Howard Marks' Oaktree Invests in Americold, Sells Montrose

- By Margaret Moran

Oaktree Capital Management recently disclosed its portfolio updates for the fourth quarter of 2020, which ended on Dec. 31.

Founded by Howard Marks (Trades, Portfolio) and several fellow investors in 1995, Oaktree Capital Management is a global investing firm that specializes in alternative and credit strategies. The Los Angeles-based firm now has over 39 portfolio managers and 950 employees in offices around the globe. Marks serves as co-chairman (along with Bruce Karsh) and chief financial officer. The firm's core investment philosophy has six tenets: risk control, consistency, market inefficiency, specialization, bottom-up analysis and disavowal of market timing.

Based on the firm's investing criteria, its top buys for the quarter were in Americold Realty Trust (NYSE:COLD) and Vale SA (NYSE:VALE), while its top sells were in Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM) and Montrose Environmental Group Inc. (NYSE:MEG).

Americold Realty Trust

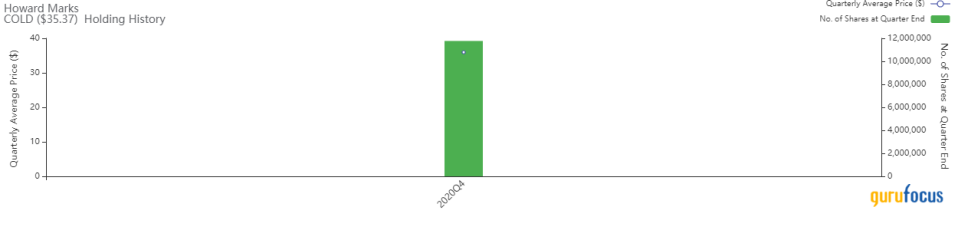

Oaktree established a new holding of 11,771,646 shares in Americold Realty Trust (NYSE:COLD), impacting the equity portfolio by 9.43%. During the quarter, shares traded for an average price of $35.96.

Americold Reality Trust is a real estate investment trust headquartered in Atlanta. It is the world's largest publicly traded REIT that is focused on the ownership, operation, acquisition and development of temperature-controlled warehouses.

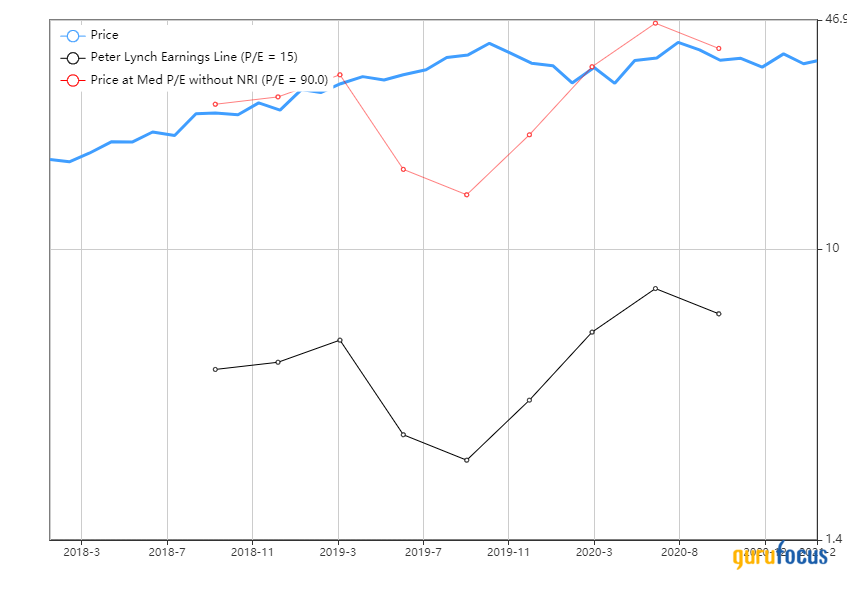

On Feb. 18, shares of Americold traded around $35.37 for a market cap of $8.90 billion. According to the Peter Lynch chart, the stock is trading above its intrinsic value but in line with its historical median valuation.

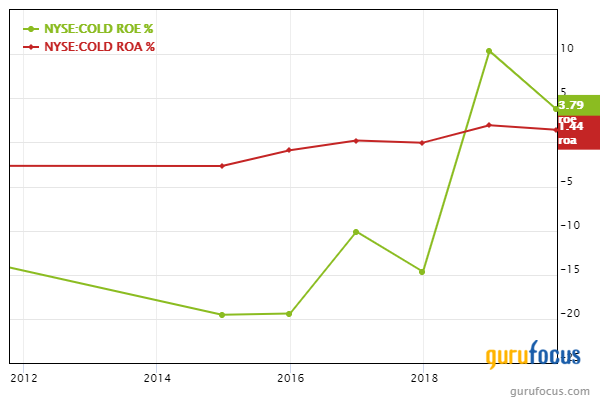

The company has a financial strength rating of 4 out of 10 and a profitability rating of 4 out of 10. The cash-debt ratio of 0.08 is average for the industry, while the Piotroski F-Score of 6 out of 9 suggests the company is financially stable. The return on equity of 3.79% and return on assets of 1.44% are underperforming their respective industry medians of 50.07% and 33.46%, though both represent improvements over the company's own history.

Vale

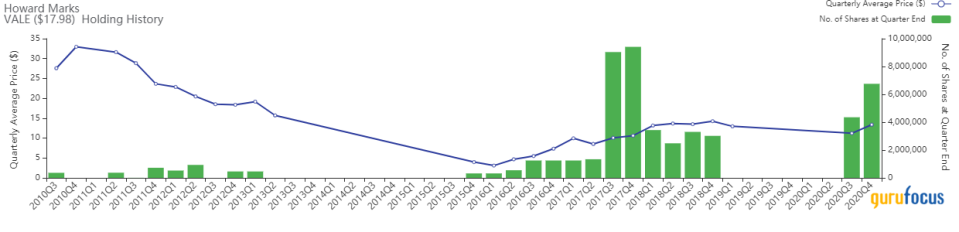

The firm added 2,403,524 shares, or 55.21%, to its investment in Vale (NYSE:VALE) for a total holding of 6,756,996 shares. The trade had a 0.86% impact on the equity portfolio. Shares traded for an average price of $13.37 during the quarter.

Vale is a Brazilian multinational metals and mining company headquartered in Rio de Janeiro. It has operations in approximately 30 countries and is the largest producer of iron ore and nickel in the world. Vale is also involved in the logistics, energy and steelmaking businesses.

On Feb. 18, shares of Vale traded around $17.98 for a market cap of $92.24 billion. The GuruFocus Value chart rates the stock as significantly overvalued.

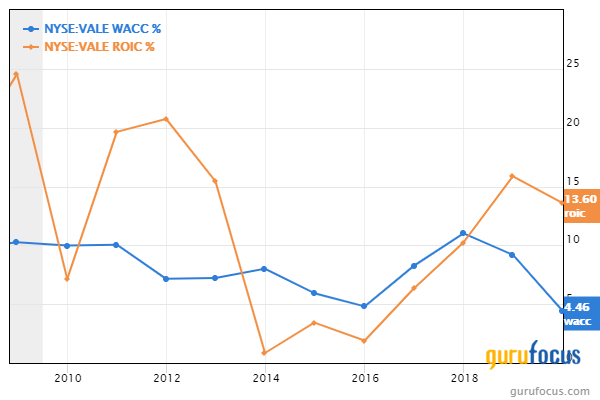

The company has a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. The Altman Z-Score of 1.79 indicates the company could face liquidity issues, though the Piotroski F-Score of 7 out of 9 is typical of a financially stable company. The return on invested capital has surpassed the weighted average cost of capital in recent years, indicating the company is creating value.

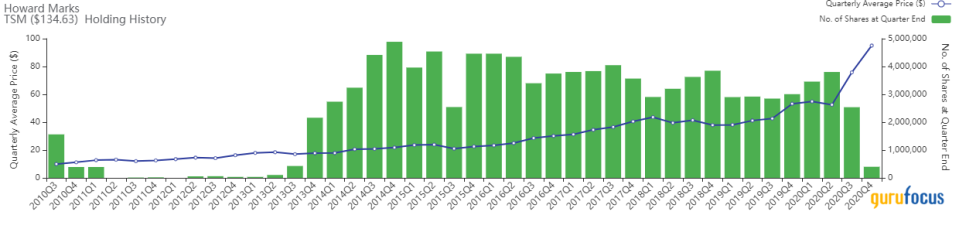

Taiwan Semiconductor Manufacturing

The firm reduced its investment in Taiwan Semiconductor Manufacturing (NYSE:TSM) by 2,139,084 shares, or 84.28%, for a remaining holding of 398,949 shares. The trade had a -4.71% impact on the equity portfolio. During the quarter, shares traded for an average price of $95.04.

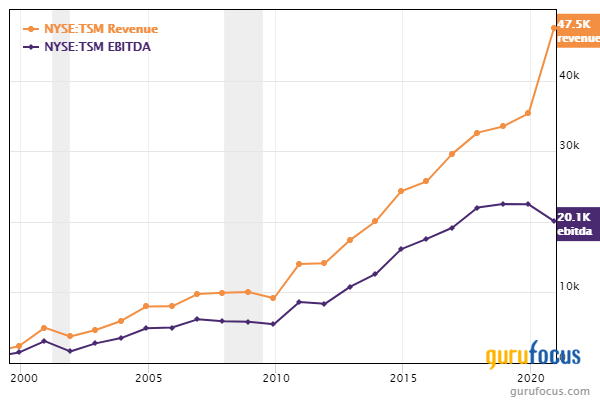

Headquartered in Hsinchu, Taiwan, Taiwan Semiconductor is the world's largest independent semiconductor producer. It derives most of its profits from smartphone components and memory, though its internet of things products have seen increasing sales in recent years.

On Feb. 18, shares of Taiwan Semiconductor traded around $134.63 for a market cap of $698.19 billion. The GuruFocus Value chart rates the stock as significantly overvalued.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 9 out of 10. The interest coverage ratio of 289.69 and Altman Z-Score of 14.36 indicate a fortress-like balance sheet. The three-year revenue growth rate is 4.1%, while the three-year Ebitda growth rate is 3.5%.

Montrose Environmental Group

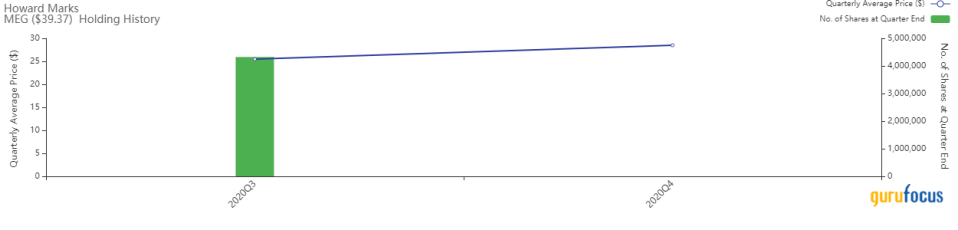

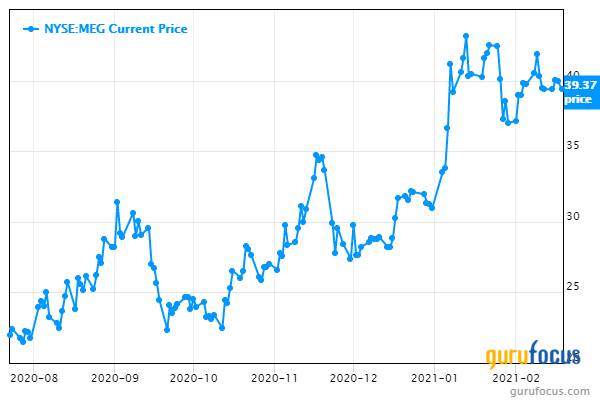

Oaktree sold all 4,322,644 of its shares in Montrose Environmental Group (NYSE:MEG), impacting the equity portfolio by -2.80%. During the quarter, shares traded for an average price of $28.49.

Based in Irvine, California, Montrose is an environmental services company that provides measurement and analytical services as well as environmental resiliency and sustainability solutions to companies in a wide variety of industries.

On Feb. 18, shares of Montrose traded around $39.37 for a market cap of $982.74 million. The stock price has increased 78% since its initial public offering on July 23.

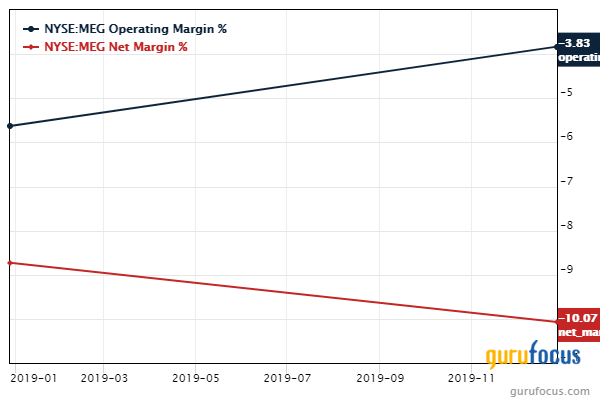

The company has a financial strength rating of 3 out of 10 and a profitability rating of 1 out of 10. The cash-debt ratio of 0.22 is lower than 66% of companies in the industry, while the Altman Z-Score of 1.19 suggests the company could be in danger of bankruptcy. The operating margin is -3.83%, while the net margin is -10.07%.

Portfolio overview

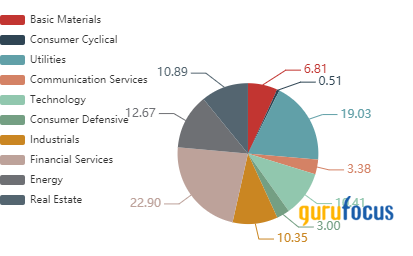

At the end of the quarter, Oaktree Capital Management held 57 common stock positions valued at a total of $4.66 billion. The firm established five new holdings during the quarter, sold out of 21 stocks and added to or reduced several other positions for a turnover of 15%.

The top holdings as of the quarter's end were Vistra Energy Corp. (NYSE:VST) with 12.77 % of the equity portfolio, Ally Financial Inc. (NYSE:ALLY) with 10.73% and Americold with 9.43%. In terms of sector weighting, the firm was most invested in financial services, utilities and energy.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Top 4th-Quarter Trades of Jeremy Grantham's Firm

Julian Robertson's Biggest Trades of the 4th Quarter

Sarah Ketterer's Top 4th-Quarter Trades

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.