From $2B to negative $500M: How Chesapeake and Aubrey McClendon fell apart

Listen on Apple Podcasts

Part 2 of Yahoo Finance’s Illegal Tender podcast about the life and death of Aubrey McClendon. Listen to the series here.

In the summer of 2008, Chesapeake Energy’s stock was worth $70 per share, which gave it a value of around $35 billion. Just a few months later, the stock would be worth $16.

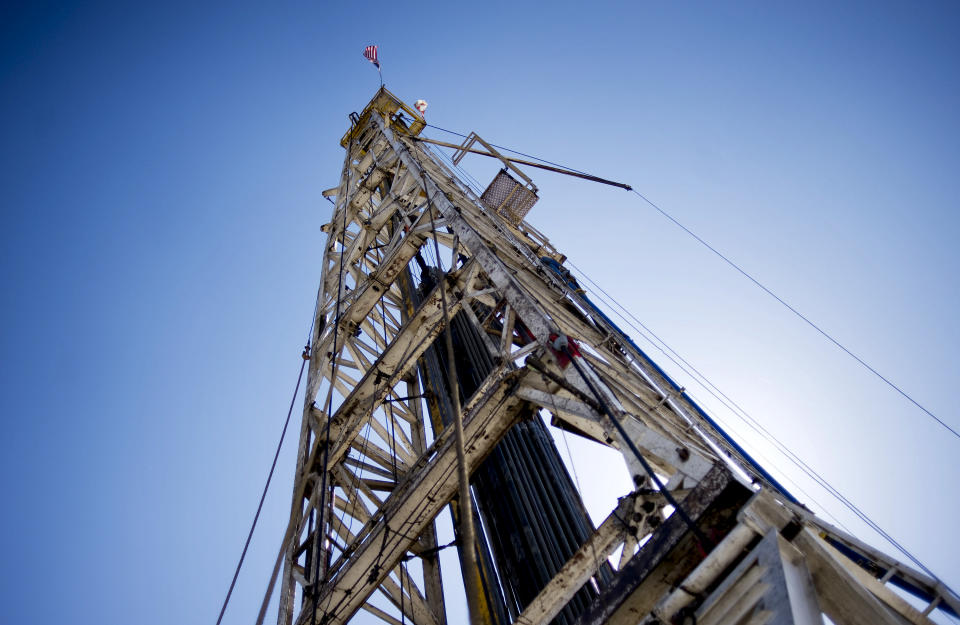

The fracking company, led by its charismatic CEO Aubrey McClendon, had flown too close to the sun. In the booming years, the CEO had fashioned his company in a culture of excess, spending on far more than land leases to frack oil. He made a corporate headquarters worthy of Silicon Valley with a 63,000-square-foot daycare for 250 children, along with massage tables.

Illegal Tender by Yahoo Finance is a podcast that goes inside mysteries in the business world. Listen to all of season one: Aubrey McClendon's life, death and fallen empire

It went past the business side into the personal. He bought the Seattle Sonics and brought them to Oklahoma City, renaming them the Oklahoma Thunder. He had one of the world’s finest wine collections and spent a fortune on a map collection that he installed at the company.

But to fund all of this excess, McClendon was using a margin loan instead of selling stock and using the proceeds. In other words, he was borrowing against the value of the stock.

An enormous, leveraged problem

The problem with Chesapeake’s business success was that it was completely tied to the price of oil and gas. Though an energy company has some control on the costs of getting energy sources out of the ground, the fact that it’s a commodity makes it hard to control on the selling end. Oil is oil and gas is gas.

So when prices fell, the stock fell hard and McClendon’s margin loans were called and he had to sell, wiping out a chunk of his net worth. The reason they fell? McClendon had been proven right and there was tons of natural gas hidden below the surface, which was contrary to public opinion at the time. But in being right, he devalued the price of natural gas, inadvertently bringing himself down in the process.

McClendon’s net worth fell from $2 billion to negative $500 million in three weeks in 2008, according to his former CFO Marc Roland. But this wasn’t the first time McClendon was in a pinch and managed to get out of it. Fortunately, McClendon had friends on the board of directors at the company.

In 2008, he was paid $112 million in total compensation — a $975,000 salary, $20 million in stock awards, and $77 million in bonuses — plus $12 million for the maps, which he ended up selling to the company.

Illegal Tender by Yahoo Finance is a podcast that goes inside mysteries in the business world. Listen to all of season one: Aubrey McClendon's life, death and fallen empire

Chesapeake, however, recovered and pivoted its business model and kept upping up his land buying in order to frack more shale. And while the stock price was going up, investors bought the story – even though the company hadn’t been able to live on the money that it itself was able to make.

It didn’t last forever, and news emerged that McClendon had used bizarre financing that may have included a conflict of interest. Activist investors like Carl Icahn came in to try to add discipline — he failed — but eventually McClendon was kicked out. When the interim CEO came in, he said he felt like an explorer walking around the place, looking at all the ridiculous excess and corporate problems.

McClendon eventually left the company in 2013 and started his next project — which would be his last.

Illegal Tender by Yahoo Finance is a podcast that goes inside mysteries in the business world. Listen to all of season one: Aubrey McClendons life, death and fallen empire

Transcript below:

Ethan Wolff-Mann: 00:00 In the summer of 2008, Chesapeake was worth $35 billion, valued at around $70 per share. By October, the stock was only worth 16 bucks. This would matter to any CEO, but it mattered even more to Aubrey McClendon, Chesapeake CEO at the time. That's because he had borrowed money to invest further into Chesapeake's businesses and pledged the shares that he had already as collateral for the loans. He was just crazy leveraged, which made any gains huge, but also any loss absolutely devastating. This is the thing about Aubrey McClendon. Chesapeake's business model was this gamble in so many ways, ways that we'll get into more later, but McClendon wasn't just gambling with other people's money. He wasn't even gambling with part of his own money. He literally gambled it all and lost.

Bethany McLean: 00:51 He did risk his own money. If he were a more callous and calculating type of CEO, instead of putting a margin loan against his stock, he would've sold some stock. Right? Why not? He had $2 billion worth. He could have taken $1 billion off the table, put it in the bank, and lived happily ever after. But instead he believed so much in Chesapeake that he took out a margin loan.

EWM: 01:17 From Yahoo Finance, this is Illegal Tender, season one. I'm Ethan Wolff-Mann. The thing about the margin loan she's talking about is that if the value of the pledged collateral drops, you have to put more up. And in this case, the collateral was actually Chesapeake stuck. In 2008 the stock cratered. Those gas prices that everybody thought would last forever, they just well didn't.

BM: 01:45 So this is what happens to McClendon in the fall of 2008. Chesapeake stocks start sliding in value because the surplus of natural gas has hit the market and natural gas prices are falling. And then you've got the global financial crisis, which reduces global demand and means that prices fall even harder.

EWM: 02:05 So now Aubrey's collateral is worth way less, and the bank is not happy.

BM: 02:08 And Goldman Sachs who has Aubrey's margin loan starts to get really nervous as they see the value of their collateral going down. And they call up McClendon one day and say, "We're selling you out. We're closing you down." And they do it.

EWM: 02:22 Mark Roland, Aubrey's CFO at Chesapeake remembers the moment well.

Mark Roland: 02:28 In October, September, October of 2008, when the stock collapsed and he had those huge margin calls at Goldman and other places, I mean he had gone from $2 billion of net worth in three weeks to minus 500 million. And his stock was all being called away.

EWM: 02:48 Roland was only a few feet away when McClendon got the news that he had to sell 94% of his Chesapeake stock.

MR: 02:54 He was going to lose his position at the company, and he never even slowed down. I mean, it was the most amazing thing. Most people would have wilted under that kind of pressure.

EWM: 03:06 This wasn't the first time Aubrey had been in a pinch. And though he wasn't happy with the margin calls, he did what he always had done. He kept going, wanting more. Roland recalls how many times Aubrey had flirted with situations like this and how he just couldn't be phased.

MR: 03:22 That was '98-'99, and he was virtually broke when he went public in '93. He lost a lawsuit the same week we went public in a small court and owed a couple of million dollars according to the judge, that he didn't have. And there were numerous occasions that I saw him facing much more daunting situations, and he was amazingly resilient.

EWM: 03:52 Maybe the craziest anecdote Roland told me was about an interesting plane ride they once took.

MR: 03:56 Of course we spent so much time in the airplanes, but a near crash landing going into Twin Cities in Minneapolis area, the gear wouldn't come down. And we were back there cranking by hand to get the gear down and finally figured out that the gear were already down. But we landed safely, and we laughed about that for a long time, but it could have been tragic.

EWM: 04:21 Was he cool under pressure in that moment?

MR: 04:24 Oh yeah. I mean we were both cooler. The copilot was ash white, but he was a very cool cucumber.

EWM: 04:35 After the bank called, Aubrey had lost a spectacular amount of money. But fortunately for him, he had a little help from his friends. They were all in Chesapeake's board.

BM: 04:46 Well this is after everything has fallen apart and McClendon is facing personal bankruptcy as well as Chesapeake's possible failure. And so his handpicked board of directors, all of whom are cozy and his friends, buys the antique map collection from him so that they can pay him $12.5 million, I believe. Aubrey's board was the ultimate crony capitalism board. It was people who he knew or had business connections to, and they were never going to tell him anything he didn't want to hear or do anything he didn't want them to do. So that means that Aubrey McClendon got paid an enormous amount of money, and there's this year when it's all falling apart, and he still ends up being the highest or one of the highest paid CEOs in America. And this is the year where he hits the financial skids and the board buys his map collection from him just so he can have a little extra $12 million of pocket cash.

BM: 05:41 You have to understand that Chesapeake's board was incredibly highly paid. So these were McClendon's handpicked board members who will do anything for him. And there's this fascinating calculation from 2009 to 2011, Chesapeake paid 13.3 million in total compensation to Ted and board members who weren't Chesapeake executives. By comparison, Exxon Mobil paid 10 non-executive board members just $9.9 million over the same period. Chesapeake board members got personal use of Chesapeake planes. I mean it just goes on and on. So this guy who starts getting angry and becomes one of the activist investors writes in a letter to Chesapeake's board, "I have never seen a more shameful document than the Chesapeake proxy statement. If I could reduce it to one page, I would frame it and hang it on your office wall as a near perfect illustration of the complete collapse of appropriate corporate governance."

EWM: 06:35 Here's another way of showing how insane the governance was. In 2008, Aubrey McClendon was paid $112 million, a $975,000 salary, 20 million in stock awards, and almost $77 million in bonuses plus another $12 million for those maps, which is really kind of a bizarre thing to read in SEC filing. This made him among the highest-paid CEOs in the U.S. So Aubrey has money again, but he's still incredibly leveraged by the loans he's taken out in big bets in the company's future. As the founder of the company, he had this interesting benefit that represented a significant amount of his leverage. He was allowed to keep 2.5% of the profits that Chesapeake made on its wells, with one catch. He had to pay for their drilling costs. The costs were not cheap, and McClendon and Chesapeake were always under pressure to drill and produce.

BM: 07:28 This means that he too, just as his company, becomes this empire of debt. McClendon personally becomes this empire of debt because paying for these drilling costs is no small thing. You don't get the choice of saying, "Eh, prices are really low. I don't want to drill right now." You have to drill. And that of course exacerbates the problem because then you're creating more supply into an already weak market. But that's the way these deals were structured.

EWM: 07:52 All of this leads to Chesapeake making these really weird changes to their business.

BM: 07:56 There's this moment where Chesapeake almost changes its business model, and instead of making money from selling natural gas, which is what it was supposed to be doing, they start making money by flipping the acreage they've accumulated to other buyers.

EWM: 08:12 To handle the rising costs, Chesapeake began cutting deals to enormous multinational energy companies.

BM: 08:18 Because as this shale revolution becomes a real thing, suddenly you have all these multinational companies who think, "We missed out. We're desperate to get into this. We too need to own some land." It's the ultimate FOMO.

EWM: 08:30 This is all really weird for a gas company.

BM: 08:33 It's supposed to be in the business of producing energy, not flipping land.

EWM: 08:38 As all this is happening, McClendon is trying to figure out how to pay for his own drilling costs in order to get that 2.5% of the profits. And so he takes out more debt. Literally everything was mortgaged, hedge fund and VC investments, and even his wine collection.

BM: 08:54 So he ends up taking personal loans from some of the very same entities that are giving Chesapeake loans, which kind of screams conflict of interest at large.

EWM: 09:04 To most investors, this just really is not kosher.

BM: 09:09 There's a belief that if the CEO is getting money from a lender and its company is getting money from the lender, somebody might be getting screwed. In other words, the company might be getting a worse deal because the CEO was getting a better deal. It's just one of those no-nos. It's just a little too incestuous for most people who want to see what they call good governance.

EWM: 09:36 During this time, it's still more of the same from Aubrey. More shale plays, more buying, more chasing funding, more, more, more. As Aubrey had said on that conference call, he just couldn't get enough. He began almost flailing in this strategy and kept pushing the fact that America should convert its entire transportation network to gas because the cheap prices were actually this great opportunity, but those prices just kept crushing him and Chesapeake. In 2012, Reuters began breaking stories about these billion-dollar-plus loans that had been taken out to help Aubrey pay for his drilling costs. People were not happy.

BM: 10:12 As long as the stock price is going up, they're willing to believe a story, willing to believe the narrative. As soon as things turn the other way, they start looking at the numbers, and they're no longer satisfied by just the story. So investors are getting antsy. And then Reuters does all these stories breaking this news about McClendon having this right to have 2.5% of each and every well and of the billion dollar loans that McClendon has taken out to cover his portion of the drilling costs on Chesapeake's wells. And investors start to revolt. And so even Chesapeake's board, you start getting activist investors involved. Activist investors are companies who buy stock and come in and want to get their people on the board so they can have an influence over the company and run it better.

EWM: 10:57 Chesapeake tries to stop the bleeding by simply removing McClendon as chairman.

BM: 11:00 So first of all, Chesapeake's board tries just getting rid of McClendon as chairman and saying, "Okay, you can stay CEO. But we'll have a new chairman." And you get this new wave of investors into Chesapeake, including Carl Icahn, who thinks at first that he can control McClendon. I mean he's Carl Icahn, right? So he thinks that he's going to be able to tell McClendon what to do.

EWM: 11:20 Carl Icahn is this famous corporate raider, and is the kind of guy that makes companies just quake in fear.

BM: 11:26 And so he thinks he can make McClendon quake and fear and do what he wants. You can reign in the worst of the corporate access. You can get rid of things like the company buying the $12 million map collection. You can make the existing CEO not overpay for acquisitions and calm down and go slower and run what he has instead of constantly trying to buy new shiny toys. They believed they could run the company better, that they could take what was a big, sprawling, inefficient crazed, debt-laden mess and fine tune it, and then it would work. And I think they found out since then, in part because natural gas prices haven't gone up, but that it's not that simple.

EWM: 12:09 Icahn gives up, but the damage is done as the company continues to slide.

BM: 12:12 And they basically began to figure out that's not going to work, and that there's no way to control Aubrey McClendon. and so they push him out. And on April Fool's Day, 2013, McClendon retires.

EWM: 12:23 The board had had enough and kicked McClendon out of his own company. With McClendon gone, the board sought a new more traditional CEO. Bethany says the guy was shocked at what he found when he went to Chesapeake HQ.

BM: 12:42 And this guy who comes in to take it over is named Robert Lawler, and he's this long time oil and gas executive. And he later tells this crowd of oil and gas people that he felt like Ernest Shackleton when he came into Chesapeake. And he says, "What I found when I got inside the company was much, much worse than I thought. It was a really, really challenging dark time." And he said that every day he discovered something shocking. It was beekeepers and gardens, wine collections, all kinds of crazy things. We're in an oil and gas company. What is this?

EWM: 13:19 A lot of people in Aubrey's situation might use this moment as an opportunity to take some time off to start fresh, to take a good long, hard look in the mirror, maybe get a new job, something where you could see the family a bit more, redefine your values a bit, maybe make some changes that you're busy, crazy life never afforded you until now. The only change that Aubrey was interested in was a change of scenery, and a very small one. The building next door. So Aubrey leaves the company, he's forced out. It is ostensibly an amicable separation.

BM: 13:52 Oh, it's not at all.

EWM: 13:53 But it's not at all.

BM: 13:55 It's not amicable at all. But I mean the couple of really amazing things about this are that it's not amicable at all, and there later becomes a lawsuit. In fact, Chesapeake sues McClendon pretty quickly after this. And when McClendon leaves, according to this lawsuit that later gets filed, he asks his assistant to print out a map of acreage that hasn't yet been leased by Chesapeake or its competitors. And he asks another Chesapeake employee to give him the contact information of a negotiator for one of the acreage owners. So no, this is not amicable.

EWM: 14:26 So just to clarify, this is theft of proprietary information.

BM: 14:28 Well, this is what Chesapeake later alleges, this theft of proprietary information, yes. So no, it's not amicable. And then McClendon immediately leases office space at the top of this tall building near Chesapeake. So according to someone who knows him, so he can look down on Chesapeake from his perch. And he puts up a billboard at the entrance to Chesapeake's campus to announce that he's now hiring. But even that's not the truly astonishing thing. The truly astonishing thing about this is you think you've basically had to, you're personally bankrupt. You've been kicked out of the company that you founded by a board of directors who has decided that you're the worst thing ever.

BM: 15:07 Most of us would probably go hide our head under a pillow for a little while, or just lay low and recover. Does Aubrey even hit pause? No, he doesn't hit pause even for a second. He immediately goes out and starts another company. And more than that, not only is he able to start another company, he gets money for it. He ends up raising I think $15 billion from investors for this new company called American Energy Partners, which is doing exactly what Chesapeake was doing. And so not only does McClendon not hit pause, but his believers don't hit pause. Just it's astonishing.

EWM: 15:42 I mean that that's an insane amount of money for a disgraced executive to go out and make.

BM: 15:49 It's just truly astonishing that there's not even a pause.

EWM: 15:55 So all of these 15 billions of dollars, they come from similar sources that funded Chesapeake and all of these sort of things that didn't pan out then. Why did people think it was different this time?

BM: 16:09 Don't know. I mean, it really is an astonishing testament to McClendon's salesmanship and his ability to get people to believe in him that this is... The guy's shown his true colors. He's crashed and burned three times now, if you count the Austin Chalky crashes and burns. He crashes and burns essentially in 2008, and then he really crashes and burns when he gets kicked out of his company amid this kind of wave of scandal. And yet here he is raising money again without even seemingly a blip. And part of it is that this narrative of American shale taking over the world has really taken hold at this point. People have made fortunes. Executives in particular have made fortunes in the shale business. Everybody sees it as the great hope for world oil supply is American shale. And this thing, FOMO, fear of missing out, is a real thing. And people believe that McClendon is a moneymaker.

BM: 17:06 I'll never forget talking to a high placed investment banker, before I was even working on this book, but just because I was really interested in McClendon. And I said to this guy, well, aren't you worried? Aren't you worried about investing in McClendon? Don't you think he's kind of a scary commodity at this point? And the guy said, "Oh, no, no, no. Aubrey is one of those men that will always make money. He'll always figure it out." And there was also this belief among other people. I talked to another investor who put money into McClendon, that McClendon himself was something you could buy and sell.

BM: 17:38 And that if you were smart enough, you could buy Aubrey at the right moments, and then you could ride along with him and make a lot of money. You just had to know when to sell him. To attribute just blind belief to investors is not quite capturing it. That's a little too nice. It wasn't just that. Investors thought that they were smarter than McClendon, and that they could figure out how to trade him like a commodity, how to buy him when he was going to have an up period and how to get out and sell him before he hit his down period. I don't think many of them would agree they got it right in retrospect, but there was this belief that you could.

EWM: 18:13 Aubrey was such a force of nature that investors not only gave him billions more dollars for his new venture, but they also looked at him as a type of commodity. They were banking on his risk taking, his relentless pursuit of domination and fracking. And the moment when it all looked like everything was about to crater, they could sell and get out ahead just like a stock. Now, there may still be a little confusion as to why the industry keeps hitting these walls. Why can't it become profitable? One way to help understand is the concept of free cashflow. Remember that lemonade stand from the beginning? $12 goes in and $6 comes out. That would be negative free cashflow. And unless you have an endless supply of piggy banks or nice parents or investors, you will run out of money eventually.

BM: 19:00 So free cashflow sounds scary because it sounds like some kind of financial term, but it really just isn't. It's just basically the money you have to live. If you think about as a person, the money you have to exist and go out and have fun after you've taken care of all your bills, that's your free cashflow. So for a company, free cashflow is the money you have, the actual cash that you've generated after you've paid all your expenses and made your necessary corporate expenditures in order to keep your business going. You've got a certain amount of, you're producing a certain amount of cash ideally, or you're not.

EWM: 19:38 Fracking has never produced free cashflow because once you take out all of their expenses and necessary reinvestments to keep the business going, there's nothing left. This is why gas prices are so important. Gas is a commodity. You can set a lemonade price higher and market it well. Maybe that'll make that price work. But you can't do that for gas. The price is what it is, so everyone is at its mercy.

MR: 20:04 Many of these plays don't generate much more than a one to one or 1.1 to one return on investment. And so that's why you're seeing the pushback I think from the investment community, saying, "Look, you're really not making any money. You've got a high velocity of cash going out and back in, but there's no real return on your equity."

EWM: 20:29 That's Mark Roland, who was Aubrey McClendon's CFO at Chesapeake for decades. And even he doesn't see this fracking story ending well. One huge problem is the decline rates of the wells. Wells don't last forever. So if a company wants to even maintain the same amount of production, they have to keep buying land.

BM: 20:48 Because of these decline rates on the wells, they can't just sit there and keep having oil and gas come out of the well and selling it. They have to constantly put more money in the ground in order to create next year's oil and gas. And so there's nothing left.

EWM: 21:02 So if a company wants to survive, it has to find another way to get more money, like lots of investors and loans, the capital markets.

BM: 21:10 The only way a company with negative free cashflow can survive is if somebody is willing to keep giving it more money.

EWM: 21:16 Despite there being so little proof that real money would ever be made in this industry, there was still plenty of money it seemed, for Aubrey. If Aubrey McClendon's companies represented one way of doing business, fast, loose, big, brash, larger than life, another company represented the opposite. A company that was known as the brain trust of the industry. The company was and is called EOG.

BM: 21:42 People call them the Harvard of shale or the Apple of shale because they get this really good reputation.

EWM: 21:47 These people have a completely different reputation. Bethany told me how much they're diametrically opposed to McClendon's style.

BM: 21:55 When I went to see EOG, they don't have EOG tower. They certainly don't have the Chesapeake campus. They're in this nondescript high rise in Houston, and there's no marker on the outside that EOG is even in there. And you go up to a high floor where their corporate offices are, and they look like they haven't been redecorated since the 1970s. Ugly brown furniture, it's a culture where it's the geology that matters and the work that's getting done, not any kind of ostentatious spending at headquarters. Could not be more different than Chesapeake. They're led by a CEO named Mark Papa during these years. And they get this really good reputation for being the smart people, the ones who really are advancing the technology and really understand this stuff. And what's funny is that Mark Papa, who's the CEO of EOG, is one of the only ones who sees that this plethora of natural gas that's being produced by fracking is going to wreck the industry.

BM: 22:49 That it's going to crater prices and make it impossible for anybody to make any money. And it's kind of funny because it seems so obvious in retrospect. How could everybody not see that? But no one saw it except for Mark Papa. So he starts experimenting with trying to drill for oil, to use fracking to get oil out of the ground instead of just natural gas. Papa says to me at one point, "Collapse was inevitable, so as a corporate strategy, we literally had to run away from North American natural gas. And we were a North American natural gas company." And he says, "It's incredible to me that other people didn't see the train coming down the tracks."

EWM: 23:29 Some people, however, did see a train coming down the tracks. As investors waited for the free cashflow to emerge and the bets to pay off, some people thought that maybe the moment wouldn't come. People with money to bet, the short sellers.

BM: 23:44 And the skepticism was always there. There were a lot of people who were skeptical of Chesapeake, in short McClendon, because they'd look at the financial statements and then say, "This company isn't making any money." Forget all the grand promises and the story. Let's put the narrative aside and let's look at the numbers, and this doesn't work. But what I think most people didn't know is that there was more broadly skepticism about the industry as well. People saw McClendon as emblematic of this larger truth about the industry, which is that it voraciously consumed capital and didn't spit back out much of a return.

BM: 24:17 But the first really public glimmer of that was when David Einhorn, who's a well known short seller who runs a firm called Greenlight, gives a presentation at this thing called the Ira Sohn conference, which is basically where hedge fund managers announce what they think are their best ideas. He goes public with his skepticism about the fracking industry, and his firm has dug through the financial statements of the 16 largest publicly traded frackers. And he's found that from 2006 to 2014, they've spent $80 billion more than they've received from selling oil and gas. And even when oil was at $100 a barrel, none of these companies generated free cash flow. In fact, in 2014 when oil was at $100 for part of the year, the group burned through more than $20 billion. And so Einhorn's argument was this business model just doesn't work.

EWM: 25:07 So kind of going back to what we were talking about earlier, all of these companies were spending far more money to get something out of the ground that they were selling for less.

BM: 25:16 Yes. Than they were able to. And it just didn't work. And people who kept saying, "Well wait until oil prices are higher or wait until we've gotten through the R & D phase of this." People who were making the Silicon Valley argument that this was just like Amazon or like Uber's going to be before it turns profitable. Well, when? Fracking's been going on at this point for almost 10 years, and we've had oil prices over a hundred dollars a barrel. Where's the money? Show me the money.

EWM: 25:41 How did the industry respond to this?

BM: 25:44 So the industry has never responded well to this as you would expect. The argument is always that outsiders just don't get it. The argument is that it's going to work eventually, and that free cashflow is not the appropriate measure. And part of that is because executives in this industry, for them free cashflow hasn't been the appropriate measure because executives have gotten paid based on production growth. So their incentive has just been to produce more oil and gas, no matter how much it's costing, because that's how they're going to get their paycheck. So the system of rewards has not been one that has encouraged financial discipline. Quite the opposite.

EWM: 26:24 That's the case for the executives and things, but not for the investors though, right?

BM: 26:28 No, but for the investors, for a long time they didn't care either because the stocks would move based on production growth. And so it's one of the things I think people who don't study Wall Street don't understand because you think in a logical world that stock prices should move relative to profits and that stock price isn't going to grow up if the profits aren't going up. But there is no place like Wall Street for narrative. Wall Street is the land of stories, and the people who can sell their stories like Aubrey McClendon do better than the people who can't sell their stories. And there are times where the street buys into an industry wide story. Wall Street loves narrative, and narrative can be much more compelling than numbers. And so for a long time these stocks moved on narrative. They didn't move on numbers.

EWM: 27:21 So one of the classic responses to short sellers making big theses public is to lash out. And that's often associated, at least in my head, and I suspect in your head, with people who are probably wrong. Because typically the best way to shut up the critics is to perform. Was there any lashing out kind of behavior from the industry or were they trying to shut up and focus on their own things?

BM: 27:51 I think it's difficult to gauge because the oil and gas industry doesn't lash out the way say an Elon Musk does because they don't have the platform that a Musk does. They lashed out in their own circles. There's an insider, outsider thing where they don't really care what outsiders are saying. And so even after I wrote my book, people would send me inside industry articles where people would proclaim how stupid it was. But it's not like they ever lashed out publicly against me. And so I think that was more of the case here. Although you've had people like Harold Hamm, the irascible CEO who runs Continental Resources going on TV, lashing out at critics. So you have had a little bit of that, but there's less of it because oil and gas is just such an insular world. In the end, they don't care as much about what we're saying because we're not part of their world.

EWM: 28:48 Another thing that Einhorn and Greenlight noticed was that the oil wells based in the United States were performing substantially lower than those in Saudi Arabia or Iraq. So David Einhorn and Greenlight are making this thesis and finding that even when oil is at $100, there is no excess cashflow.

BM: 29:06 So the big issue with a fracked well is the decline rates. So in general, just think about anything. If you were starting a business, if you were selling something, you might want to have to invest a lot in building a factory, but then you want that factory to pump out tee shirts or widgets for 10 years and you don't want to have to build a new factory every year. If you have to build a new factory every year, you're going to have a much tougher business than if that factory you build can produce tee shirts or widgets or whatever it is you're selling for a decade or two decades.

BM: 29:36 And the problem with fracking is essentially that you have to build the new factory every single year. And that's because of these decline rates on the wells. So this Kansas City Federal Reserve did an analysis of wells in the Bakken, which is one of the big plays. And found that the average well in the Bakken declined 69% in its first year and more than 85% in the first three years, meaning it's producing just a fraction of the oil after three years that it was initially, while a conventional well might decline around 10% a year.

BM: 30:04 So in the conventional well, you get to build your factory and it keeps going for a while. With a fracked well, by year three you got to build a whole new factory. So one energy analyst I found calculated that to maintain production of a million barrels per day, shale requires up to 2,500 wells while production in Iraq can do it with fewer than a hundred wells. So for a fracking operation to show growth requires huge investment each year just to offset the decline from the previous year's wells. This guy named Jonathan Tepper, who's a researcher, does research on all sorts of stuff, put together this presentation. And he likened the dynamics of fracking to the Red Queen's race in Alison Wonderland, and he said the Red Queen has to run faster and faster just to stay where she is.

EWM: 30:50 Amidst all of this, something critical happens to Aubrey that some think maybe led to his death. He became the subject of a Department of Justice investigation and was indicted by a grand jury.

EWM: 31:10 Illegal Tender is made by Yahoo Finance at our studios in New York City. This episode was written and hosted by me, Ethan Wolff-Mann. This episode was mixed and edited by Dan Brantigan, who also contributed music. Illegal Tender is produced by Alex Sugg. Thank you to Bethany McLean for being a key contributor to this story. To learn more about Aubrey's story, get her book, Saudi America, wherever good books are sold. And if you enjoyed this podcast, head over to Apple podcasts and leave us a five star rating and review it for the show. Until next time, thank you for listening to Illegal Tender.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.