Hurricane Ian one year later: How has it affected beach, inland real estate in SWFL?

Hurricane Ian accelerated a move east in Southwest Florida and helped correct a runaway real estate market.

But even with inland demand increasing, people still want to live the beach life and are willing to pay for it.

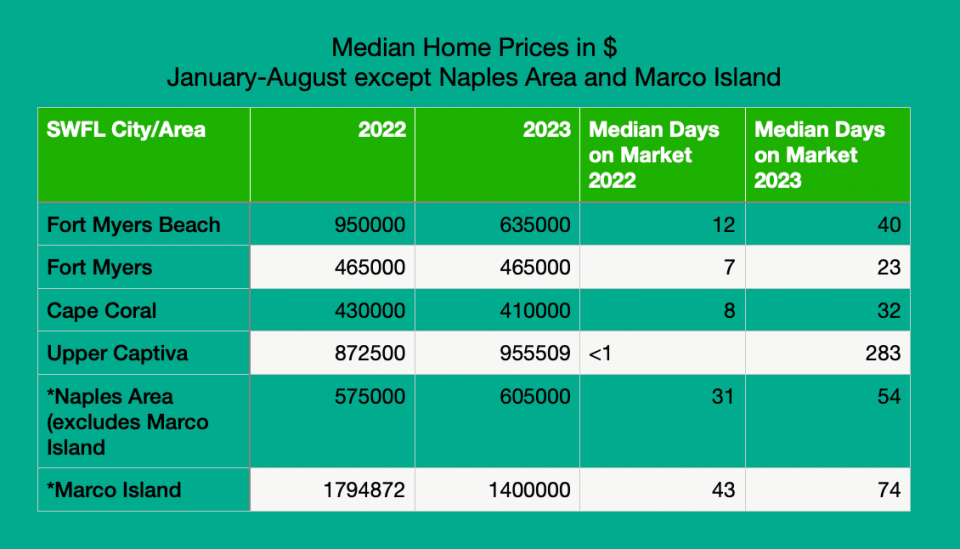

Demand for single-family homes, condos and commercial space rebounded and remains high after a significant drop following the Sept. 28 near-Category 5 hurricane. Prices and days on the market look more like 2019 instead of 2020-2022 when homes would sell the same day as being listed with bidding wars and cash-only deals.

“Home sales are still really hot,” said Gary Tasman, CEO Cushman & Wakefield | Commercial Property Southwest Florida. “You’re comparing white hot to just hot.”

Some areas of Southwest Florida are hotter than others.

Upper Captiva anomaly among housing price drops

In Lee County, which sustained more than $100 billion in damage when the monster that was Ian decimated communities on the coast and far inland, everywhere except Upper Captiva is following Southwest Florida trends for lower pricing, more days on the market and more listings.

Upper Captiva is a private island community of about 600 properties located about five miles offshore in the Gulf of Mexico that can only be accessed by boat. Here, the median sale price from January to August was up 9.5 percent over the same period a year ago to $955,509 from $872,500. With listings down, closings were down 75% to five from 20 and the median days on the market were 283 vs. less than one day a year ago. This, according to the Royal Palm Realtors Association.

In the rest of Lee and in Collier County, home prices are down, not an indicator of a declining market but a needed adjustment, say area real estate agents.

The median sale price is down 4.1% from last year for single-family homes in Lee County and the median price remained flat from last year for single-family homes in Collier County, Palm Paradise Real Estate's Marcus Larrea said in his August market report on Sept. 13.

“You would think that with interest rates increasing, prices would drop, but lack of inventory and continuous high demand are keeping prices up,” Larrea said.

"In the immediate aftermath of the storm, the real estate market in Southwest Florida slowed significantly," Michael Polly, president and managing broker of Royal Shell Real Estate told clients this month. "The market has since rebounded."

The market began slowing down from the post pandemic boom around the beginning of second quarter in 2022, Naples Area Board of Realtors President Nick Bobzien said in an interview. "So just prior to Hurricane Ian, the market was already calm yet stable. Post hurricane, we had some pending contracts fall through due to damage to homes, some closings were delayed while repairs were made, and some had little to no impact at all."

Hurricane Ian made landfall twice in Southwest Florida, first in Cayo Costa and then in Punta Gorda, as a Category 4, "producing catastrophic storm surge, damaging winds, and historic freshwater flooding across much ofcentral and northern Florida.," according to the National Hurricane Center. Ian was responsible for more than 150 direct and indirect deaths and more than $112 billion in damage, making it the costliest hurricane in Florida’s history and the third costliest in United States history.

At the same time, the U.S. was feeling the squeeze of rising inflation, increased interest rates, low inventory and supply-chain delays in every industry − all of which combined to ease housing prices some. Demand for homes across the country, and especially in Florida, remains high. In other words, people are still moving to Florida − at a rate of almost 1,000 per day. Accelerated by the COVID-19 pandemic, moves to the Sunshine State haven't slowed.

Between July 2019 and July 2020, 252,000 people moved to Florida. Between April 2020 and April 2021, 330,000 moved here, according to the James Madison Institute. Florida ranks number one as the state with the most residents interested in relocating.

"As inventory faded away during the homebuying frenzy of the pandemic years, median closed prices rose by over 50 percent. In July 2019, the median closed price in Naples was $325,000," according to Southwest Coast Realty's most recent market report. "But in July 2023, the median closed price increased 9.2 percent to $595,000 from $545,000 in July 2022."

Sarah Angelson with Palm Paradise Real Estate said she was surprised prices and buying continued so robustly after Ian."The market didn’t go down like we thought it would," Angelson said in an interview. "People are still buying. People still buy at 7 percent interest."

Are people ignoring the dangers, forgetting the past or merely so attracted to Florida's warm weather, laid-back lifestyle and lack of a state income tax?

Is it hurricane amnesia?

Residents, governments and buyers aren't forgetting about hurricanes and their dangers,

"As far as the attitude from buyers towards hurricanes and flooding, they certainly ask questions about elevation of the home, is flood insurance required, etc.," said Bobzien, a broker associate at Downing Frye Realty, Inc. "Natural disasters occur all over the country, but one thing buyers have mentioned to me they like, is the warning time they receive, and the fact homes built to hurricane code hold up very well to hurricanes."

With five to seven days' notice about a potential hurricane threat, buyers feel confident and comfortable buying, Bobzien said. "While the path the hurricane takes may shift, the warnings are still there several days in advance."

Demand hasn't waned, agrees Tasman.

"All the metrics point to Southwest Florida as a good safe bet going forward despite the storm," he said. "There’s more demand there than supply. And we can’t build it fast enough."

In most market areas, "property values remain stable or have returned to our long-term historical trend of 8 percent per year appreciation," NABOR's Cindy Carroll said in the group's August market report released Sept. 22.

"It doesn’t appear there is much of a hurricane amnesia attitude, if at all," Bobzien said.

Interest in moving inland, east to communities including Babcock Ranch and Ave Maria, has increased.

A move inland

"Ian’s effect on the coastal communities has also prompted a notable surge in interest in inland real estate," Polly wrote in a market report.

Among the The Top-Selling Master-Planned Communities of Mid-2022, Babcock Ranch ranked fifth on a list of 50 in the United States, followed by Ave Maria at number 18.

"Development is going to continue to push east. That’s happening in Lee, Collier and Charlotte County. The transportation corridors are east," Tasman said. "It's happening faster because of Ian. It was going to happen anyway."

Why? Because I-75 should be looked at as an economic corridor, drawing jobs and people, Tasman said. Combine that with the inability to add density on and near the barrier islands and that's why growth is happening inland.

"Ave Maria and Babcock Ranch. That’s what the future is going to look like," he said.

The outlook for all of Southwest Florida the rest of the year is: More buying ahead and high prices.

What's next for 2023?

"Until we see a significant amount of inventory, we aren’t going to see home sales go down," Tasman said.

What does that look like?

A healthy inventory is six to 12 months' supply of homes, he said. "Right now, we probably have a two- to four-month supply."

With that in mind, look for Southwest Florida's market to continue to be strong even throughout the rest of hurricane season, which ends Nov. 30.

"The third and fourth quarters of 2023 for Florida’s housing market are set to be dynamic and bustling,” Polly at Royal Shell told clients. “With property values steadily on the rise, it’s the perfect landscape for both homebuyers looking for long-term value and investors seeking robust returns.”

This article originally appeared on Naples Daily News: How has Hurricane Ian affected real estate in Southwest Florida?