Imagine Holding Natera (NASDAQ:NTRA) Shares While The Price Zoomed 798% Higher

While Natera, Inc. (NASDAQ:NTRA) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 14% in the last quarter. But that does not change the realty that the stock's performance has been terrific, over five years. Indeed, the share price is up a whopping 798% in that time. So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price.

It really delights us to see such great share price performance for investors.

See our latest analysis for Natera

Given that Natera didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Natera can boast revenue growth at a rate of 15% per year. Even measured against other revenue-focussed companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 55%(per year) over the same period. It's never too late to start following a top notch stock like Natera, since some long term winners go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

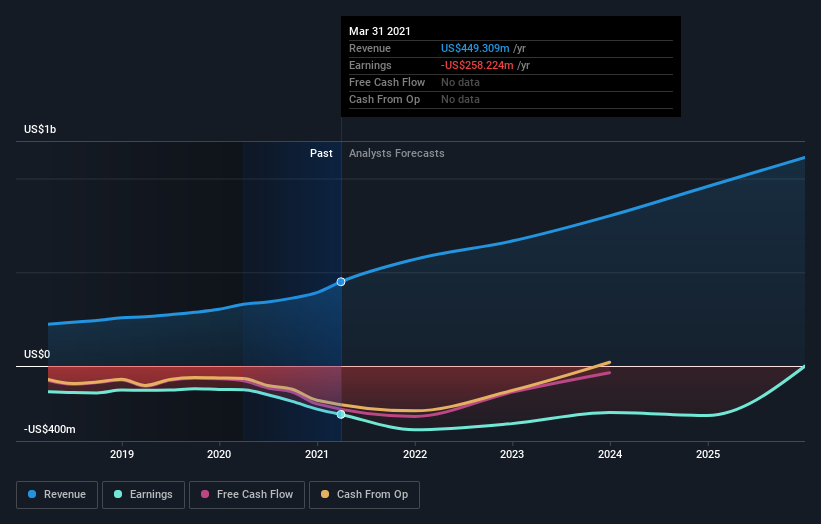

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Natera is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It's good to see that Natera has rewarded shareholders with a total shareholder return of 134% in the last twelve months. That gain is better than the annual TSR over five years, which is 55%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for Natera you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.