Hunt Rolls Out Tax Cuts in Bid to Jam Labour Before UK Vote

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Chancellor of the Exchequer Jeremy Hunt cut personal and business taxes as he tried to shift the economic narrative and set out dividing lines with the opposition Labour Party ahead of a general election expected next year, even as the UK’s growth forecast was substantially downgraded.

Most Read from Bloomberg

Hulu for $1, Max for $3: Streaming Services Slash Prices This Black Friday

OpenAI Engineers Earning $800,000 a Year Turn Rare Skillset Into Leverage

McKinsey and Its Peers Are Facing the Wildest Headwinds in Years

Asia Stocks Set to Open Mixed as Dollar, Oil Slip: Markets Wrap

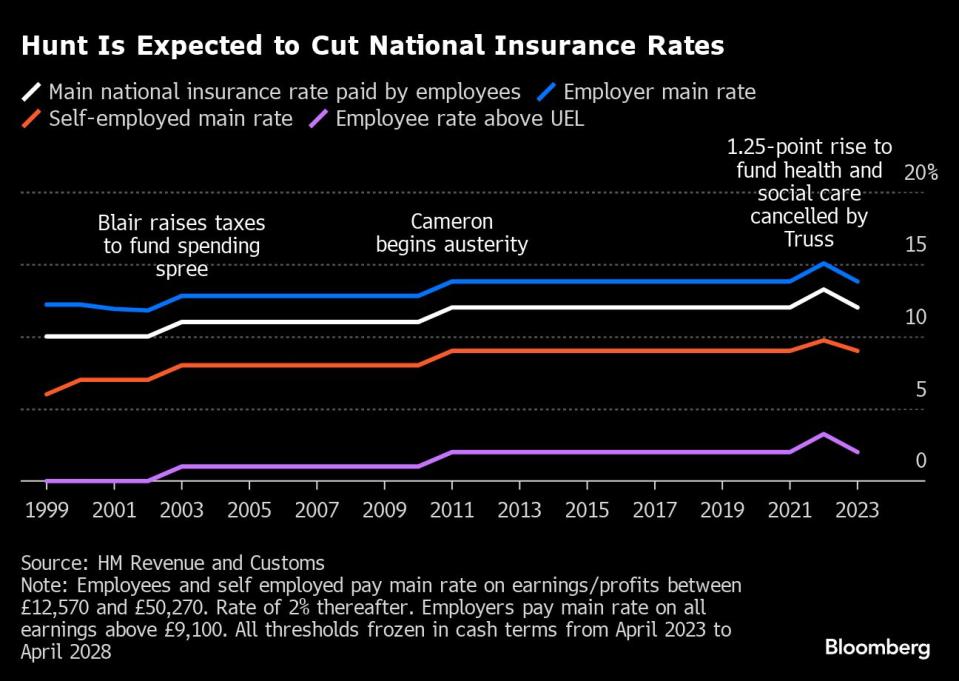

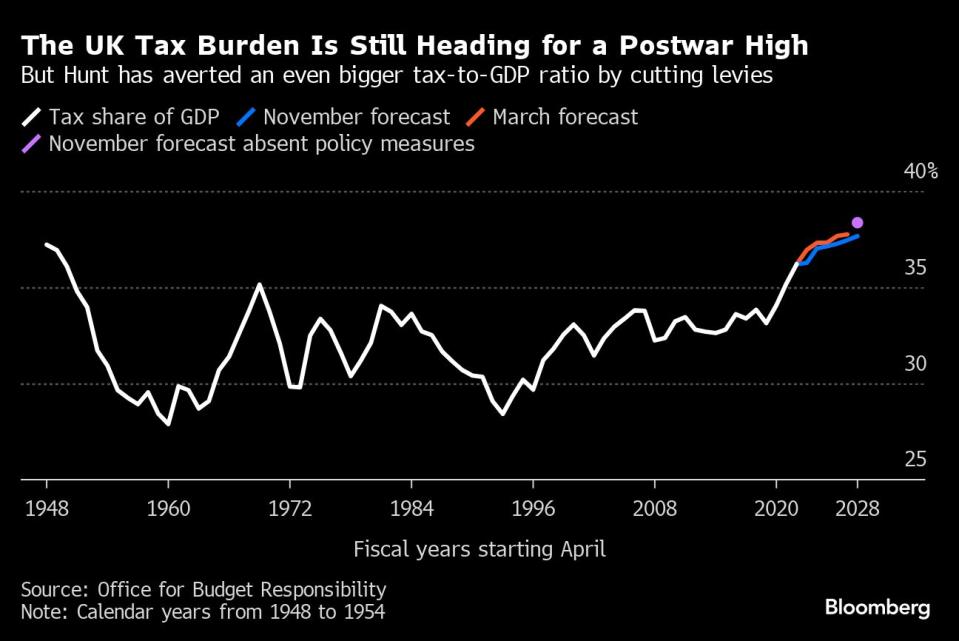

Hunt’s most eye-catching announcement was a two percentage point reduction to the headline 12% rate of national insurance, a payroll tax, a move he said would help 27 million people. He also made permanent a tax break for corporate investment known as “full expensing,” calling it the largest business tax cut in modern British history. Nevertheless, the government’s fiscal watchdog said the overall tax burden is still set to rise to its highest since World War II.

“Our choice is not big government, high spending and high tax because we know that leads to less growth, not more,” Hunt said in the House of Commons on Wednesday. “Instead we reduce debt, cut taxes and reward work.”

The emphasis on tax cuts underscored the pressure faced by Prime Minister Rishi Sunak’s Conservative government, which is running out of time to win back voters and claw back a 20-point gap to Keir Starmer’s Labour in national opinion polls. Yet despite Hunt’s bullish rhetoric, think tanks like the Resolution Foundation said his measures would barely dent the economic strain felt by Britons, even as he stores up spending trouble for the next government.

“Nothing that has been announced today will remotely compensate rising mortgages, rising taxes eating into wages, inflation high with prices still going up in the shops, public services on their knees, and too many families struggling to make ends meet,” Labour’s Rachel Reeves, who polls suggest could be giving the chancellor’s statement in a year’s time, said in Parliament.

Still, Reeves welcomed the National Insurance reduction, saying she had “long argued that taxes on working people are too high.”

What had been predicted to be an Autumn Statement bereft of large giveaways over the summer morphed dramatically in the run-up to Hunt’s announcement, as Sunak and his senior ministers began to talk up the prospect of tax cuts. They cited the reduction in inflation as a rationale for shifting tack, but in reality, Hunt’s measures were funded in large part because high inflation and wage growth boosted tax receipts.

It gave Hunt a buffer before hitting his fiscal rule — having debt falling as a share of GDP in the fifth year of the forecast period — of £30.9 billion to play with. Factoring in his measures, the number drops to £13 billion, which is double the headroom he left himself in March but is still small by historic standards and leaves his plans exposed to a downturn in the economy.

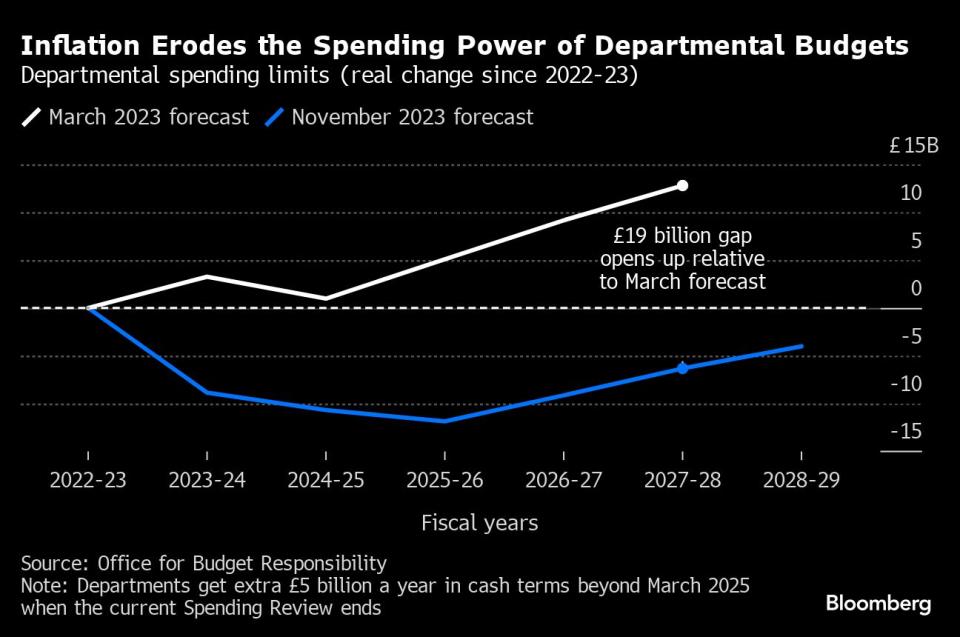

According to the Resolution Foundation, what Hunt has effectively done is spend his inflation windfall on tax cuts while leaving in place government spending plans as implausibly low for the remainder of the forecast period. Or put simply, leaving a future administration the choice of raising taxes or cutting public services. Hunt’s headroom is a “fiscal illusion” because post-election commitments will likely prove politically impossible to deliver, it said.

“For all the talk of a long-term strategy this was a short-term approach, with giveaways today but the costs to be borne by the country in the future,” Carys Roberts, executive director at the Institute for Public Policy Research think tank, said in an emailed statement.

Hunt’s package of tax cuts was overshadowed by anemic economic forecasts from the Office for Budget Responsibility, as well as its analysis that despite Wednesday’s giveaways, the overall tax burden is still set to increase to 37.7% of gross domestic product by 2028-29, a post-war high. The UK economy is predicted to grow 0.7% in 2024 and 1.4% in 2025, compared with the OBR’s previous forecasts of 1.8% for 2024 and 2.5% for 2025.

“Under this Conservative government economic growth is flat-lining and public services are on their knees,” Sarah Olney, Treasury spokeswoman for the Liberal Democrats, said in Parliament.

On spending, Hunt said he would raise welfare payments in line with September’s inflation figure rather than October’s lower reading, a prospect that had sparked concern among some of his MPs worried about the impact on struggling voters. He also maintained the pensions triple lock, deciding not to use a lower pay figure for the latest uprating.

But he unveiled a crackdown on long-term jobless welfare claimants, warning that if they failed to engage with “intensive support” to help them find work for six months their benefits would be stopped. Reeves hit back, saying: “The best way to get people back to work is by getting the NHS working.”

The chancellor had been under intense pressure to announce personal tax cuts, as Tory MPs demand he reduce a tax burden that is on course for a postwar high under the Conservatives. The stakes for the Autumn Statement grew for Sunak after a run of failed resets, including a largely-forgotten conference speech last month and a slim legislative agenda at the King’s Speech.

Reaction from many Tory MPs was positive. The statement “cuts taxes, invests in growth, seeks to shrink the size of the state and reforms welfare,” Ben Bradley said in the Commons. “It will go down very very well with the vast majority of my constituents who voted for a Conservative government in 2019.”

But just how successful the speech was will become clear in the months running up to the election, which must take place by January 2025. Hunt took aim at various Labour policies including the pledge to spend £28 billion a year transitioning the economy to green energy.

The strategy is clear, to present the Tories as a party bringing taxes down — hoping voters look past their record in government — while trying to show Labour as a government that would raise the burden to finance its ambitions.

The question is whether voters will bite. “What has been laid bare today is the full scale of the damage that this government has done to our economy over 13 years,” Reeves said, revealing how Labour will respond.

--With assistance from Kitty Donaldson, Irina Anghel, Philip Aldrick, Andrew Atkinson, Tom Rees and Alex Morales.

(Updates with details about tax burden in 11th paragraph.)

Most Read from Bloomberg Businessweek

How Elon Musk Spent Three Years Falling Down a Red-Pilled Rabbit Hole

More Americans on Ozempic Means Smaller Plates at Thanksgiving

Guatemalan Town Invests Remittance Dollars to Deter Migration

©2023 Bloomberg L.P.