Hyatt Brown: Congressional leaders need to consider debt-to-GDP solutions

DAYTONA BEACH — Billionaire and philanthropist Hyatt Brown has been thinking about the federal government.

Armed with several dozen graphs and charts, Brown made a presentation to the Tiger Bay Club of Volusia County on Thursday, spelling out what he sees as a looming economic concern: How much is owed versus the gross domestic product, or the debt-to-GDP ratio. He cited the figure at 138%, as compared with China, at about 70%.

Brown, who from 1978 to 1980 was Florida Speaker of the House but has not run for office since, called this "a severe problem we have that sooner or later we have to deal with."

Watch: Cici and Hyatt Brown on donating $25M to Embry-Riddle's research park in Daytona

Milestone: Daytona Beach-based Brown & Brown Inc. chosen to join S&P 500

Adornment: New sculpture adorns Brown & Brown headquarters on Beach Street

What's more, Brown said there are ways to do it, but said it will take elected officials — the president, senators and representatives — to take actions that might not be politically expedient.

Addressing the problem, he said, boils down to whether those elected officials are representatives or delegates.

"The difference is the representative always wants to find out exactly what the general opinion is of the people they are representing," Brown said. "A delegate is one who knows they are going to make votes that really aren’t all that popular back home but they do it because they know it’s the right thing for the whole."

How to reduce debt-to-GDP

After the costly World War II, the United States' debt was about 124% of GDP.

Congress raised taxes while a number of other factors came into play — such as population growth — leading to a reduction in the debt-to-GDP ratio to about 24%.

Brown addressed one common refrain from politicians.

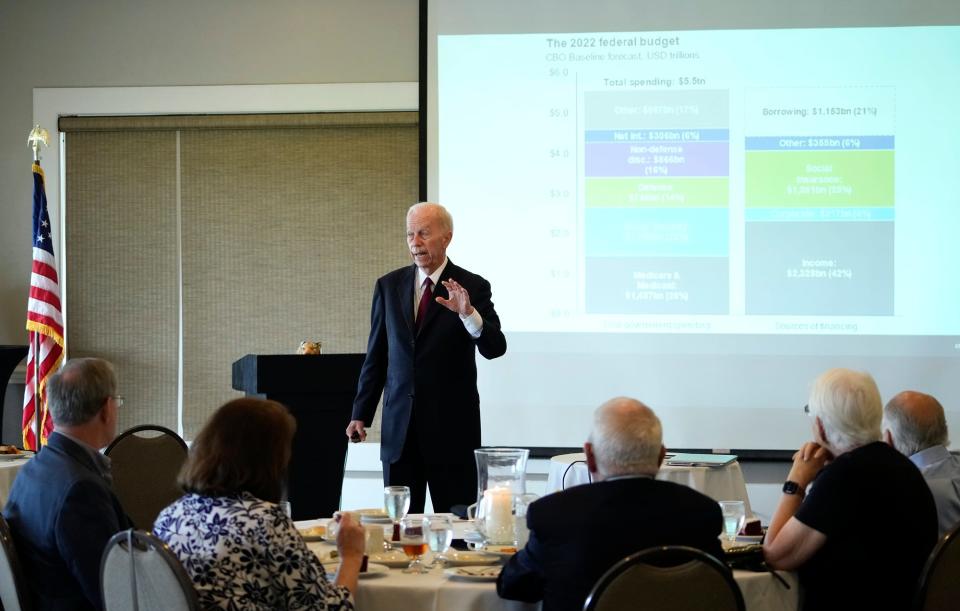

“Everyone says cut spending. Cut spending. Cut spending,” he said.

The problem with that is virtually no one will support cuts in the federal spending on national defense, Medicare and Medicaid and Social Security.

Brown said one former congressman he knows well and helped fund was the conservative Republican Ander Crenshaw of Jacksonville, who served from 2001 to 2017. Brown said he asked Crenshaw why he was retiring from Congress when he had reached a position of power as deputy majority whip and a member of the Appropriations Committee.

Crenshaw said he had worked to make cuts in government spending, but was running low on ideas on how to make a major impact.

"We're down to the bone," Crenshaw said, according to Brown. "We can't cut any more and I'm tired of the knuckle-dragging. I'm going to go back to Jacksonville and I'm going to enjoy life."

So the next most likely solution, Brown concluded, is to raise GDP.

One issue with the American GDP is the U.S. economy's reliance on folks "buying stuff," Brown said.

“We’re buying things more than we’re selling things. And if we wanted to increase GDP by $900 billion all you do is change that negative to flat,” he said. "Buy American."

There are other ways GDP grows, he said, including:

Population growth, either in the form of increased births or immigration

Increased efficiency in the production of goods and services

A positive export balance

Increased government spending

More private investment

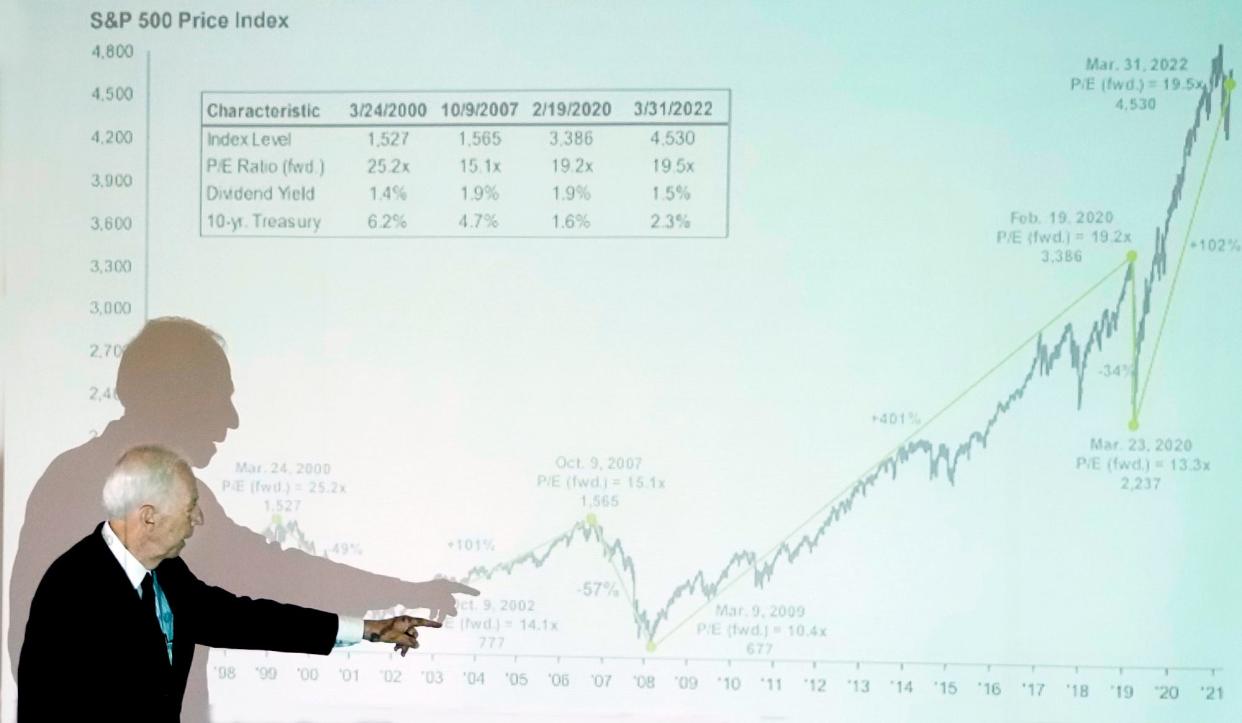

Brown said a "short-term joker in the deck" is the stock market, which has seen long periods of expansion followed by precipitous drops. In the long run, though, the market is up, while he said forward earnings are projected at 19.5, which is better than average.

The United States, he emphasized, has an economy that's the envy of the rest of the world.

"I'd say yeah, don't worry about it," Brown said. "It will all work out."

During a question-and-answer session, retired Dr. Carl "Rick" Lentz asked Brown about the possibility of moving from cash to a digital currency.

"It's coming," Brown said. "The people who hate it are the criminals and the black market, where people re running businesses for cash and, therefore, they're avoiding taxes."

Lentz expressed reservations.

"The problem that I have is that everything you're spending on everything, you have no secrets," he said.

Brown responded; "Do you have any secrets? I don't have any secrets."

Never miss a story: Subscribe to The Daytona Beach News-Journal using the link at the top of the page.

This article originally appeared on The Daytona Beach News-Journal: Hyatt Brown challenges Congress to address 'severe' GDP-to-debt ratio