How to invest in stocks if record-high prices and volatility make you nervous: Morning Brief

Tuesday, September 8, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

Time is a stock market investor’s best friend

The stock market has gotten slammed by a bout of volatility that came as prices hit new record highs. And it’s during times like these when investors without a plan and under duress ask themselves extremely hard questions like “Should I buy the dip?” or “Should I sell?”

Read more: How to think about stock investing: The full breakdown

When your financial well-being is on the line, it’s generally ill-advised to go all-in on what you may think will happen in the coming days, months, or even few years. The truth is that regardless of whether the stock market is at an all-time high or trading near a bear market low, investors will always be concerned with the risk of losing money.

So with all that in mind, how should investors be thinking? What should new investors understand before committing new capital?

Earlier this month, Bank of America’s U.S. equity strategy team led by Savita Subramanian offered some simple, time-tested guidance.

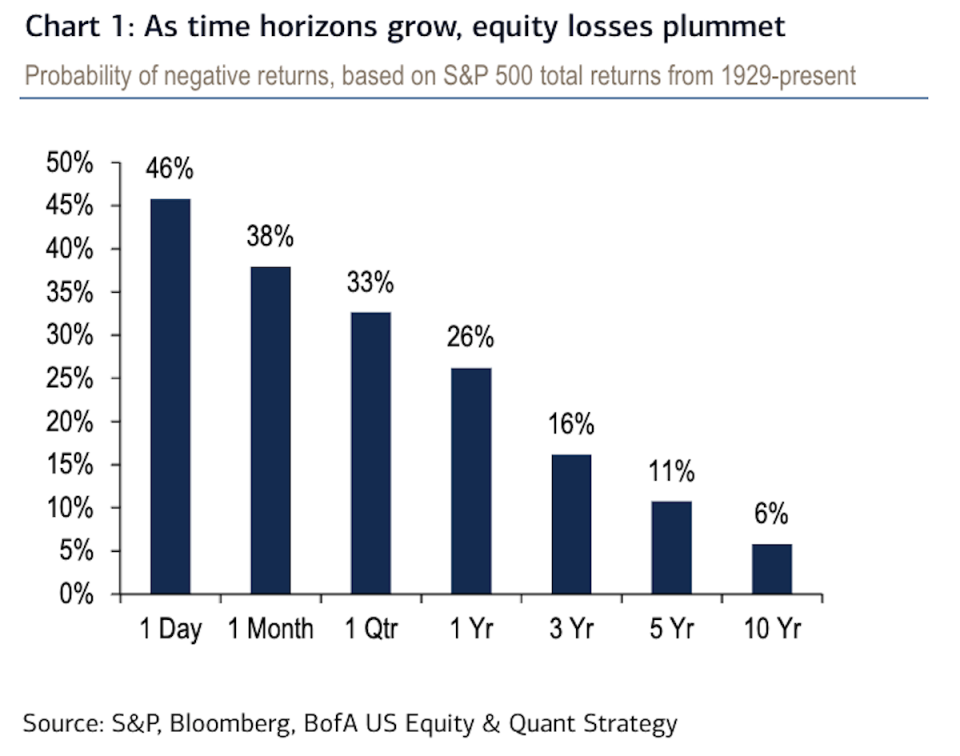

“Best recipe for loss avoidance is time: As time horizons lengthen, the probability of losing money in stocks has decreased,” Subramanian wrote in an August 27 note to clients.

Her team reviewed the history and considered various time horizons since 1929. And their findings were very straightforward. The longer you were willing to hold on to stocks, the less likely you were going to lose money.

“For U.S. stocks in particular, lengthening one's time horizon is a recipe for loss avoidance,” she wrote. “10yr S&P 500 returns have been negative just 6% of the time; other asset classes do not sport such characteristics - for example, the same 10-yr loss rate for commodities is 30% (both based on data back to 1929).“

Of course, if you are good enough — or lucky enough — to sit out periods of market declines, then your returns would be higher. But almost no one has demonstrated an ability to consistently time the market.

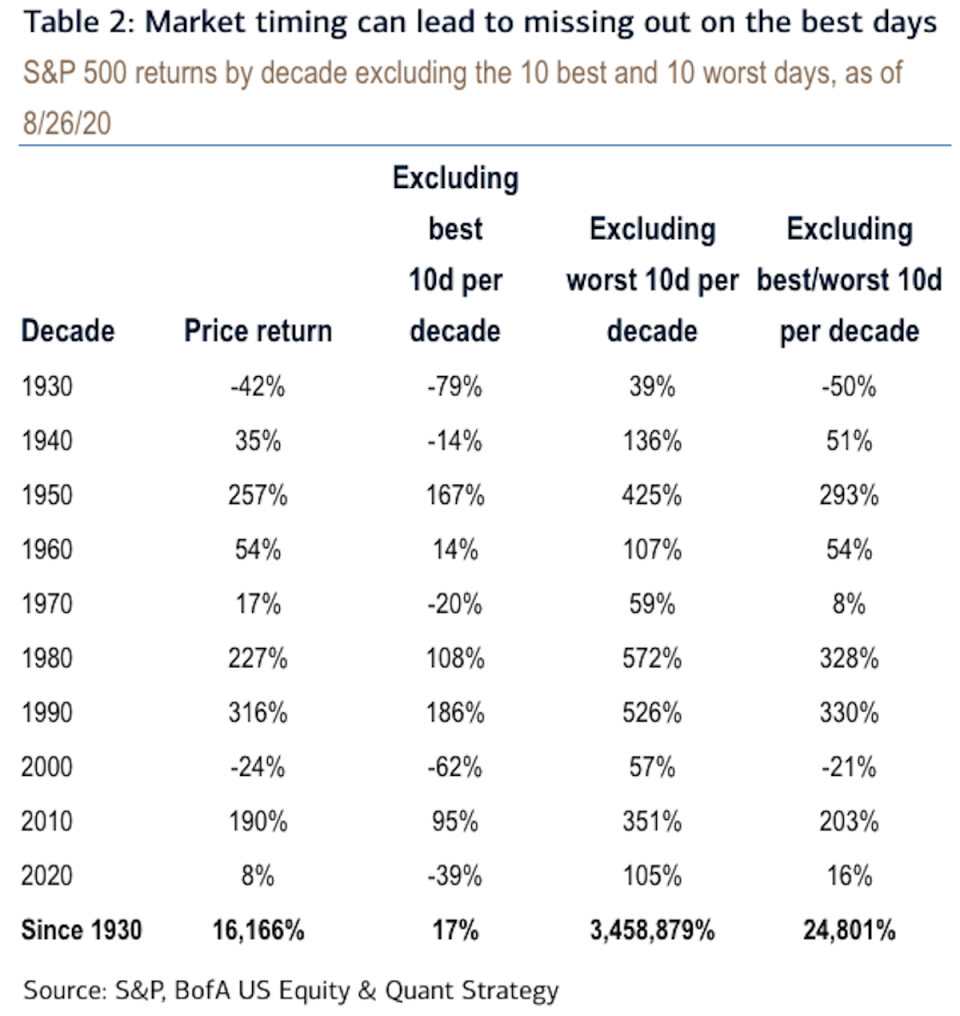

Keep in mind: for investors, attempting to avoid market downturns is not about just knowing when to sell. It’s actually about making two very hard-to-make calls: when to sell and when to buy. And getting these calls wrong can be devastating.

“Market timing is difficult,” Subramanian said. “Since the 1930s, if an investor sat out the 10 best return days per decade, his/her returns would be just 17% compared to 16,166% returns since then.”

“Remaining invested during turbulent times can help recover losses following bear markets,” she said, adding “it takes about 1100 trading days on average to recover losses after a bear market, but some recoveries, like this year's, are much swifter.”

Subramanian is far from alone in offering this kind of advice to clients.

“We recommend against staying on the sidelines, even when markets are at record highs,” wrote Mark Haefele, UBS’s CIO of Global Wealth Management. “Time in the market is important to achieving one's financial goals.”

For investors with cash available to invest, Haefele suggests dollar-cost averaging using a set schedule, which would relieve the investor of the task of trying to time the market. And for folks who are a little more sophisticated, he suggests writing put options or using other structured investment strategies designed to limit losses or amplify gains.

But for folks looking to keep it simple, nothing is more time-tested than time itself.

“Long-term fundamental investing is out of vogue, but may be the best arbitrage opportunity out there,” Subramanian said.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

6:00 a.m. ET: NFIB Small Business Optimism, August (99.0 expected, 98.8 in July)

3:00 p.m. ET: Consumer credit, July ($12.9 billion expected, $8.94 billion in June)

Earnings

4:05 p.m. ET: Coupa Software (COUP) is expected to report adjusted earnings of 8 cents per share on revenue of $119 million

4:10 p.m. ET: Slack (WORK) is expected to report an adjusted loss of 3 cents per share on revenue of $209.121 million

Top News

European stocks mixed ahead of Wall Street return from holiday [Yahoo Finance UK]

China proposes global data rules to counter U.S. moves on TikTok [Bloomberg]

Pound's slide continues as UK and EU clash on Brexit Withdrawal Agreement [Yahoo Finance UK]

FAA investigating manufacturing flaws in Boeing 787 jetliners [Reuters]

YAHOO FINANCE HIGHLIGHTS

'Mulan' release leads to 68% spike in Disney+ app downloads

'It's been painful:' Chapel Hill mayor on COVID-19's toll on college towns

The NFL overlooking coronavirus threat is 'extremely concerning' says former White House doctor

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay