How Hunter Biden's drug addiction could be a bedrock of his legal defense on tax charges

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Call it the Addiction Defense.

Hunter Biden's very public history of prolific drug abuse, the source of years of heartbreak and embarrassing disclosures, may form a key part of his defense against nine tax charges that carry a combined maximum penalty of 17 years in prison, legal experts say.

The son of President Joe Biden was indicted in a California federal court earlier this month on three felony and six misdemeanor tax charges. Prosecutors allege he failed to pay at least $1.4 million in taxes on time and evaded other taxes, all while burning millions on a lavish lifestyle.

Hunter Biden, who is a central figure in a Republican presidential impeachment inquiry, blew his cash "on drugs, escorts and girlfriends, luxury hotels and rental properties, exotic cars, clothing, and other items of a personal nature, In short, everything but his taxes," according to the indictment.

The felony charges were a dramatic reversal, coming just months after federal prosecutors offered the Biden son a deal to plead guilty to two tax misdemeanors and potentially avoid jail time on both the tax charges and a separate gun charge. The plea agreement fell apart after Hunter and prosecutors disagreed on whether it protected him from future charges and a judge refused to quickly rubberstamp it.

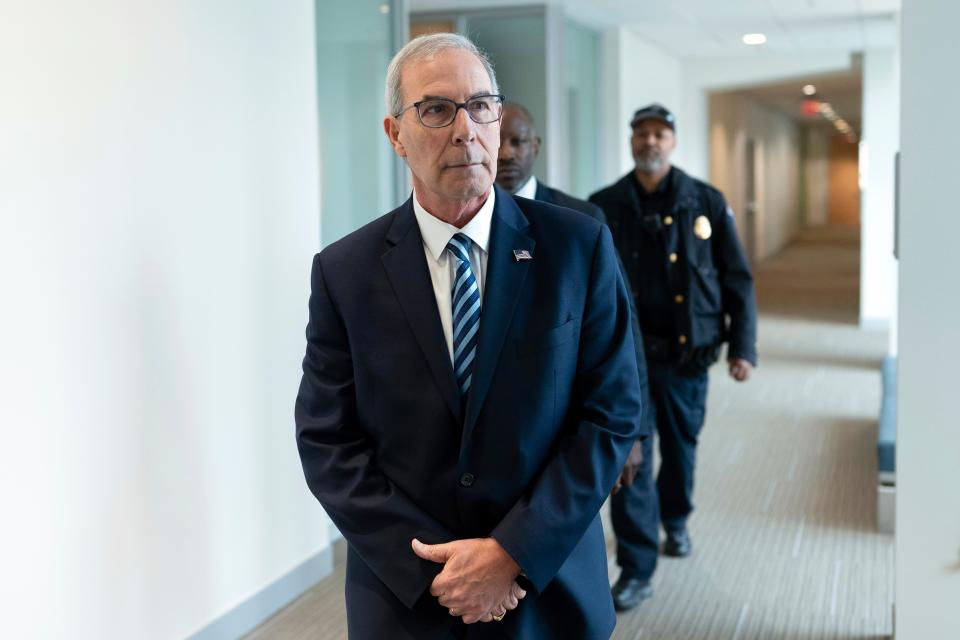

Now, Hunter's lawyers must work to devise defense strategies as their client faces down not only serious tax charges in California, but also felony gun charges in Delaware that carry a 25-year maximum sentence. He pleaded not guilty to the gun charges in October.

Asked to comment for this story, a spokesperson for defense attorney Abbe Lowell pointed USA TODAY to a statement released shortly after the indictment was filed. Lowell said his client has now paid his taxes in full, and questioned prosecutors' motivation for bringing the charges.

"Based on the facts and the law, if Hunter’s last name was anything other than Biden, the charges in Delaware, and now California, would not have been brought," Lowell said.

'If I rested too long between hits on a pipe, I'd be thrown into a panic.'

Federal tax crimes can be harder to prove than other crimes because prosecutors typically have to show the defendant's misconduct involved a particularly high level of willfulness: Tax missteps such as those alleged against Hunter are only criminal if the government can show defendants knew their legal duty and intentionally violated it.

The three felonies Hunter faces – one count of tax evasion and two counts of filing false returns – all tie to 2018. In his candid 2021 memoir, Beautiful Things, Biden describes periods during that year when day "bled into night and night into day" as he compulsively smoked crack cocaine.

"If I rested too long between hits on a pipe, I'd be thrown into a panic. I'd crash for a few minutes, come to, and the first thing I'd demand would be 'Where's the pipe?'" he wrote.

Hunter's defense team may highlight that, for much of the period the indictment focuses on, 2016-2019, Biden had serious substance abuse problems that may have undermined his ability to be aware of − and intentionally violate − tax laws.

"When you're talking about substance abuse, I would expect that that's going to play a large role in trying to negate his intent," said Tino Lisella, a lawyer who spent nearly a decade prosecuting tax crimes at the Justice Department.

A note in the indictment suggests prosecutors may be anticipating that defense. They said Hunter was sober in 2020 and filed his outstanding 2016-2018 personal tax returns that year, but still "did not direct any payments toward his tax liabilities for each of those years," despite continuing to spend on a "lavish" home on a canal in southern California's Venice Beach and on a Porsche car.

But Hunter's team could still argue that, when it comes to the 2018 felony charges of tax evasion and filing false tax returns, his understanding about his activities that year was marred by his drug use, even if he was clean by the time he filed his 2018 return in 2020.

"I would expect Abbe Lowell will say, 'Yeah, but you're still asking him about expenses that relate back to a time when he was not sober,'" Lisella said.

In 2021, a third party helped Hunter pay the back taxes at issue in some of his misdemeanor charges, according to documents in the failed plea agreement.

Unconstitutional 'selective prosecution'?

Experts also said Hunter will likely argue the charges reflect "selective prosecution," a legal term for discriminatory, unconstitutional prosecutions. That's an argument his lawyers have already indicated they are exploring in the gun case.

But proving an unconstitutional, selective prosecution is taking place can be an uphill battle, according to David Sklansky, a Stanford law professor and former federal prosecutor.

"The problem would be proving that other people who haven't been prosecuted for tax evasion in connection with conduct of the kind that he's alleged to have engaged in, weren't prosecuted based on political affiliation," Sklansky said.

Michelle Abroms Levin, a tax lawyer and former Justice Department trial attorney, said prosecutors might choose to pursue famous people in order to deter lawbreaking and encourage the broader public to have confidence in the tax system.

Unlike political targeting, taking someone's fame and the resulting deterrence into account when choosing whether to bring charges doesn't implicate the selective prosecution defense, Sklansky said.

Levin noted other high-profile defendants who have faced serious tax charges, such as reality TV stars Todd and Julie Chrisley. They were each sentenced to several years in prison after being convicted of bank fraud, tax evasion, and other crimes tied to charges that they conspired to defraud banks out of tens of millions of dollars.

Josh Ungerman, a former IRS and Justice Department lawyer, said there are many other cases involving wealthy people who live lavishly, don't pay their taxes, and only face civil consequences like having to pay penalties and interest. But he too said the tax system relies on deterrence.

"They want people talking around going like, 'Hey, you really need to pay your taxes, you really need to be in compliance – look what happened to the president's son,'" he said.

The 2018 tax evasion and false return felony charges go beyond instances where a taxpayer honestly reported taxes but failed to pay them on time. With those charges, prosecutors are alleging Hunter intentionally misreported taxes, including by falsely claiming as wages money he'd paid to women he had romantic and sexual relationships with.

The case's strange unfolding may also be explored in addressing why the charges were brought. In July, two IRS whistleblowers testified before Congress that the Justice Department had slow-walked the years-long investigation and hamstrung Delaware U.S. Attorney David Weiss.

Weiss has denied being thwarted. “At no time was I blocked, or otherwise prevented, from pursuing charges or taking the steps necessary in the investigation," he told a congressional committee.

Later in July, Hunter's plea deal collapsed inside a Delaware federal courthouse, and in August, Attorney General Merrick Garland appointed Weiss as special counsel in the investigation, giving Weiss more independence. In September and December, Weiss brought the felony gun and tax charges.

Lowell, Hunter's attorney, has questioned how that change in prosecutorial approach came about.

"As to the mounting charges, people just need to ask the question: What changed between June and December other than Republican political pressure?" Lowell told MSNBC in an interview.

'Thieves, junkies, petty dealers, over-the-hill strippers': Can the evidence go to a jury?

The tax indictment against Hunter is filled with salacious allegations about his personal conduct, sometimes referring specifically to his memoir.

In 2018, for instance, prosecutors say Hunter claimed false deductions for money he spent on luxury clothes, escorts, and dancers, and a $10,000 payment for a sex club membership.

They also quote from his memoir that, for months in 2018, he allowed a motley collection of "thieves, junkies, petty dealers, over-the-hill strippers, con artists, and assorted hangers-on" to latch onto him, "who then invited their friends and associates and most recent hookups." That's evidence Hunter wasn't conducting business and generating the deductible expenses he claimed, according to prosecutors.

Lisella said he expects the government to try to bring in evidence that Hunter was spending his money on illegal or morally questionable activities, and for Hunter's attorneys to argue the salacious details should be kept out because they would unfairly prejudice a jury.

"Those are just things you can't predict how the judge is going to rule, but it could be that a lot of what the government is alleging or at least some portion of it is kept away from the jury," Lisella said. "That could be consequential to the outcome."

When it comes to the most serious charges – the felony tax evasion and false return allegations – Hunter's team may also attack the prosecution's allegations about the taxes themselves.

A spokesperson for Lowell provided USA TODAY with a letter that appears to have been sent by Lowell in September to the Republican head of a congressional committee that heard IRS whistleblower testimony. In it, Lowell says the whistleblowers wrongly claimed Hunter underreported his 2018 taxes.

To win a conviction on the felony tax evasion charge in particular, prosecutors must prove there are taxes "due and owing," according to Justice Department guidance.

"Pending final development of facts impacting Mr. Biden’s 2018 tax year, it appears Mr. Biden will be due a refund for that tax year," Lowell said in his letter.

This article originally appeared on USA TODAY: Addiction struggle history could help Hunter Biden fight tax charges