Idaho taxpayers already fund one school system. Now we have to subsidize another? | Opinion

If you’re not moved by Robbe Hart’s story, you’ve got ice in your veins.

Hart, of Emmett, is a single dad to two boys, Emmett, 11, and Wyatt, 10. Every day, he drives from their home in Emmett to school at Greenleaf Academy, the oldest private school in Idaho. Then he drives to Boise Bible College, where he’s a student, and then drives to Greenleaf to pick up the boys before driving back home. It’s 62 miles in the morning, 72 in the afternoon.

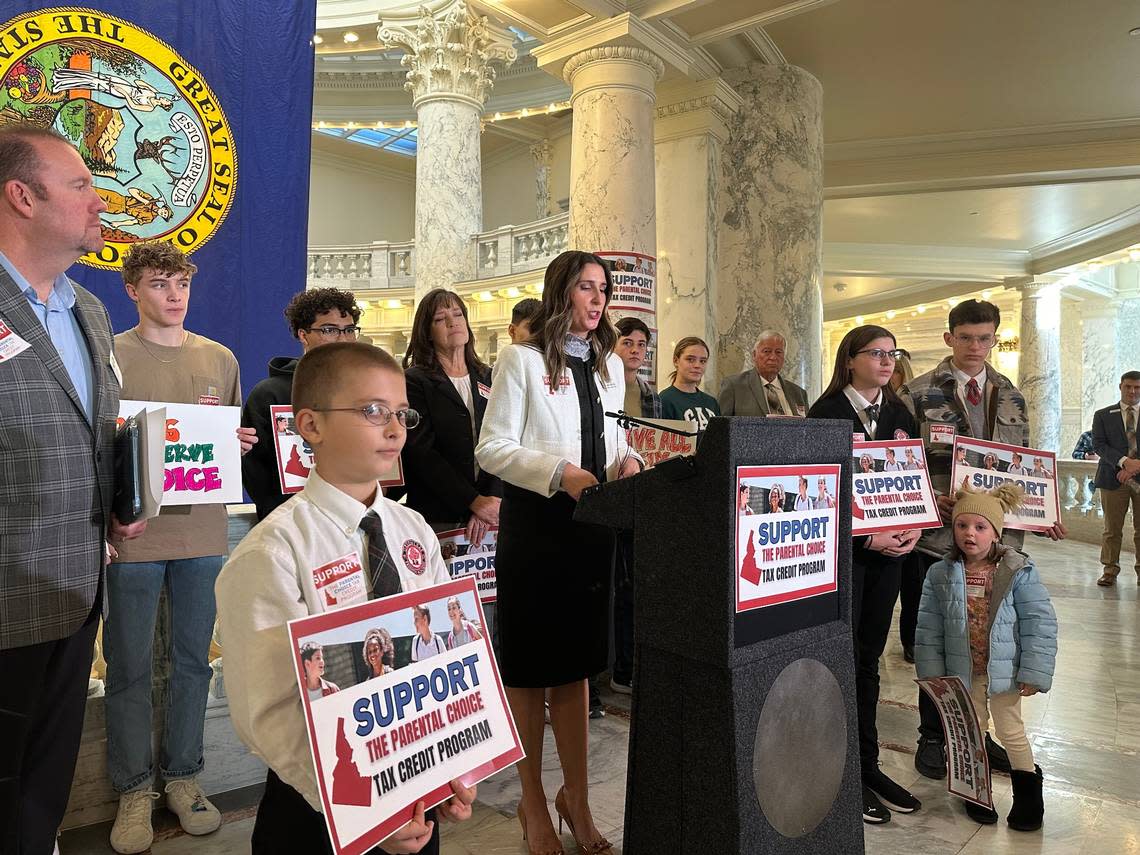

He told his story recently during a press conference for a bill that was proposed Tuesday and would benefit Hart. He also wrote a guest op-ed for the Idaho Statesman this week.

The bill would allow tax credits for parents who send their children to private schools. Parents would receive up to a $5,000 tax rebate per eligible student for school expenses, including private school tuition, textbooks, transportation costs, or to pay for schooling received in smaller “learning pods.” Parents with special-needs children who have disabilities could receive up to $7,500. The expense for the program is capped at $40 million.

The second part is a grant, a straight payment for families who qualify for the federal earned income tax credit but “can’t incur those expenses up front and wait for the tax refund to come to them,” according to Republican Sen. Lori Den Hartog.

The grant program is capped at $10 million, so all in, it’s a $50 million proposal.

As it is, the legislation doesn’t have any income limits, and it’s first-come, first-served.

So someone like Hart is going to be competing with thousands of other families, presumably, for the tax credit. That means somebody like Hart could still get shut out, while a wealthy family sending their children to Riverstone gets the break.

When I asked about that, Den Hartog, R-Nampa, bristled at my question about helping wealthy families.

“I think it is a complete misunderstanding that families who have made the sacrifice and choice to put their kids in private school today are only wealthy families,” Den Hartog said.

I get it. There are parents like Hart out there who aren’t wealthy and choose to send their kids to private school. But, come on, let’s be real: Families who send their children to private schools right now are wealthier than most.

My wife and I don’t consider ourselves “wealthy” (I’m a journalist, for crying out loud), but we managed to send our two sons to private schools, first St. Joe’s and then Bishop Kelly.

I estimate we’ve spent more than $100,000 over the past several years on private school. I would never expect taxpayers to pay for that family decision.

At the same time, we’ve spent tens of thousands of dollars on the public school system, including paying for bonds to build new schools and levies to supplement shortfalls in public education funding.

That’s the deal. We all pay into the public education system, whether we’ve got children in the system or not.

Those who support this proposal say “the money should follow the student.” But it’s not the student’s money. It’s everyone’s money, and the directive of the Idaho Constitution for that money is “to establish and maintain a general, uniform and thorough system of public, free common schools.”

I feel for Hart. I really do. But he’s choosing to not send his kids to school in Emmett, something Idaho taxpayers have provided for him and his family.

Instead of giving Hart a tax break so he can send his sons to a private school, we should be putting that money toward improving and upgrading the public education system.

Setting aside for a moment all the valid arguments about siphoning money from public education, the lack of accountability, the potential for abuse and fraud, the credits benefiting mostly the well-off, there’s another argument against school vouchers that is more philosophical — and it has to do with the notion of choice.

Supporters of vouchers, education savings accounts and tax credits claim that “parents know what’s best for their children.”

But what if a parent simply doesn’t like their public school — which Idaho taxpayers already pay for — because they don’t pray there? They want the “choice” to send their children to a private religious school.

What if a parent doesn’t like their child’s public school because it teaches evolution? Teaches that Earth is round, that we landed on the moon or that slavery was bad?

Should Idaho taxpayers, in addition to funding the public school system, now be required to subsidize a parent’s personal, private choice?

Under this bad bill, we would.

A parent certainly has the freedom of choice to go find a school that meets their wishes and standards, whatever those may be.

Just don’t expect Idaho taxpayers to foot the bill.