ICYMI: Florida's tax-free school supplies holiday is underway

The school sales tax holiday in Florida starts Monday. Here are most of the items you can buy missing the state's 6% tax . The holiday ends Aug. 7.

Accessories

• Barrettes and bobby pins • Belt buckles • Bow ties

• Hairnets, bows, clips and hairbands, • Handbags

•Neckwear • Ponytail holders • Scarves

•Ties • Wallets • Aerobic and fitness clothing

• Aprons and clothing shields

• Athletic supporters • Baby clothes

Other tax holidays: Here's how you can take advantage of the Florida sales tax holiday

School board elections: School board candidates campaigning at gun shows in Palm Beach County. Is this the new norm?

• Backpacks and book bags • Bandanas

• Baseball cleats • Bathing suits, caps, and cover-ups

• Belts • Bibs • Bicycle helmets (youth)**

• Blouses • Boots (except ski or fishing boots) • Bowling shoes (purchased)

• Braces and supports worn to correct or alleviate a physical incapacity or injury*

• Bras • Choir and altar clothing* • Cleated and spiked shoes • Clerical vestments*

• Coats • Coin purses • Costumes • Coveralls • Diaper bags

• Diapers, diaper inserts (adult and baby, cloth or disposable)

• Dresses • Fanny packs • Fishing vests (non-flotation)

• Formal clothing (purchased) • Gloves - Dress (purchased) - Garden - Leather - Work

• Graduation caps and gowns • Gym suits and uniforms

• Hats and caps • Hosiery and pantyhose (including support hosiery)

• Hunting vests • Jackets • Jeans • Lab coats

• Leggings, tights, and leg warmers • Leotards • Lingerie

• Martial arts attire • Overshoes and rubber shoes

• Pants • Purses • Raincoats, rain hats and ponchos • Receiving blankets

• Religious clothing* • Robes • Safety clothing • Safety shoes

• Scout uniforms • Shawls and wraps • Shirts • Shoe inserts and insoles

• Shoes (including athletic) • Shoulder pads (e.g., dresses or jackets)

• Shorts • Ski suits (snow) • Skirts • Sleepwear (nightgowns and pajamas)

• Slippers • Slips • Socks • Suits, slacks, and jackets • Suspenders

• Sweatbands • Sweaters • Swimsuits and trunks

• Ties (neckties and bow ties) • Tuxedos (purchased) • Underclothes

• Uniforms (work, school and athletic, excluding pads) • Vests

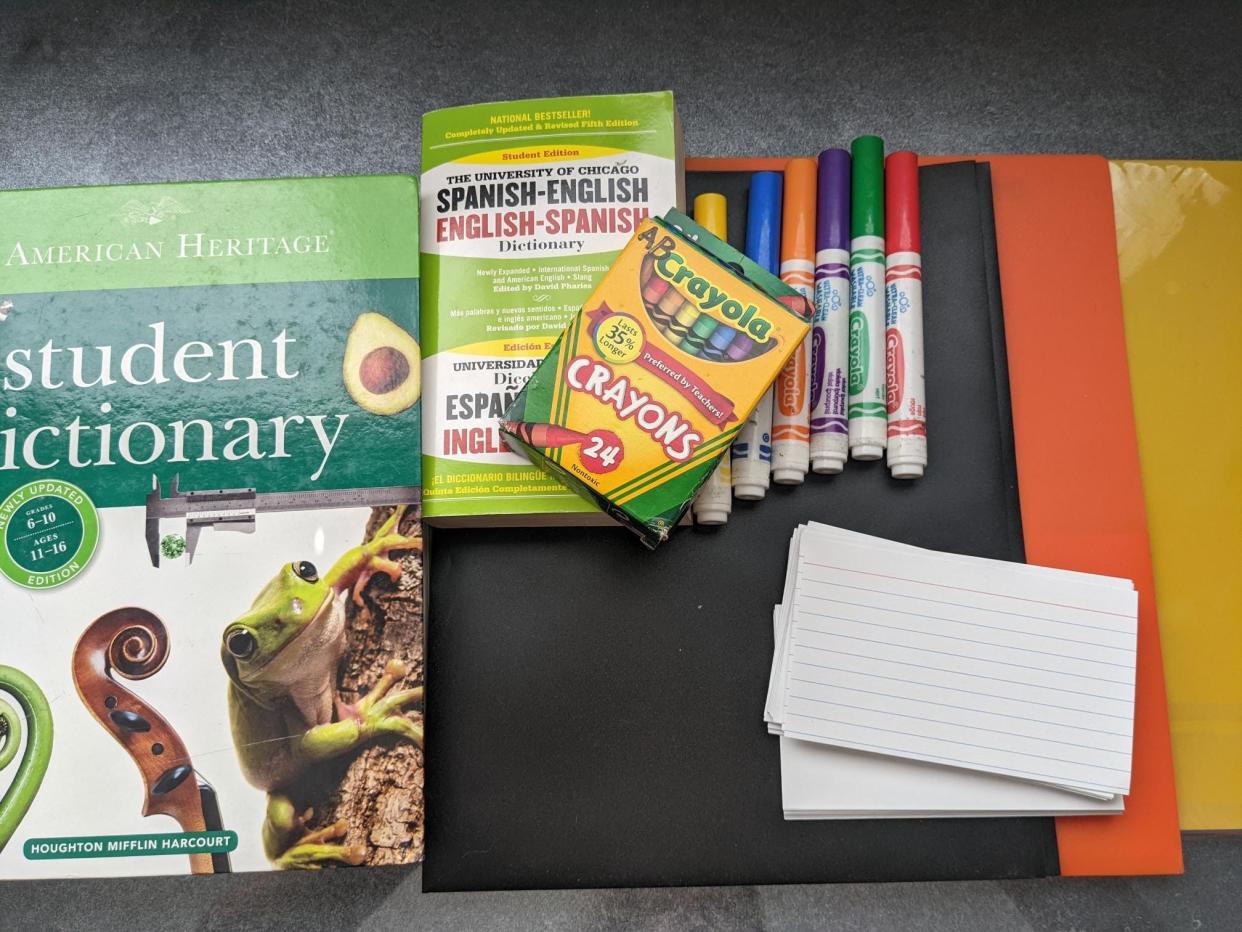

School supplies

• Binders • Calculators • Cellophane (transparent) tape • Colored pencils

• Compasses • Composition books • Computer disks (blank CDs only)

• Construction paper • Crayons • Erasers • Folders • Glue (stick and liquid)

• Highlighters • Legal pads • Lunch boxes • Markers

• Notebook filler paper • Notebooks • Paste

• Pencils, including mechanical and refills

• Pens, including felt, ballpoint, fountain, highlighters and refills

• Poster board • Poster paper • Protractors • Rulers • Scissors

• Staplers and staples (used to secure paper products)

Complete list of items: For more information, click here

Computers and accessories

•Cables (for computers) • Car adaptors (for laptop computers)

• Central processing units (CPU) • Compact disk drives

• Computers for noncommercial home or personal use - Desktop - Laptop - Tablet

• Computer batteries • Computer towers consisting of a central processing unit, random-access memory and a storage drive

• Data storage devices (excludes those devices designed for use in digital cameras or other taxable items) - Blank CDs - Diskettes - Flash drives - Jump drives - Memory cards - Portable hard drives - Storage drives - Thumb drives - Zip drives

• Docking stations (for computers) • Electronic book readers • Hard drives

• Headphones (including “earbuds”) • Ink cartridges (for computer printers)

• Keyboards (for computers) • Mice (mouse devices) • Microphones (for computers)

• Modems • Monitors (except devices that include a television tuner)

• Motherboards • Personal digital assistant devices (except cellular telephones)

• Port replicators • Printer cartridges • Printers (including “all-in-one” models)

• RAM (random access memory) • Routers • Scanners

• Software (nonrecreational) - Antivirus - Database - Educational - Financial - Word processing

• Speakers (for computers) • Storage drives (for computers)

• Tablets • Web cameras

* These items are always exempt as religious, prescription, prosthetic, or orthopedic items. ** Bicycle helmets marketed for use by youth are always exempt from sales tax.

This article originally appeared on Naples Daily News: Florida school sales tax holiday: A list of what you can get tax-free