Imagine Holding Bubs Australia (ASX:BUB) Shares While The Price Zoomed 367% Higher

While Bubs Australia Limited (ASX:BUB) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 19% in the last quarter. But that doesn't change the fact that the returns over the last three years have been spectacular. In fact, the share price has taken off in that time, up 367%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Bubs Australia

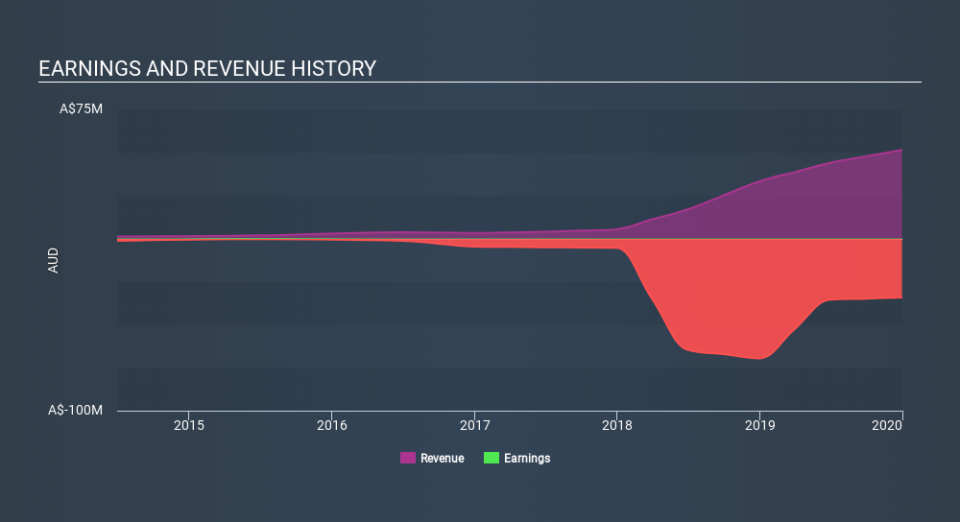

Bubs Australia wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Bubs Australia's revenue trended up 83% each year over three years. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 67% per year, over the same period. It's always tempting to take profits after a share price gain like that, but high-growth companies like Bubs Australia can sometimes sustain strong growth for many years. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Bubs Australia shareholders have gained 1.3% (in total) over the last year. But the three year TSR of 67% per year is even better. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for Bubs Australia that you should be aware of before investing here.

Of course Bubs Australia may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.