Idaho bill for private school tax rebates would have ‘lasting negative impact,’ critic says

A bill that would have provided $50 million in tax credits and grants for families whose children attend private schools or other non-public options will not be advancing to the House floor.

House lawmakers on Tuesday voted to hold the bill in a committee after over an hour of testimony and concerns from some legislators. Lawmakers initially rejected a motion to send the bill to the House floor with no recommendation before they voted to hold the bill.

House Bill 447 would have provided refundable tax credits of up to $5,000 for families for tuition and other fees related to attending private school or home-school, such as textbooks, tutoring or costs associated with “learning pods” or “micro-schools.” For families of children with special needs, it would have provided up to $7,500.

The bill would have been capped at $50 million, most of which would have been offered on a first-come, first-serve basis, while $10 million would have specifically gone to low-income families.

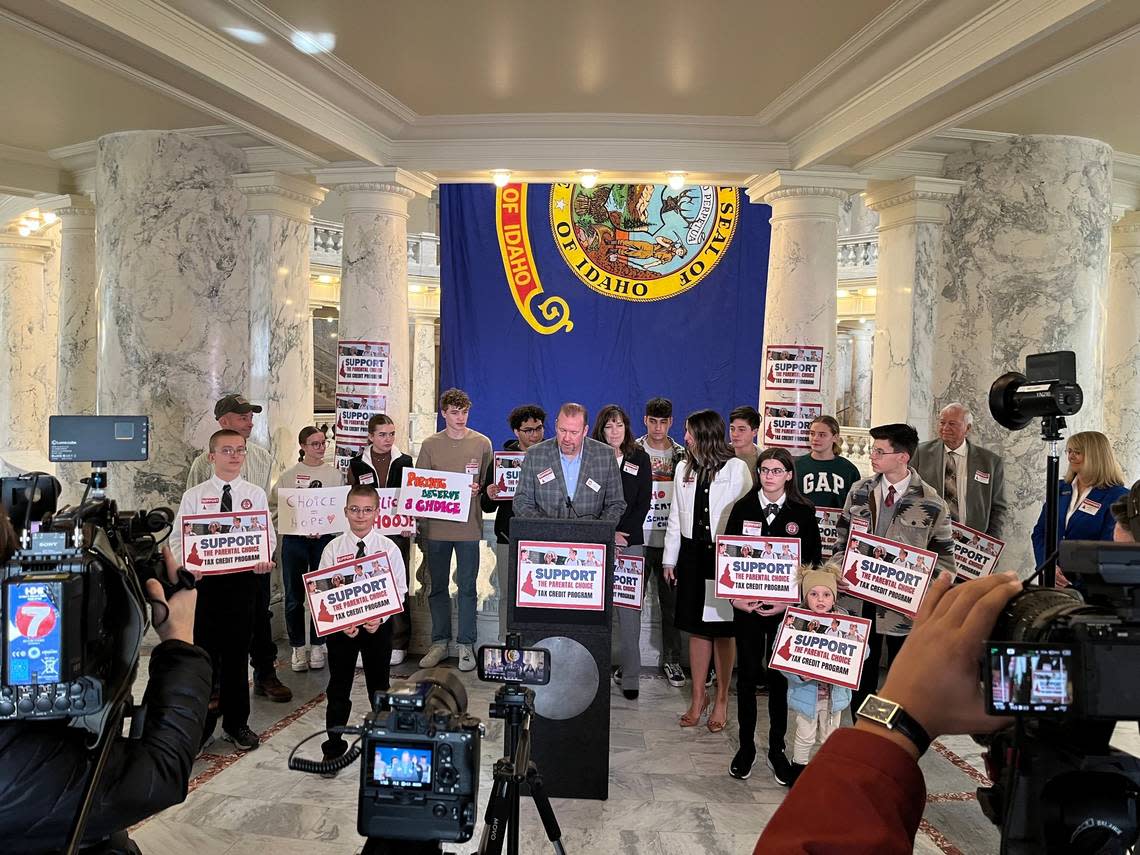

Lawmakers and those who testified in support of the bill said public school isn’t the perfect fit for all Idaho children, and that this legislation would offer support for parents to give their kids the best possible education for them. The legislation would also provide more parental choice and increase competition in education, lawmakers said.

“I don’t think it will be that many kids. But for those who need it, it is life changing,” said Rep. Wendy Horman, R-Idaho Falls, one of the sponsors of the bill. “I feel a moral obligation to care about every child’s learning.”

Those in opposition worried about the lack of transparency and accountability and said the money would primarily go to parents who already pay to send their kids to private schools. Lawmakers worried about the program’s long-term sustainability, its fiscal impact and the impacts it would have on rural schools and communities.

“These are just public dollars replacing private dollars, and so there’s no return on our investment and that’s what’s so fiscally irresponsible about this bill to me,” said House Assistant Minority Leader Lauren Necochea, D-Boise. “Not to mention that there’s still zero accountability.”

For years, Idaho lawmakers have been discussing school choice bills, iterations of school vouchers, that would direct public money to private schools. The topic was expected to be a key issue this legislative session as states across the country pass similar bills to expand vouchers and other systems.

In Idaho, most private schools are concentrated in urban areas, according to previous Idaho Statesman reporting. Although tuition for private schools vary, it can cost tens of thousands of dollars per year.

Under the bill, lawmakers would have had to evaluate the $50 million spending cap in 2026 to determine whether it’s “sufficient to address the needs of the program.”

Horman said she’ll keep fighting for legislation that will allow parents to choose the best learning environment for their children.

“We are having continuing conversations about if there is anything we can still move this session,” she told the Statesman. “We will keep pressing forward until we can get a solution that we believe serves all children in the state of Idaho.”

Idaho public schools ranked near last in spending

During public testimony, representatives from education groups worried the bill could take money away from the state’s public schools. Idaho has for years ranked last or near last in spending per pupil across the country.

“I continue to be somewhat astonished that we would be considering dropping all this extra money into a whole new educational system when we’re regularly not meeting the existing needs of our established ones,” said Zach Borman, the president of the West Ada Education Association.

Quinn Perry of the Idaho School Boards Association said the legislation violated the principles of fiscal responsibility and conservatism. She pointed to other states across the country that have adopted voucher systems and have seen the appropriations for them grow significantly to support families whose children already attend private school.

Robert Sanchez, the vice president of Idaho Business for Education, who presented testimony on behalf of the group’s president, called the bill one of the most important pieces of legislation in the history of Idaho.

It “would have a lasting negative impact on our public schools,” Sanchez said. “Over time, the legislation would become more and more expensive. It would tie the hands of future lawmakers and make it more difficult for them to fulfill their constitutional mandate to fund free, uniform and thorough public schools.”

But several parents said paying tuition to send their kids to private schools had been a significant burden on them. The tax credit would help them keep their children in their schools of choice, they said.

Others who testified in support of the bill came from out-of-state groups, including the American Federation for Children, which is headquartered in Texas and calls itself a national leader in school choice.

Chris Cargill, the president of the Mountain States Policy Center, said analysis shows few families would sign up for the program because they like their public schools.

“What we’re talking about here is for the small percentage of students who don’t necessarily fit into the public school box,” he said. “Many of those kids are special needs kids like my son.”