Can You Imagine How Chuffed Maanshan Iron & Steel's (HKG:323) Shareholders Feel About Its 127% Share Price Gain?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For instance the Maanshan Iron & Steel Company Limited (HKG:323) share price is 127% higher than it was three years ago. Most would be happy with that. Better yet, the share price has risen 5.1% in the last week. But this could be related to the buoyant market which is up about 2.2% in a week.

View our latest analysis for Maanshan Iron & Steel

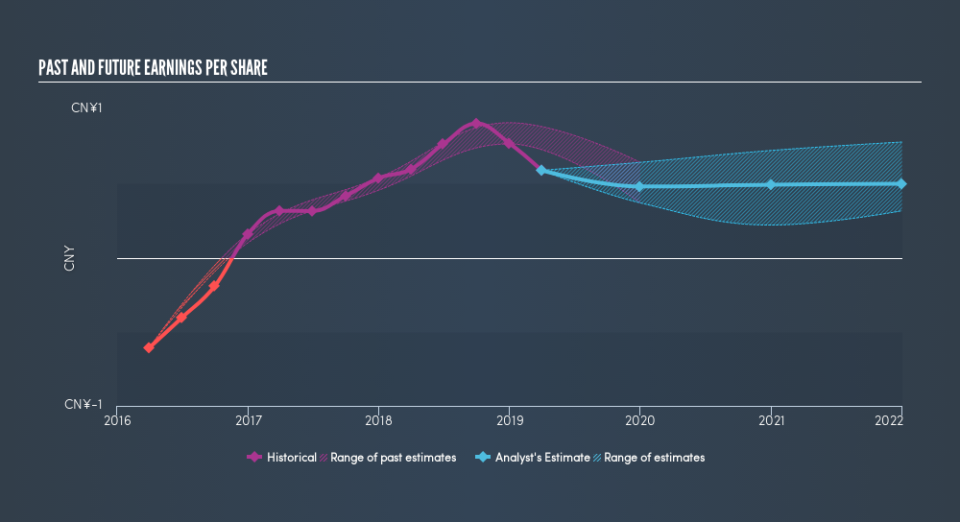

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Maanshan Iron & Steel became profitable within the last three years. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Maanshan Iron & Steel's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Maanshan Iron & Steel's TSR for the last 3 years was 144%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While it's certainly disappointing to see that Maanshan Iron & Steel shares lost 9.2% throughout the year, that wasn't as bad as the market loss of 14%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 18% for each year. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. Keeping this in mind, a solid next step might be to take a look at Maanshan Iron & Steel's dividend track record. This free interactive graph is a great place to start.

We will like Maanshan Iron & Steel better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.