IBM Sinks on 4th-Quarter Sales Decline

- By James Li

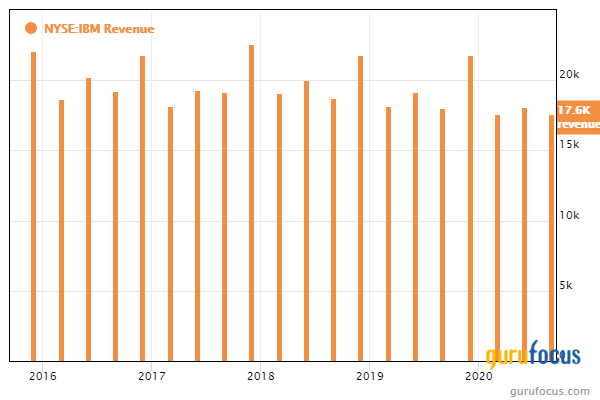

Shares of International Business Machines Corp. (NYSE:IBM) tumbled over 6% in aftermarket trading on Thursday on the heels of reporting annualized revenue decline of 6% for the fourth quarter of 2020, its fourth consecutive quarter of revenue decline.

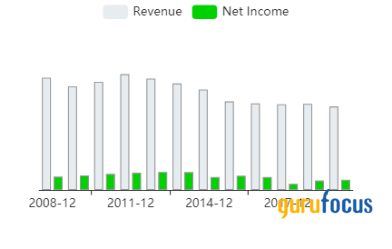

For the quarter ending December 2020, the Armonk, New York-based company reported net income of $1.356 billion, or $1.41 in earnings per share, compared with net income of $3.67 billion, or $4.11 in earnings per share in the prior-year quarter. Revenue of $20.367 billion underperformed the Refinitiv consensus estimate of $20.67 billion and was down approximately 6% from the prior-year quarter revenue of $21.777 billion.

Company revenue declines during the fourth quarter and for the full year

Full-year revenue of $73.62 billion was down approximately 5% from the prior-year revenue of $77.14 billion. During the fourth quarter, revenue declined in several business segments, which include Cloud & Cognitive Software, Global Business Services, Global Technology Services and Systems.

Cloud & Cognitive Software sales of $6.8 billion declined 5% year over year and underperformed the FactSet estimate of $7.18 billion. Likewise, Systems revenue of $2.5 billion declined over 17% year over year, driven by lower demand in Systems Hardware platforms.

Chief Financial Officer Jim Kavanaugh said during the earnings call that key drivers of revenue decline include the shift in client purchasing trends from long-term enterprise license agreements to short-term enterprise license agreements given the level of macroeconomic uncertainty. Kavanaugh also mentioned that although the fourth quarter usually is a "seasonally high transaction" quarter, the current macroeconomic trends resulted in a slower-than-usual quarter of transactions.

Stock tumbles in aftermarket trading

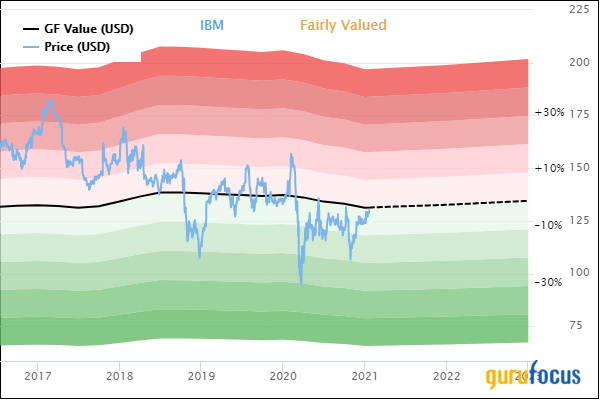

Shares of IBM traded around $123.21, down over 6% from the closing price of $130.16. The stock is fairly valued based on a price-of-GF Value ratio of 1.

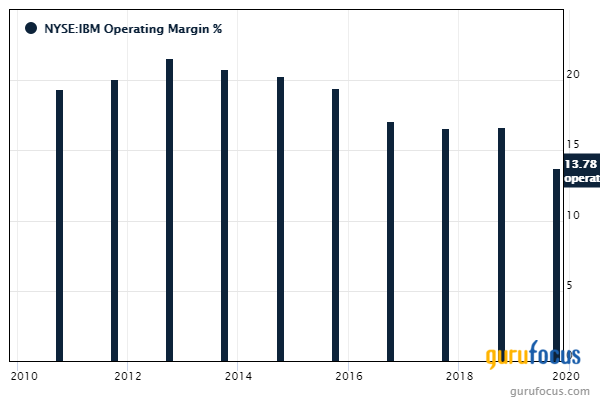

GuruFocus ranks the company's profitability 7 out of 10: Even though three-year revenue and earnings growth rates are underperforming over 66% of global competitors, profit margins and returns are outperforming over 70% of global software companies.

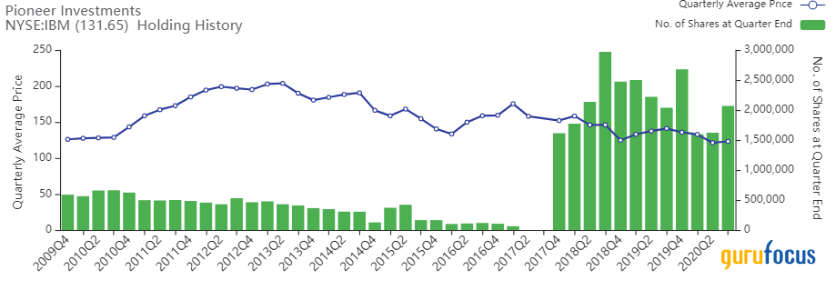

Gurus with holdings in IBM include Pioneer Investments (Trades, Portfolio), Robert Bruce (Trades, Portfolio)'s Bruce & Co. and Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management.

Disclosure: No positions.

Read more here:

5 Oceania Companies With Good Financial Strength and Profitability

5 Historical Low Price-Book Companies for 2021

Yacktman Fund's Top 5 4th-Quarter Trades

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.