Some Ideanomics (NASDAQ:IDEX) Shareholders Are Down 33%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Ideanomics, Inc. (NASDAQ:IDEX) shareholders should be happy to see the share price up 29% in the last month. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 33% in that half decade.

Check out our latest analysis for Ideanomics

Because Ideanomics is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

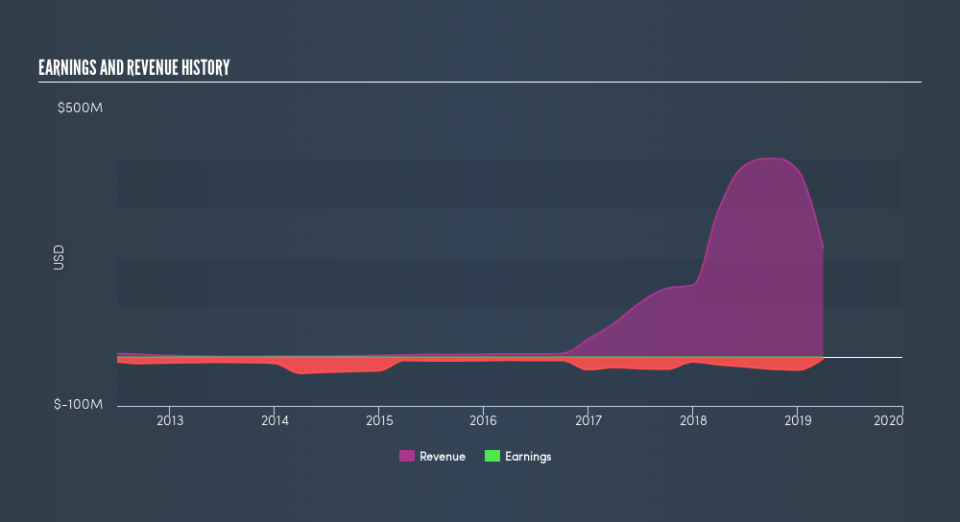

Over five years, Ideanomics grew its revenue at 74% per year. That's better than most loss-making companies. The share price drop of 7.7% per year over five years would be considered let down. You could say that the market has been harsh, given the top line growth. So now is probably an apt time to look closer at the stock, if you think it has potential.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Ideanomics's earnings, revenue and cash flow.

A Different Perspective

Ideanomics shareholders are down 0.5% for the year, but the market itself is up 6.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 7.7% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.