Is Huanxi Media Group (HKG:1003) A Risky Investment?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Huanxi Media Group Limited (HKG:1003) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Huanxi Media Group

What Is Huanxi Media Group's Debt?

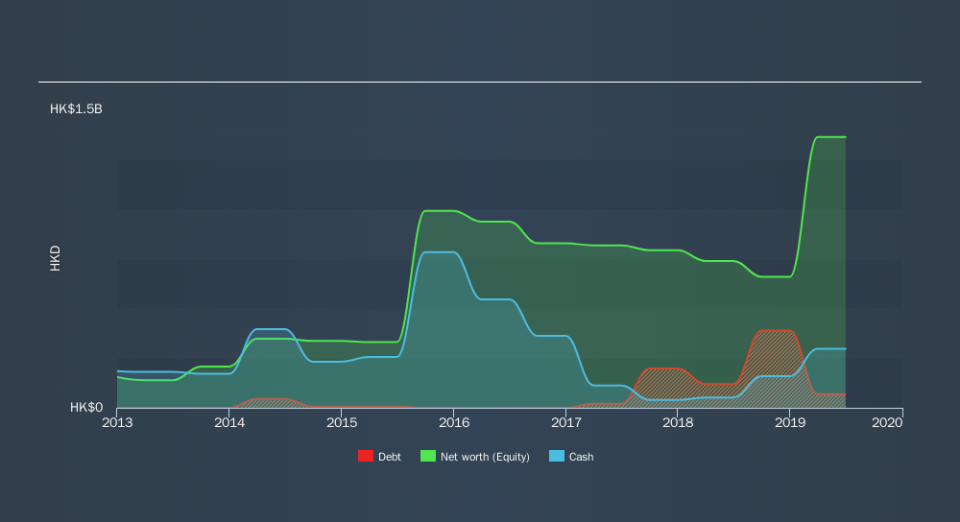

The image below, which you can click on for greater detail, shows that Huanxi Media Group had debt of HK$68.3m at the end of June 2019, a reduction from HK$119.7m over a year. But it also has HK$297.1m in cash to offset that, meaning it has HK$228.9m net cash.

How Healthy Is Huanxi Media Group's Balance Sheet?

We can see from the most recent balance sheet that Huanxi Media Group had liabilities of HK$436.0m falling due within a year, and liabilities of HK$29.2m due beyond that. Offsetting these obligations, it had cash of HK$297.1m as well as receivables valued at HK$361.5m due within 12 months. So it actually has HK$193.5m more liquid assets than total liabilities.

This short term liquidity is a sign that Huanxi Media Group could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Huanxi Media Group has more cash than debt is arguably a good indication that it can manage its debt safely.

It was also good to see that despite losing money on the EBIT line last year, Huanxi Media Group turned things around in the last 12 months, delivering and EBIT of HK$102m. There's no doubt that we learn most about debt from the balance sheet. But it is Huanxi Media Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Huanxi Media Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last year, Huanxi Media Group recorded free cash flow worth a fulsome 86% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to investigate a company's debt, in this case Huanxi Media Group has HK$228.9m in net cash and a decent-looking balance sheet. The cherry on top was that in converted 86% of that EBIT to free cash flow, bringing in HK$88m. So we don't think Huanxi Media Group's use of debt is risky. Another factor that would give us confidence in Huanxi Media Group would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.