Is ILPRA S.p.A. (BIT:ILP) A Good Fit For Your Dividend Portfolio?

Today we'll take a closer look at ILPRA S.p.A. (BIT:ILP) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

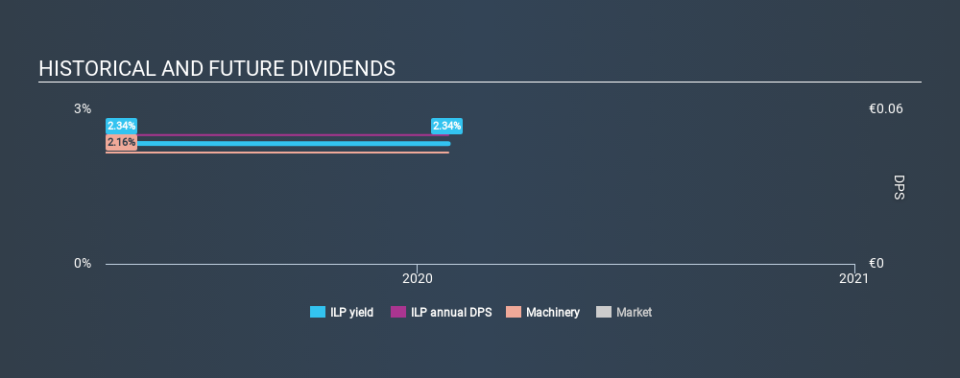

ILPRA has only been paying a dividend for a year or so, so investors might be curious about its 2.3% yield. The company also bought back stock during the year, equivalent to approximately 3.1% of the company's market capitalisation at the time. Some simple analysis can reduce the risk of holding ILPRA for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. ILPRA paid out 34% of its profit as dividends, over the trailing twelve month period. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Unfortunately, while ILPRA pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

We update our data on ILPRA every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was €0.05 per share.

It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. ILPRA's earnings per share have fallen -75% over the past year. This is a pretty serious concern, and it would be worth investigating whether something fundamental in the business has changed - or broken. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. ILPRA has a low payout ratio, which we like, although it paid out virtually all of its generated cash. Earnings per share are down, and to our mind ILPRA has not been paying a dividend long enough to demonstrate its resilience across economic cycles. Overall, ILPRA falls short in several key areas here. Unless the investor has strong grounds for an alternative conclusion, we find it hard to get interested in a dividend stock with these characteristics.

Now, if you want to look closer, it would be worth checking out our free research on ILPRA management tenure, salary, and performance.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.