Can You Imagine How Cabot's (NYSE:CBT) Shareholders Feel About The 20% Share Price Increase?

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. But Cabot Corporation (NYSE:CBT) has fallen short of that second goal, with a share price rise of 20% over five years, which is below the market return. The last year hasn't been great either, with the stock up just 4.7%.

See our latest analysis for Cabot

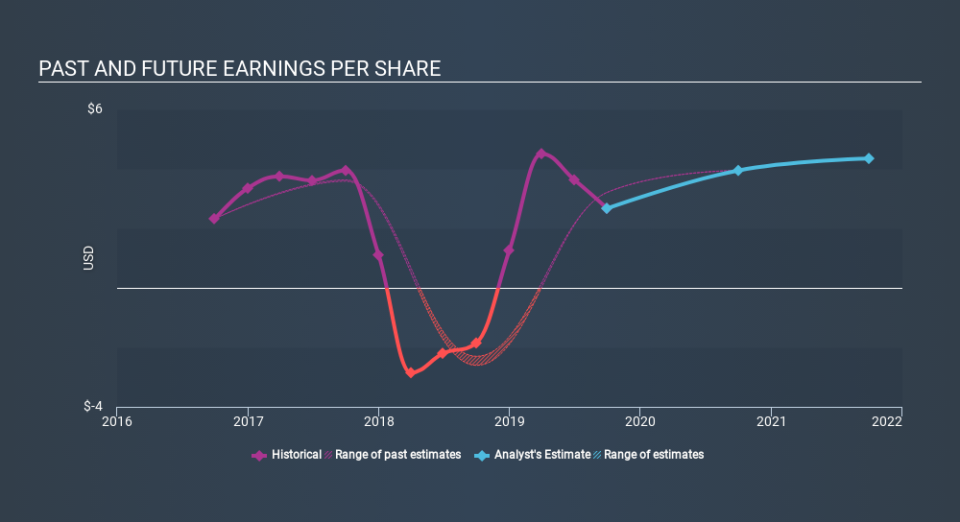

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Cabot moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Cabot has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Cabot's TSR for the last 5 years was 36%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Cabot provided a TSR of 8.1% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 6.4% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. Is Cabot cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.