How to balance paying for college and saving for retirement

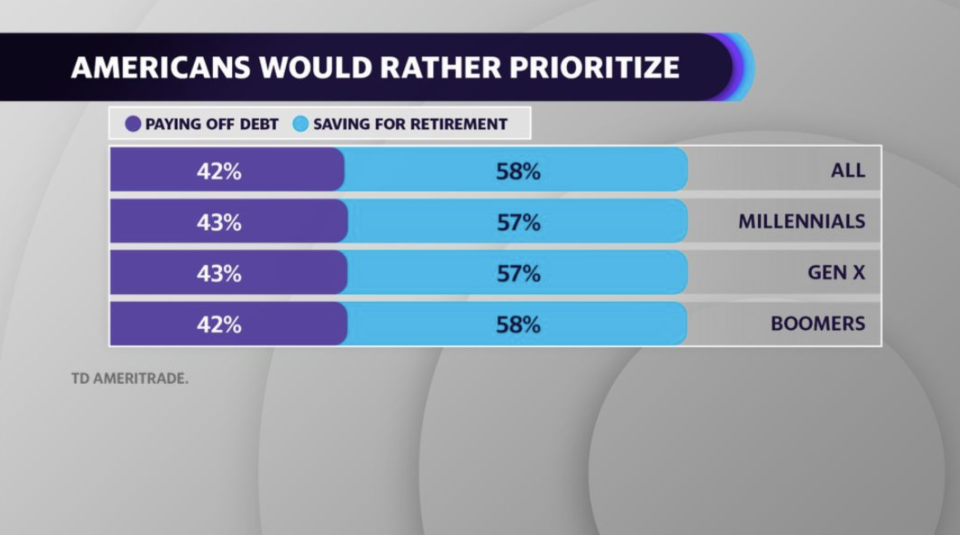

Outstanding student debt in the United States stands at $1.48T, according to the New York Federal Reserve. But should you pay for your child's education, or save for retirement instead? Morningstar’s director of behavioral science Sarah Newcomb says parents should focus on retirement, even if that means their children will be burdened with student loans.

“As parents, we are used to sacrificing for our children,” Newcomb tells Yahoo Finance’s The Ticker. “Sometimes we can even make that a point of pride, but if you sacrifice your retirement savings to send your child to college, you’re making a huge mistake.”

According to a recent Transamerica study, nearly half of all workers surveyed say they are guessing how much they need to save for retirement, and most Americans are lowballing their estimates. The average cost of retirement is $738,400, according to MetLife, but Gen Xers and baby boomers who responded to Transamerica estimated they would need only $500,000 for retirement.

“It’s already a crisis in America that people are not prepared for retirement,” Newcomb says. “We hear more and more about how the student debt crisis is hampering students and graduates, but there are ways that you can plan for both.”

Newcomb says parents who save for retirement instead of giving their children a free ride to college are not bad parents.

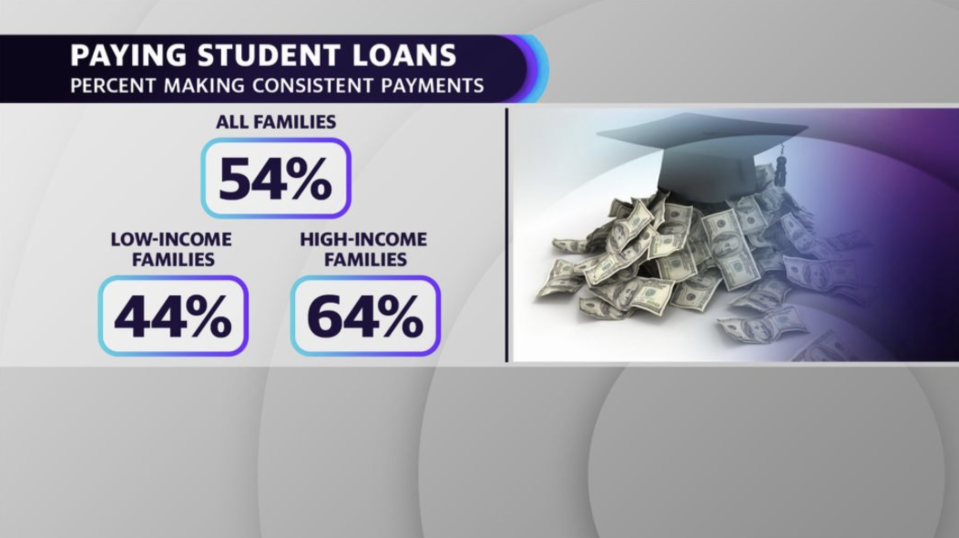

“A good parent who can’t afford to pay for college is still a great parent,” Newcomb explains. “We think giving our kids a full ride to school is going to help them, but research shows kids that don’t get a full ride- kids who work up to 15 hours a week on campus- that boosts performance. We think loans are evil because we see a lot of people saddled with them. But what most of the work on life after college shows, is that as long as you keep the payment of that loan at or below 8% of your after-graduation salary, then that loan will be affordable to you.”

Newcomb is referring to a Journal of Financial Aid study that found students who worked 1-15 hours per week had significantly higher grade point averages than those who did not work at all. The data found kids who worked part-time were also more involved in the academic and social communities on campus.

Morningstar says the benefits of saving for retirement outweigh those of paying for a college education in terms of interest as well. It says interest that can be earned on funds saved for retirement is expected to be greater than the interest that would be paid on student loans.

“If you can clear six percent real return on that for twenty years, your money will triple in that time,” Newcomb explains. “The loans that a student can take out for college are advertised over a period of time when their earning power is the highest, but if you don’t prepare for retirement, there’s no loan you can take. What you really need to think about and maybe talk to your kids about is that you can burden them now while they’re young and healthy and able to repay, or you can burden them later when you need to move in with them because you didn’t prepare for retirement.”

Meghan Fitzgerald is a producer at Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.