How Wall Street and the Fed got 2019 wrong

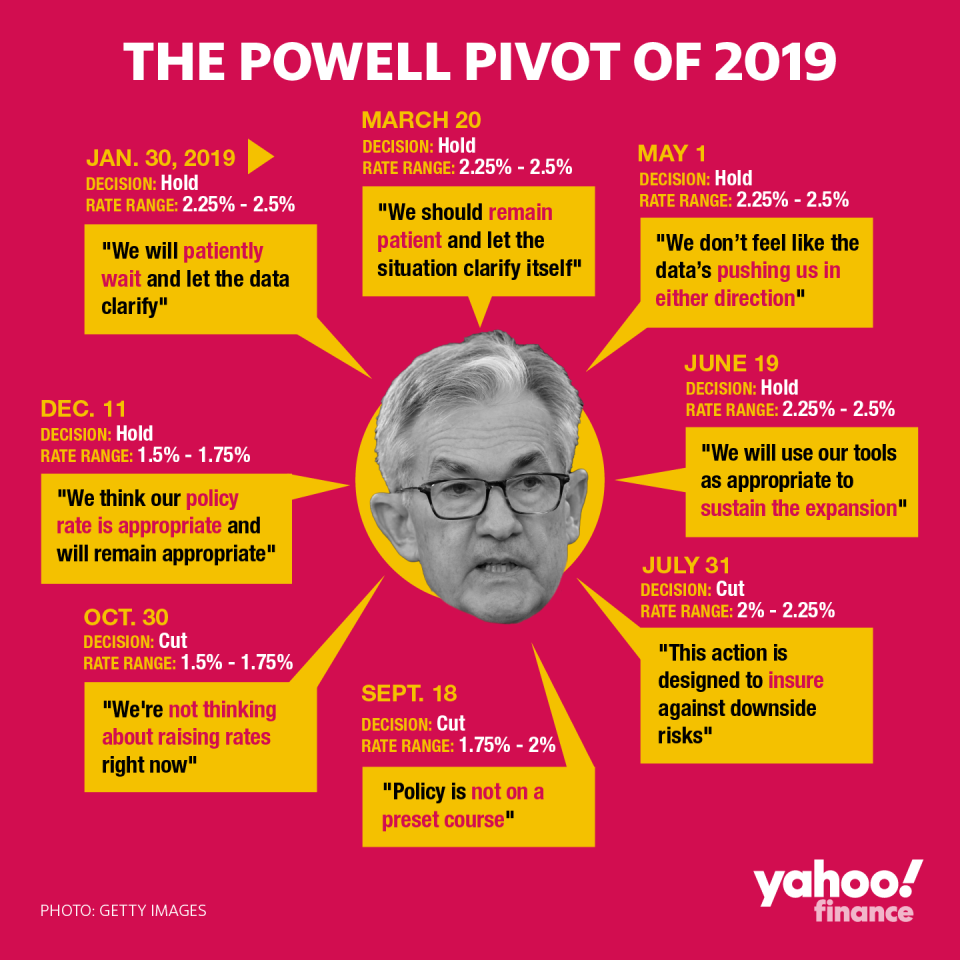

Federal Reserve Chairman Jerome Powell described monetary policy as “far from dull” in 2019, an understatement for a year where the central bank made a remarkable U-turn on interest rate policy.

Many on Wall Street entered 2019 expecting two rate hikes. But instead, the Fed cut rates three times in the face of trade uncertainties, weaker global growth, and tepid inflationary pressures.

One year ago, Wall Street analysts were filing their outlook notes for 2019, predicting a solid U.S. economy that would continue to extend the expansion. In November 2018, unemployment was at 3.7%, showing a healthy labor market. And inflation, as measured by core personal consumption expenditures, clocked in at 1.9% year-over-year, close to the Fed’s 2% target.

The Fed signaled that the economy looked poised to absorb further rate hikes.

“Fed officials can high five each other as the economy is in excess of full employment while inflation is hovering close to target,” BofA wrote, forecasting four rate hikes in 2019.

In the following days, the market would experience a harsh sell-off, sending Wall Street scrambling to revise their predictions on rates headed until the new year. Still, no shop predicted that the Fed would flip this early on rates, including the Fed itself.

Two hikes and a cautious warning

Headed into the Fed’s final meeting of the year, on Dec. 19, the Dow Jones had lost over 8% and the yield curve was flattening slightly.

Several banks pointed to tightening financial conditions in lowering their expectations for how many times the Fed would hike rates in 2019. BofA, in addition to JPMorgan Chase and Barclays, revised projections for 2019 rate hikes from four to two.

Goldman Sachs, which had originally forecast five rate hikes in 2019, revised its modal forecast for rate hikes to three. Goldman Sachs added there was only a “small chance” of rate cuts.

The Fed itself was also signaling more rate hikes. When it delivered its “dovish hike” in December 2018, it raised rates by 25 basis points but projected two more rate hikes in 2019. Two rate hikes was lower than its previous projections earlier in the year, but nonetheless boxed out the possibility of a rate cut.

Capital Economics was not so convinced, arguing that the rate hikes in 2018 may have been a “policy mistake.” Two days after the December 2018 meeting, CapEcon wrote that fading stimulus from the Trump tax cuts would slow economic growth and force the Fed to ease policy.

“We think that will eventually prompt the Fed to reverse course, delivering something like 75bp of rate cuts in the early 2020,” Capital Economics wrote.

The Fed delivered exactly that: 75 basis points of cuts. But in 2019.

Fed U-turn

Fed officials have acknowledged the policy change has been fairly dramatic. In a year that Fed Chairman Jerome Powell described as “far from dull,” the central bank paused on rate moves, then cut rates in three successive meetings, and then paused again on rate moves.

The job market continued to tighten, but inflation ticked down as projections for global growth fell and the U.S.-China negotiations devolved into a tit-for-tat tariff war. As the yield curve flashed recession worries, the Fed pledged to “act as appropriate” to sustain the expansion as it cut by 75 basis points to a target range between 1.50% and 1.75%.

Policymakers have said they are comfortable with where rates are now, but they have differing views on whether the “insurance cuts” this year were designed to undo the rate hikes of 2018.

In April 2019, St. Louis Fed President James Bullard told Yahoo Finance the Fed confused markets in December 2018 by saying that it would raise rates while simultaneously signaling a slowing economy in 2019.

“We tried to do a more dovish hike, it didn’t come off very well,” said Bullard, who said he did not support that hike.

For his part, Powell has said he is comfortable with the Fed’s actions this year, but does not see the rate cuts as a validation of the December rate hike as a “mistake.” In a press conference last week, Powell said the insurance cuts reflected change in the “facts on the ground” and defended the central bank’s rate hikes in 2018.

“We took steps to make [rates] less accommodative, and that seemed to be the right thing,” Powell said. “It still seems to me to be the right thing in hindsight.”

In the Fed’s most recent dot plots, the central bank telegraphed no rate changes through 2020. The Fed’s next meeting, and first of 2020, will take place Jan. 28 and Jan. 29.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Fed holds steady on rates, may continue to hold through 2020

Fed in focus as worries mount over a year-end repo market flare-up

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.