Can You Imagine How Chuffed Garo Aktiebolag's (STO:GARO) Shareholders Feel About Its 128% Share Price Gain?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. For example, the Garo Aktiebolag (publ) (STO:GARO) share price has soared 128% in the last three years. That sort of return is as solid as granite. On top of that, the share price is up 36% in about a quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

See our latest analysis for Garo Aktiebolag

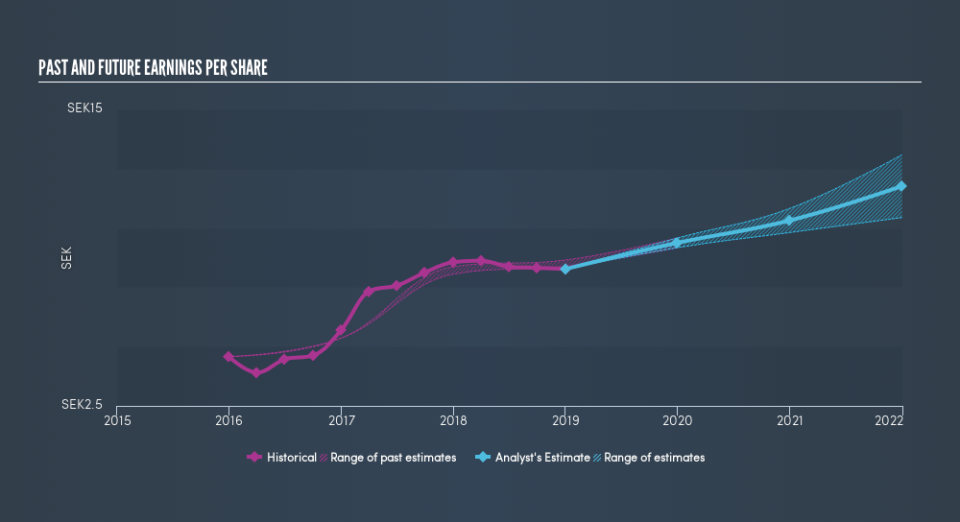

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Garo Aktiebolag achieved compound earnings per share growth of 22% per year. In comparison, the 32% per year gain in the share price outpaces the EPS growth. This suggests that, as the business progressed over the last few years, it gained the confidence of market participants. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Garo Aktiebolag's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Garo Aktiebolag's TSR for the last 3 years was 135%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Garo Aktiebolag shareholders have gained 27% (in total) over the last year. And yes, that does include the dividend. That falls short of the 33% it has made, for shareholders, each year, over three years. If you would like to research Garo Aktiebolag in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Garo Aktiebolag may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.