to shareholders’ funds, or net assets, of £286m, and there are no intangibles included in that figure. At the last count as of June 2023, inventories stood at £344m.

The latest update suggests that patience will be needed as shareholders wait for earnings momentum to turn, while profit and dividend forecasts for the fiscal year 2024 are lower now than at the time of our initial study in May last year, even though the share price is some 10pc higher. However, our lowly entry point should provide some protection and any whiff of a turn in the interest rate cycle could bolster sentiment and ultimately demand and earnings.

MJ Gleeson still offers good grounds for optimism. Hold.

Questor says: hold

Ticker: GLE

Close price: 464P

Update: Costain

News of a multi-year contract from Northumbrian Water under the auspices of Ofwat’s regulatory framework for 2025-30 is exactly what we were hoping for in November when we took a look at Costain.

Shares in the infrastructure specialist are already showing a pleasing gain but there could be more to come, especially as the company’s £164m cash pile compares with a market value of £198m; this effectively values a business with £1.4bn in annual sales at less than £40m.

Granted, Costain has had its problems turning revenues into profits and the margin of 2.3pc in the interim results is nothing any chief executive or boardroom would brag about.

The ultimate goal of the chief executive, Alex Vaughan, and the management team is to drive that figure above 5pc over time, helped in part by ongoing development of a higher-margin consultancy revenue stream.

Reaching that target should boost profits nicely and although even the 5pc figure would not command a high multiple of earnings or sales it would merit more than the rating attributed by the market to Costain at the moment – based on analysts’ estimates, the stock trades at around 11 times earnings for the year just ended and eight times for the year just begun.

The margin target implies a far higher earnings number by 2025 and 2026 and thus earnings multiples that are lower still, assuming an unchanged share price.

The 12-year, £670m contract with Northumbrian Water could be the first of many such deals as water utilities prepare to boost capital investment in a bid to appease their regulator and angry customers alike.

As a contracting and consultancy expert for the energy, transport and defence industries, as well as in water, Costain is well placed to help, and benefit, as Britain looks to upgrade its infrastructure.

Costain can continue to please. Hold.

Russ Mould is investment director at AJ Bell, the stockbroker

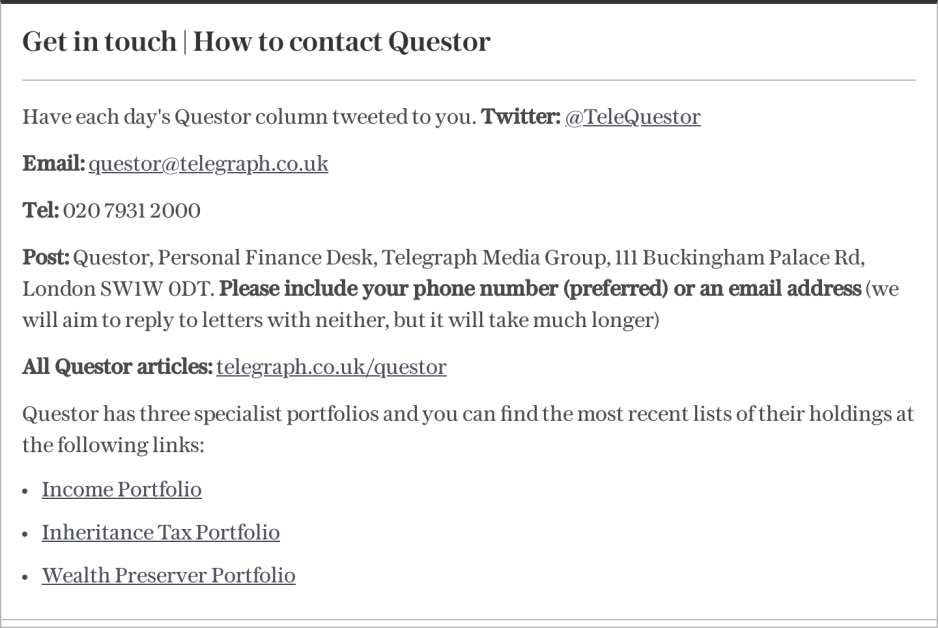

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips