What Is IFB Agro Industries's (NSE:IFBAGRO) P/E Ratio After Its Share Price Rocketed?

IFB Agro Industries (NSE:IFBAGRO) shareholders are no doubt pleased to see that the share price has had a great month, posting a 35% gain, recovering from prior weakness. But shareholders may not all be feeling jubilant, since the share price is still down 41% in the last year.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that deep value investors might steer clear when expectations of a company are too high. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

View our latest analysis for IFB Agro Industries

Does IFB Agro Industries Have A Relatively High Or Low P/E For Its Industry?

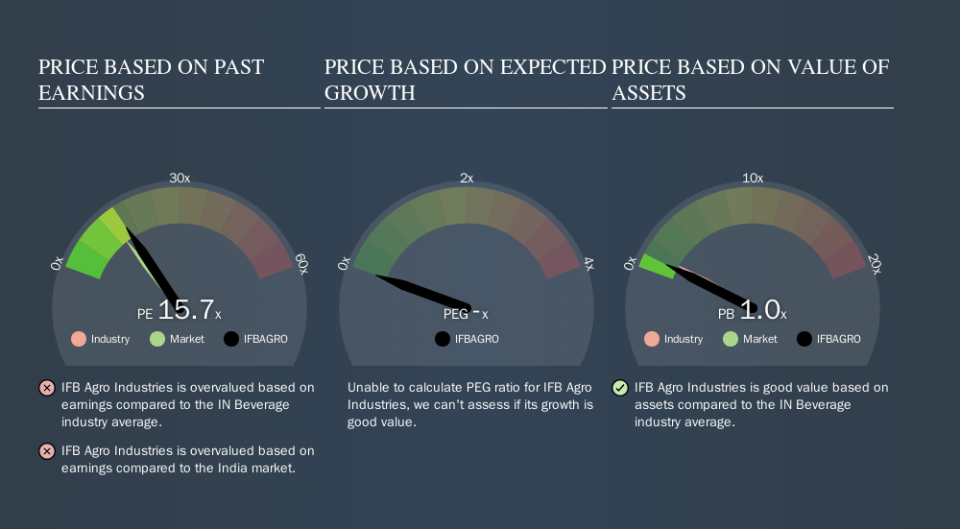

IFB Agro Industries's P/E is 15.70. As you can see below IFB Agro Industries has a P/E ratio that is fairly close for the average for the beverage industry, which is 15.5.

That indicates that the market expects IFB Agro Industries will perform roughly in line with other companies in its industry. The company could surprise by performing better than average, in the future. Checking factors such as director buying and selling. could help you form your own view on if that will happen.

How Growth Rates Impact P/E Ratios

Companies that shrink earnings per share quickly will rapidly decrease the 'E' in the equation. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. So while a stock may look cheap based on past earnings, it could be expensive based on future earnings.

IFB Agro Industries's earnings per share fell by 31% in the last twelve months. And it has shrunk its earnings per share by 11% per year over the last five years. This might lead to muted expectations.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

Don't forget that the P/E ratio considers market capitalization. So it won't reflect the advantage of cash, or disadvantage of debt. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

How Does IFB Agro Industries's Debt Impact Its P/E Ratio?

With net cash of ₹1.1b, IFB Agro Industries has a very strong balance sheet, which may be important for its business. Having said that, at 30% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On IFB Agro Industries's P/E Ratio

IFB Agro Industries's P/E is 15.7 which is above average (13.9) in its market. Falling earnings per share is probably keeping traditional value investors away, but the relatively strong balance sheet will allow the company time to invest in growth. Clearly, the high P/E indicates shareholders think it will! What is very clear is that the market has become more optimistic about IFB Agro Industries over the last month, with the P/E ratio rising from 11.7 back then to 15.7 today. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

When the market is wrong about a stock, it gives savvy investors an opportunity. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

You might be able to find a better buy than IFB Agro Industries. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.